[ad_1]

Ethereum is the second-largest cryptocurrency by market capitalization, and its dominance available in the market is because of its versatility and potential as a platform. The Ethereum blockchain permits builders to create their tokens representing something from a digital asset to a utility or a bodily asset.

This ETH characteristic has led to hundreds of Ethereum-based tokens and tasks supporting a major enhance within the worth and adoption of the Ethereum community. Ethereum’s dominance available in the market is pushed by its versatility as a platform for decentralized purposes and its good contract capabilities, that are revolutionizing the way in which we take into consideration conventional monetary methods.

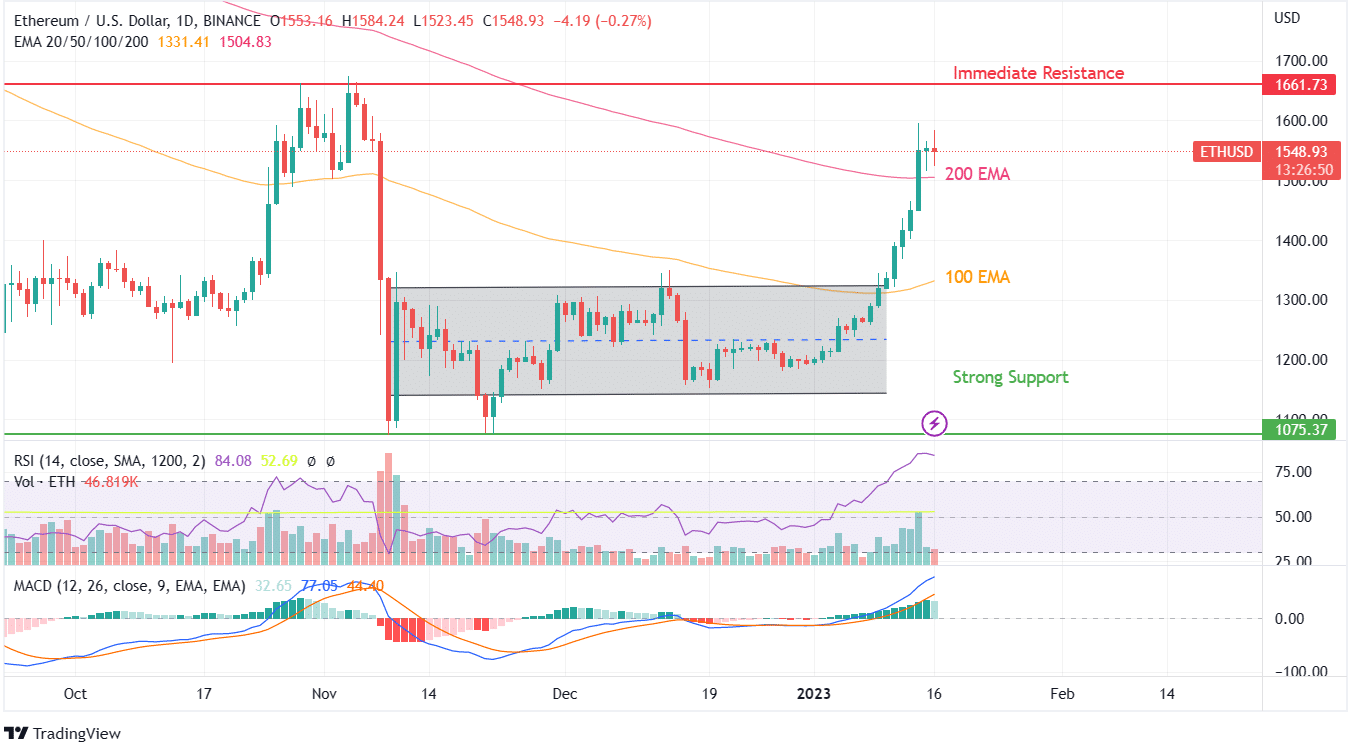

Ethereum has made fairly a robust retracement from $1075 to the presently traded worth of $1548. The outlook for this crypto token is getting even stronger, with extra blockchain networks being developed on the again of its stronger basis. ETH has regained $189 billion of its market capitalization marking an enormous achieve in January 2023.

Ethereum token follows the dominant value motion of BTC, whereas the previous trades above the important thing resistance zone of 200 EMA. The one resistance in entrance of this cryptocurrency is $1661. Learn our ETH predictions to know if it could possibly overcome this resistance or not!

The clear image of a bullish development may be ascertained from a single look on the one-day candlestick chart of ETH. With the present worth above 200 EMA, a sudden upward motion of its shifting averages may be observed.

RSI buying and selling within the 80 vary just isn’t a optimistic indication, as it could possibly push away enthusiastic patrons on the present value band. Above the 200 EMA curve, the subsequent apparent resistance comes within the face of $1661, adopted by $2000. After consolidation, an extra uptrend to the tune of $2000 is more likely to be achieved by ETH.

Even on weekly charts, ETH has managed to challenge a robust stance. Though there have been frequent rejections on the peak ranges, consolidation is required at this level to ease the rising volumes. With an overbought zone of value motion, a brief consolidation in ETH eases the excessive shopping for volumes created within the final week.