[ad_1]

The Bitcoin market was swept right into a frenzy following an alleged hack of the US Securities and Change Fee’s (SEC) X account, falsely claiming the approval of 11 spot ETFs. This misinformation led to a rollercoaster in Bitcoin’s value, which initially soared from $46,800 to $48,000, solely to crash to $45,000 inside a span of 20 minutes.

This incident has grow to be a pivotal second for market analysts, offering insights into how the market would possibly react to at this time’s potential Bitcoin spot ETF approvals within the quick time period. So right here’s what consultants from K33 Analysis, QCP Capital, and Daan Crypto Trades should say.

#1 K33 Analysis: Approval Will Be ‘Promote-The-Information” Occasion

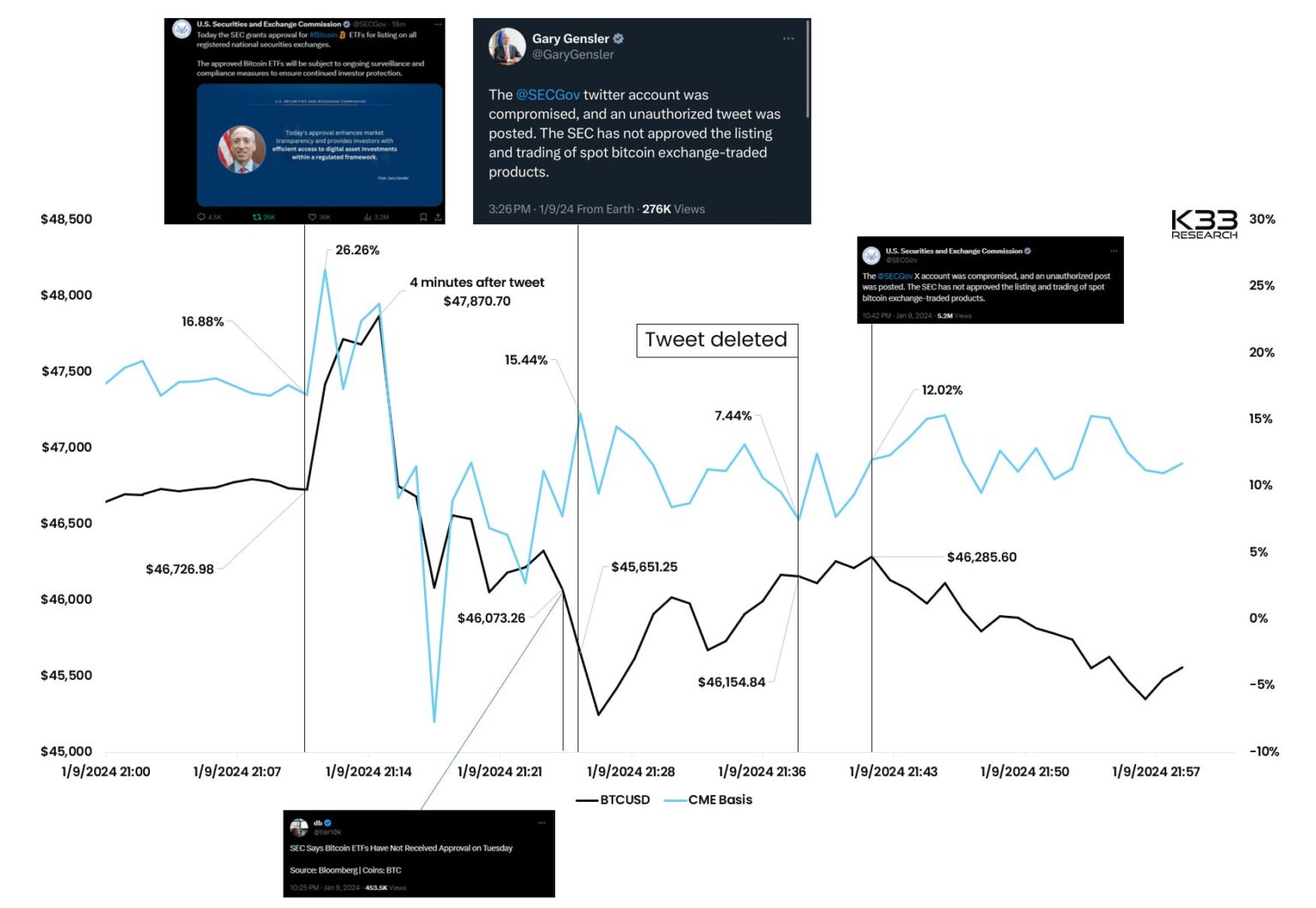

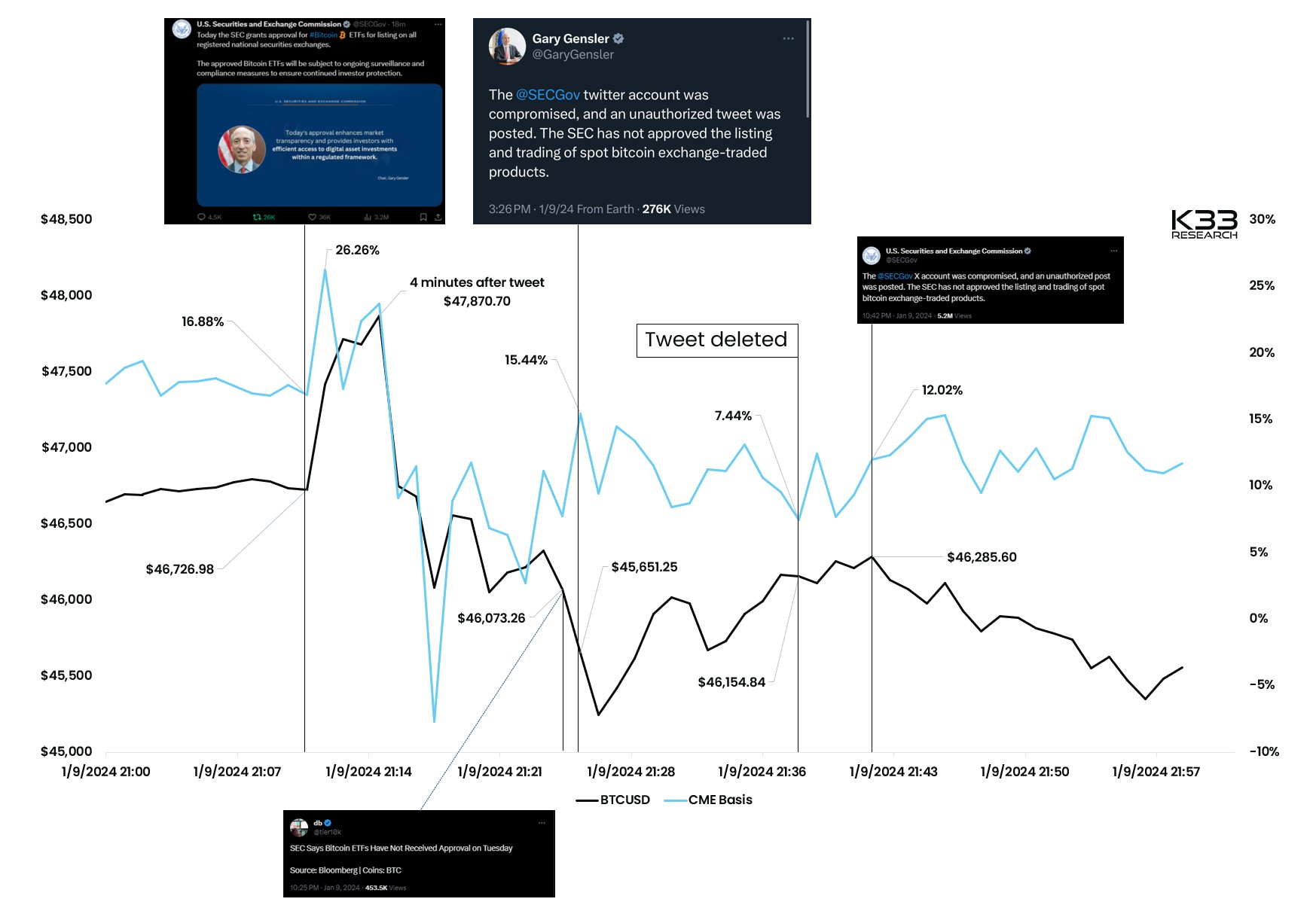

Vetle Lunde, a senior analyst at K33 Analysis, provided an in-depth evaluation of the market’s response to the inaccurate announcement. He noticed that the market’s rapid response was indicative of an inclination in the direction of a ‘sell-the-news’ response. The preliminary surge in Bitcoin’s value was shortly met with a flood of lengthy positions, inflicting a big value fluctuation.

“The market confirmed its fingers yesterday; the ETF approval rehearsal favors a sell-the-news response. Instantly after the announcement, longs shortly crowded the market, imposing a whipsaw within the following minutes,” Lunde acknowledged.

Lunde additionally identified that till the SEC’s clarification, the market largely accepted the announcement at face worth, triggering an natural response. He outlined the sequence of occasions, noting a 2.4% improve in Bitcoin’s value inside 4 minutes post-announcement, adopted by a 1.4% lower in 14 minutes till Bloomberg debunked the approval information.

The market ultimately stabilized when Gensler confirmed the hack, highlighting the market’s sensitivity to regulatory information and rumors.

#2 QCP Capital: Warning Signal For Bitcoin Merchants

QCP Capital, of their “QCP Market Replace – 10 Jan 24,” mirrored on the weird nature of the occasion with a mixture of humor and evaluation. “We’re on the cusp of a BTC Spot ETF approval, and what transpired within the final 24 hours is one thing you possibly can’t make up,” their replace started.

They identified the lukewarm preliminary response to the ‘approval,’ suggesting that the market may need already priced in the opportunity of an precise ETF approval.

“The preliminary response to the ‘approval’ was muted with BTC being unable to commerce out of the resistance space. We take this as a warning signal that an approval is usually priced in and there is probably not an enormous rally submit the approval,” QCP warned.

