[ad_1]

Ethereum is at present the main platform for the deployment of good contracts. Its use of a Turing-complete programming language, Solidity, permits builders to create advanced good contracts and its massive and lively developer group. Moreover, Ethereum’s decentralized nature and using its cryptocurrency, ETH, make it a sexy platform for decentralized purposes and different blockchain-based tasks.

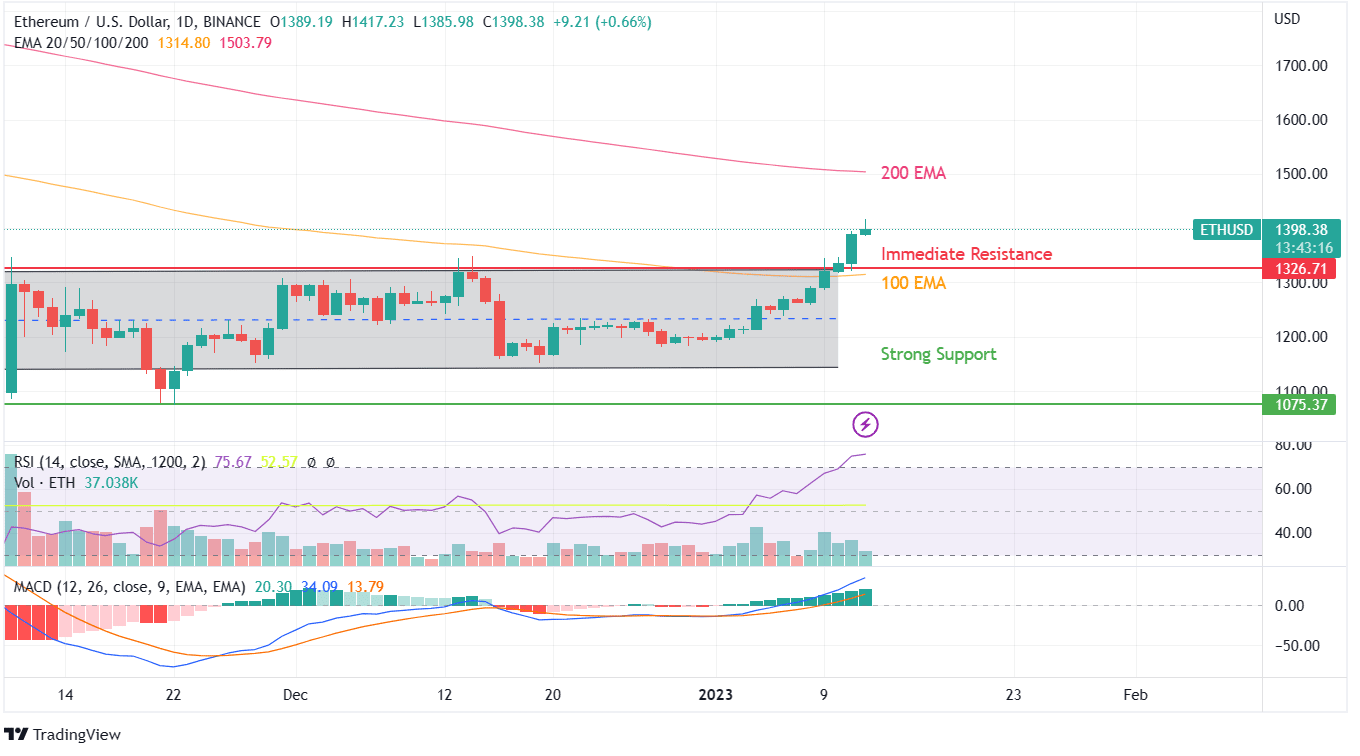

With sturdy valuations and no competitor close to its dominance within the cryptocurrency world, particularly relating to good contracts and decentralized purposes. The worth for ETH has reached practically $1400 in 2023.

Regarding the shopping for spree on ETH, a bull rally could possibly be proper across the nook. Any authorities scheme or discount in crypto buying and selling might deliver a excessive uptrend for the main crypto cash.

Ethereum was affected by a large consolidation sample the place the valuation of ETH was dropping to help ranges of promoting depth. Though the only candlesticks are witnessing a wick on the high indicating promoting strain to extend with every high-level ETH reaches. Will the promoting strain proceed? Click on right here to know extra and Ethereum forecasts!

The conduct of ETH has been a transparent indication of a optimistic pattern. Patrons had been actively ready for a breakout from the 100 EMA to extend their shopping for, whereas many trapped at comparable ranges could be looking for an exit cue. ETH might witness minor volatility from present ranges and even create a pink candle, however given the optimistic indication supported by the patterns.

Furthermore, a restraint on the present degree is the demand of the pattern since RSI has reached an overbought territory which might set off a large fall. The MACD indicator additionally actively helps the bullish pattern on the every day candlestick sample. Even on the weekly candlestick charts of Ethereum, RSI has began shifting in direction of bullish territory showcasing shopping for exercise to have pumped up even on weekly charts.

Though the token has simply recovered from a good rise, the likelihood of a revenue reserving stays dim. On long-term worth motion, the resistance has shifted to $1500, which brings the chance to make as much as 15 % within the brief run.