[ad_1]

Bitcoin Spot Alternate-Traded Funds (ETFs) have as soon as once more garnered the eye of crypto fans and traders because the merchandise have witnessed a whopping $10 billion in complete buying and selling quantity within the first three days of buying and selling.

Bitcoin Spot ETF Sees Vital Uptick In Day 3 Buying and selling

The event was revealed by Bloomberg Intelligence analyst James Seyffart on the social media platform X (previously Twitter). The knowledge shared by the analyst demonstrates a agency want for publicity to digital belongings through regulated monetary markets.

Seyffart’s X publish delves in on the info from the “Bitcoin ETF Cointucky Derby.” In accordance with the analyst, “ETFs traded nearly $10 billion in complete over the previous 3 days.”

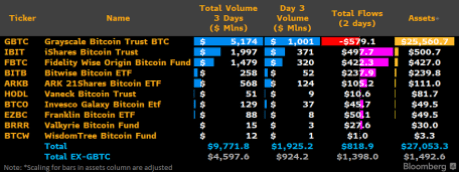

The analyst additionally supplied a digital document of the info to additional elaborate on the substantial buying and selling quantity. With a complete quantity of over $5 billion, Grayscale Bitcoin Belief (GBTC) stands out as the highest performer among the many notable monetary companies.

In the meantime, iShares Bitcoin Belief (IBIT) and Constancy Sensible Origin Bitcoin Fund (FBTC) come subsequent in line. The info reveals that the monetary companies witnessed an general buying and selling quantity of $1.997 billion and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) adopted behind with a considerable complete buying and selling quantity of $568 million and $258 million, respectively. This spike in buying and selling quantity signifies that each institutional and particular person traders are rising extra relaxed using conventional funding engines to commerce BTC.

Though Grayscale’s Bitcoin fund continues to realize the best general buying and selling quantity, the fund has seen vital withdrawals from traders in search of to decrease their publicity.

There have been withdrawals totaling greater than $579 million since Grayscale began buying and selling on January 11. At the moment, Grayscale remains to be thought-about the “Liquidity King” of the Bitcoin spot ETFs.

Nonetheless, Bloomberg analyst Eric Balchunas anticipates that Blackrock would possibly oversee Grayscale to assert the title. “IBIT holding result in be one almost certainly to overhaul GBTC as Liquidity King,” he acknowledged.

3-Day Buying and selling Surpassed 500 ETFs In 2023

Following the report, Eric Balchunas has supplied a context for the large surge of those merchandise. The analyst did so by evaluating the buying and selling quantity of BTC ETFs to all of the ETFs that have been launched in 2023.

“Let me put into context how insane $10b in quantity is within the first 3 days. There have been 500 ETFs launched in 2023,” Balchunas acknowledged. In accordance with him, the five hundred ETFs accomplished a $450 million mixed quantity at present, and the perfect one did $45 million.

As well as, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a greater efficiency than the five hundred ETFs. “IBIT alone is seeing extra exercise than your complete ’23 Freshman Class,” he acknowledged. It’s noteworthy that half of the ETFs launched in 2023 recorded an general buying and selling quantity of “lower than $1 million” at present.

Balchunas additionally harassed the problem in buying quantity, noting that it’s tougher than flows and belongings. It’s because the amount has to return genuinely within the market, which supplies an “ETF lasting energy.”

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.