[ad_1]

The latest deluge of spot Bitcoin ETF purposes sparked a serious mid-June rally for Bitcoin. Whereas the primary crypto asset managed to beat the 30,000 degree because of this, Bitcoin’s value has in any other case fallen into a good vary in latest days and solely managed a single shut above 31,000. Let’s look at whether or not this slender Bitcoin value vary suggests a giant transfer forward or extra sideways motion for the foreseeable future.

One other Slender Base For Bitcoin

Following June’s giant advance, Bitcoin’s value has continued to commerce sideways, falling into a good vary of lower than 5 % from its highest near its lowest shut over a latest fifteen day interval. Whereas not an on daily basis incidence, there have been thirty-six such bases in Bitcoin’s fashionable historical past (2011 – current) if utilizing a comparatively short-term holding time of seven days. Briefly, it’s simply one other slender base for Bitcoin.

Bitcoin Day by day Chart | BTCUSD on TradingView.com

What does this latest tight base counsel for Bitcoin’s value? To search out out, we’ll take a look at all alerts since 2011, including an additional situation which higher describes present market situations with respect to Bitcoin.

Potential Large Transfer In 90 Days

Along with requiring a spread of lower than 5 % from its highest near its lowest shut over a 15 day interval, our further situation requires that Bitcoin’s value additionally closes above its 200MA. This extra situation filters out slender bases in periods of downward value momentum and higher describes Bitcoin’s present technical state amid an enhancing macro atmosphere.

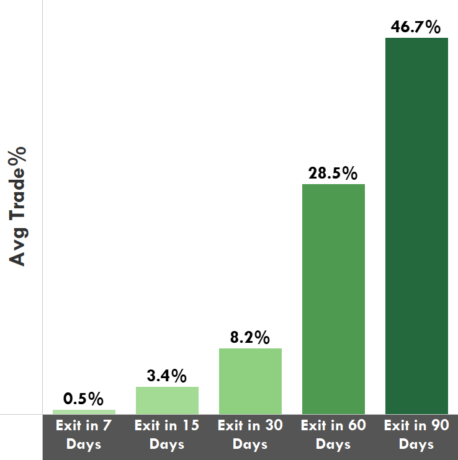

The holding time graphic under illustrates Bitcoin’s historic tendency for less than modest positive aspects within the short-term, with an unimpressive +0.5% common hypothetical commerce utilizing a 7-day maintain, a meager +3.4% common commerce utilizing a 15-day maintain, and a extra respectable 8.2% common commerce utilizing a 30-day maintain.

Bitcoin Holding Time Stats | SOURCE: Tableau

Past the short-term time horizon, nevertheless, Bitcoin’s historical past suggests a a lot brighter outlook with a barely longer 60-day holding time, returning a +28.5% common commerce from 2011 to the current. From a extra intermediate-term perspective, nevertheless, the 90-day maintain time sees Bitcoin’s common commerce stats leap meaningfully increased to +46.7%.

Whereas the previous doesn’t predict future, primarily based on our evaluation, the same consequence for Bitcoin going ahead would put BTCUSD at 44,752 by early October, roughly three months away. Whereas the prospect of a looming recession and continued regulatory uncertainty for the crypto trade within the U.S. could dampen this prospect, historical past suggests the potential for a giant transfer forward within the intermediate-term future.

DB the Quant is the writer of the REKTelligence Report e-newsletter on Substack. Observe @REKTelligence on Twitter for evidence-based crypto market analysis and evaluation. Necessary Be aware: This content material is strictly academic in nature and shouldn’t be thought-about funding recommendation. Featured pictures created with Tableau. Charts from TradingView.com.