[ad_1]

Ethereum has damaged past the $2,900 degree throughout the previous day, however knowledge exhibits the futures market could also be beginning to turn into overheated.

Ethereum Has Now Damaged By way of The $2,900 Stage

Whereas Bitcoin has slumped to an general sideways trajectory just lately, Ethereum seems to have determined to choose a path of its personal, because the second largest asset within the sector has surged virtually 4% over the previous 24 hours.

Throughout this newest leap, Ethereum has touched the $2,900 mark for the primary time because the begin of Might 2022. The beneath chart exhibits how the coin has carried out over the previous couple of days.

The value of the asset seems to have shot up over the previous day | Supply: ETHUSD on TradingView

Following this rise, Ethereum traders would now be having fun with income of greater than 16% over the previous week. In the identical interval, Bitcoin has solely put collectively returns of about 8%.

Whereas ETH’s decoupling could also be an optimistic signal for the asset, a sample appears to be rising that would show to be a worrying signal.

ETH Open Curiosity Has Noticed A Sharp Enhance Lately

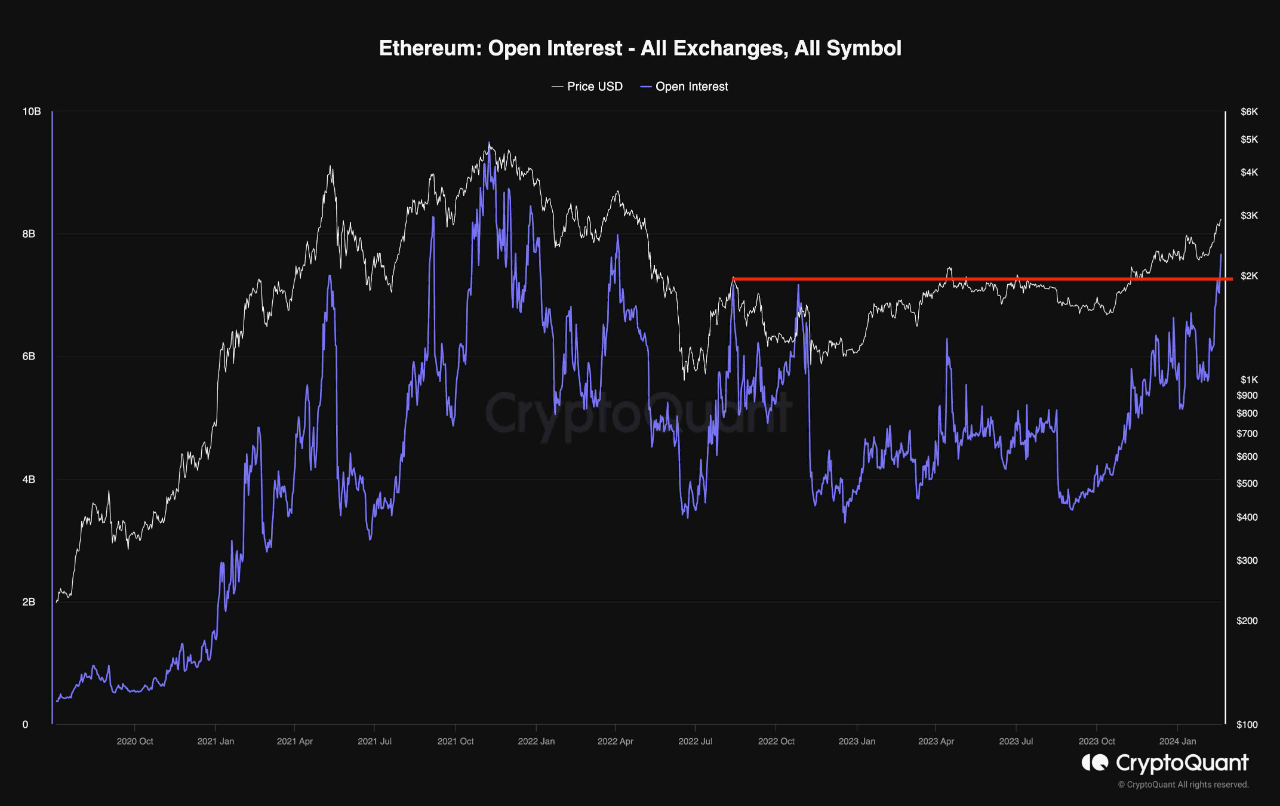

As defined by an analyst in a CryptoQuant Quicktake submit, the ETH Open Curiosity has gone by a powerful surge just lately. The “Open Curiosity” is an indicator that retains monitor of the whole quantity of Bitcoin futures contracts which can be presently open on all centralized spinoff exchanges.

When the worth of this metric rises, it signifies that the traders are opening up contemporary positions on the futures market proper now. Typically, whole leverage within the sector goes up as extra positions pop up, so this development may end up in the next quantity of volatility for the cryptocurrency.

However, a decline within the indicator implies ETH futures contract holders are both closing up their positions of their very own volition, or are being liquidated by their platform. The asset’s worth might behave extra stably following such a lower.

Now, here’s a chart that exhibits the development within the Ethereum Open Curiosity over the previous couple of years:

The worth of the metric appears to have quickly been going up in current days | Supply: CryptoQuant

From the graph, it’s seen that the Ethereum Open Curiosity has risen to excessive ranges just lately and has attained a peak that’s increased than any witnessed in virtually two years.

“This surge signifies sustained confidence amongst futures merchants in Ethereum’s present uptrend,” notes the quant. “Nonetheless, given the impulsive nature of the current ascent, merchants ought to train warning and take into account the potential for sudden liquidation occasions, which may set off notable brief to mid-term worth declines.”

As talked about earlier than, the asset turns into extra prone to present volatility when this indicator rises. The supply of this volatility will be mass liquidation occasions known as squeezes, which may set off a violent cascade impact on the futures market, amplifying the value swing that triggered the occasion.

For the reason that Ethereum Open Curiosity could be very excessive proper now, a futures squeeze may undoubtedly be a risk for the cryptocurrency.

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal danger.