[ad_1]

Whereas most crypto market watchers stay centered on Bitcoin’s ongoing battle with $31,000, Ethereum just lately closed above the psychologically necessary $2000 degree for the primary time in weeks. Now poised to shut decrease for 4 straight days, let’s take an evidence-based method and decide whether or not 4 consecutive days decrease for Ether is traditionally bullish or bearish going ahead. Let’s dive in!

Ethereum’s Shut Above $2000 Adopted By Pullback

After closing at a formidable multi-week excessive and again above the $2000 degree on July thirteenth, Ether has pulled again for 4 consecutive classes, one of many situations we’ll check momentarily. To raised add context to the check, we’ll additionally add two extra situations requiring that [1] Ether is above its 200ma and that [2] its 200ma is rising. Why? The 200ma and its slope each act as easy filters to assist decide market regime. For instance, this newest 4 day pullback in Ether happens in an bettering market through which ETH is above the rising 200ma. If the present 4 day pullback had been occurring in a down trending market regime, we’d require that ETH be beneath its declining 200ma.

Ethereum every day chart | ETHUSD on TradingView.com

What does this pullback in Ethereum recommend for its value? To search out out, we’ll have a look at all alerts since inception, and in addition evaluate these alerts to a easy “purchase and maintain” method. This may present us with a baseline to raised perceive immediately’s check outcomes.

4 Days Down In contrast To Purchase And Maintain

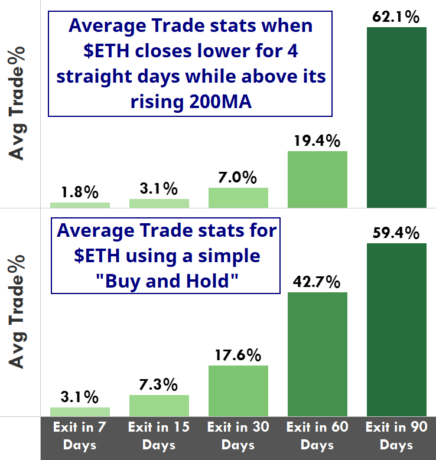

The holding time graphic beneath reveals historic outcomes for Ether’s present technical setup on high with a easy “purchase and maintain” method on the underside. In different phrases, we’ll present hypothetical outcomes utilizing varied holding instances solely for when Ethereum has closed decrease for 4 straight days whereas above its rising 200ma on high. The underside outcomes will act as a baseline, assuming a hypothetical buy of ETHUSD with no situations by any means and an exit n-days later.

Common Commerce Comparability | SOURCE: REKTelligence, Tableau

Whereas each approaches present optimistic common commerce outcomes over each exit we examined from 7 days by way of 90 days, our baseline “purchase and maintain” truly outperforms the present technical setup of 4 days down. The one exception is the “exit in 90 days” through which the present setup barely outpaces the historic common “purchase and maintain” commerce, beating it 62.1% to 59.4%.

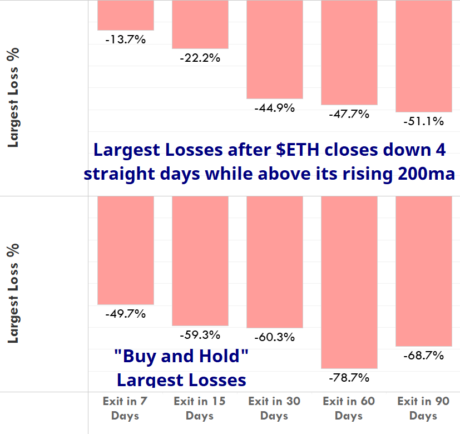

However whereas the typical commerce statistic stays necessary, it doesn’t at all times inform the entire story. When a comparability of the biggest hypothetical losses for each approaches utilizing the identical situations described earlier, observe that the biggest losses (i.e., worst trades) for the present 4 days down setup are far decrease than for a easy “purchase and maintain” method. This largest loss comparability signifies that whereas the present setup could not beat “purchase and maintain” when it comes to common commerce, Ethereum could at the moment have a decrease than traditional danger publicity – one thing most skilled merchants will respect.

Largest Loss Comparability | SOURCE: REKTelligence, Tableau

Whereas the previous doesn’t predict future, primarily based on our evaluation, Ethereum appears to be like poised for potential upside largely according to typical “purchase and maintain” expectations. In different phrases, not overly thrilling and apparently missing any significant edge in the intervening time. That mentioned, danger additionally seems decrease than traditional relative to the “purchase and maintain” largest loss stats. Merchants take observe. Ethereum could now offer its typical return profile primarily based on its present technical setup, however with a decrease general danger publicity.

DB the Quant is the writer of the REKTelligence Report publication on Substack. Comply with @REKTelligence on Twitter for evidence-based crypto market analysis and evaluation. Essential Word: This content material is strictly academic in nature and shouldn’t be thought-about funding recommendation.

Featured picture from nadia_snopek/Adobe Inventory. Charts from TradingView.com.