[ad_1]

TRON has overshadowed Ethereum and plenty of different cryptocurrencies concerning lively customers. Nonetheless, its worth has been consolidating inside a spread in the previous couple of months, whereas Bitcoin and Ethereum costs have risen, particularly after the US banking disaster.

In response to current information, the day by day lively customers on the TRON community cross 1.7 million, which is best than Binance Chain, Polygon, and Ethereum. Furthermore, throughout the numerous different protocols, TRON has achieved a Complete Worth Locked (TVL) of $5.5 billion as a decentralized finance chain.

#CMCReport: Day by day Lively Addresses by Chain ✨#Tron #BNBChain & #Bitcoin continues to steer the chart with probably the most lively customers this previous week. 💪 pic.twitter.com/BvIJ90vv8e

— CoinMarketCap (@CoinMarketCap) April 26, 2023

The day by day lively customers cross 7.7 million, excess of Ethereum’s 1 million. It suggests TRON has gained the customers’ consideration with its distinctive efficiency because the DeFi community. Nevertheless, the demand has not been mirrored within the asset worth.

Consultants imagine an absence of real-world use circumstances could discourage buyers from holding TRX for the long run as a result of the native coin TRX is just used on the TRON community and isn’t an appropriate asset for long-term funding. Alternatively, Ethereum can be utilized as a cost system with higher real-world use circumstances. Crypto fans choose Ethereum for long-term funding in addition to buying and selling. That’s the reason the consumer engagement of TRON is just not mirrored within the worth motion. And primarily based on our TRON prediction, it would consolidate within the upcoming months.

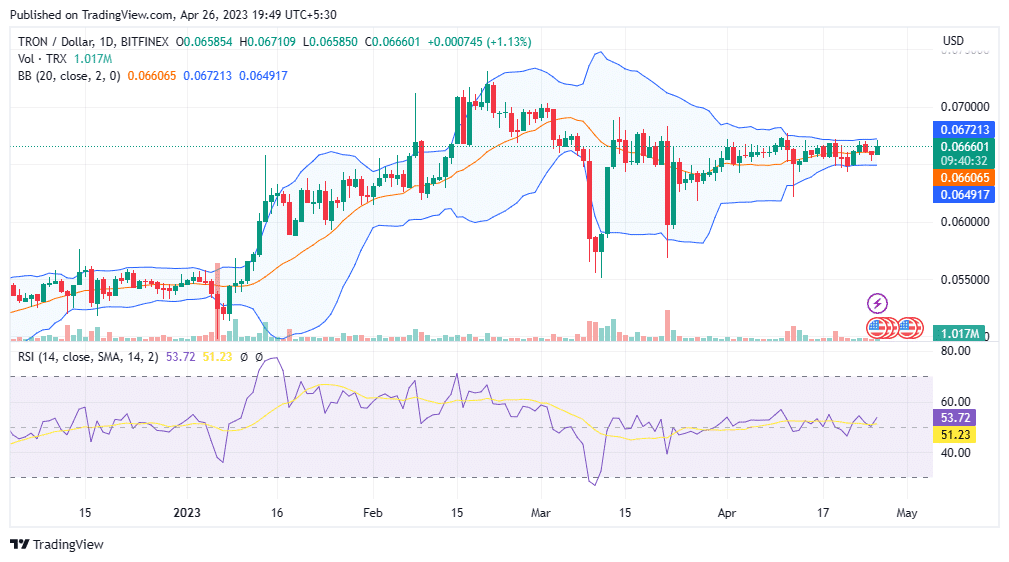

On the time of writing, the TRX worth is buying and selling round $0.066, consolidating inside a spread of $0.065 and $0.067. The day by day chart has fashioned a development line of upper lows and a resistance of $0.067. If it breaks the resistance, TRON might be bullish for the brief time period. Nevertheless, Bollinger Bands lack volatility, and its RSI is over 50, which doesn’t counsel a robust uptrend momentum regardless of excessive consumer engagement on the community.

Even on the weekly worth motion, TRON has been consolidating inside a spread across the baseline of the Bollinger Bands, and RSI is round 50, however yow will discover a robust resistance round $0.07. If it breaks the $0.07, it could possibly be long-term bullish.