QCP Capital additionally targeted on the implications of this occasion for future market traits. “The restrained response to the fake approval alerts a warning – the precise approval of a Bitcoin ETF won’t set off the anticipated rally,” they noticed, additionally pointing to the present market dynamics, such because the elevated choices volatility and spot-futures foundation unfold. Notably, the agency sees Bitcoin’s subsequent help at $40,000 to $42,000, and resistance round 48.500.

Daan Crypto Trades: ETH/BTC Might See A Spike

Daan Crypto Trades supplied a concise however insightful analysis. “The false ETF approval information was a litmus check for the market’s post-approval route,” he commented. The evaluation highlights the sample of Bitcoin’s value spiking after which totally retracing following the pretend announcement.

“This sample might nicely repeat upon precise ETF approval, however with extra pronounced promoting strain,” he recommended. Daan Crypto Trades additionally touched on the broader market implications, particularly for the ETH/BTC ratio, which began rallying instantly after the pretend announcement.

He additional remarked:

ETH/BTC began rallying immediately which can be what we’ve been in search of. I feel at this time we would get yet another small spike down on ETH/BTC as BTC spikes up however after that I don’t see a lot holding again the ETH/BTC ratio anymore. Particularly if BTC cools off submit ETF.

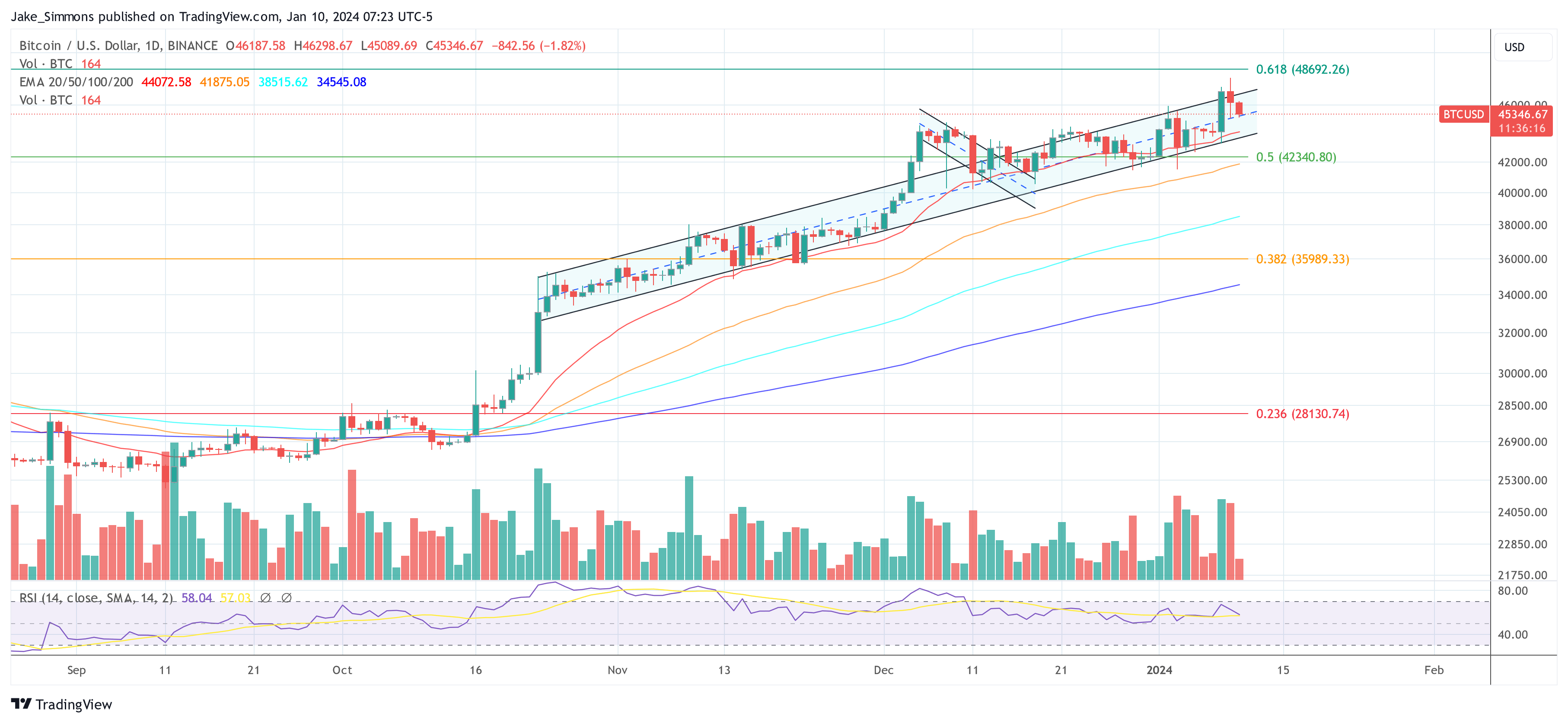

At press time, BTC traded at $45,346.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal threat.