[ad_1]

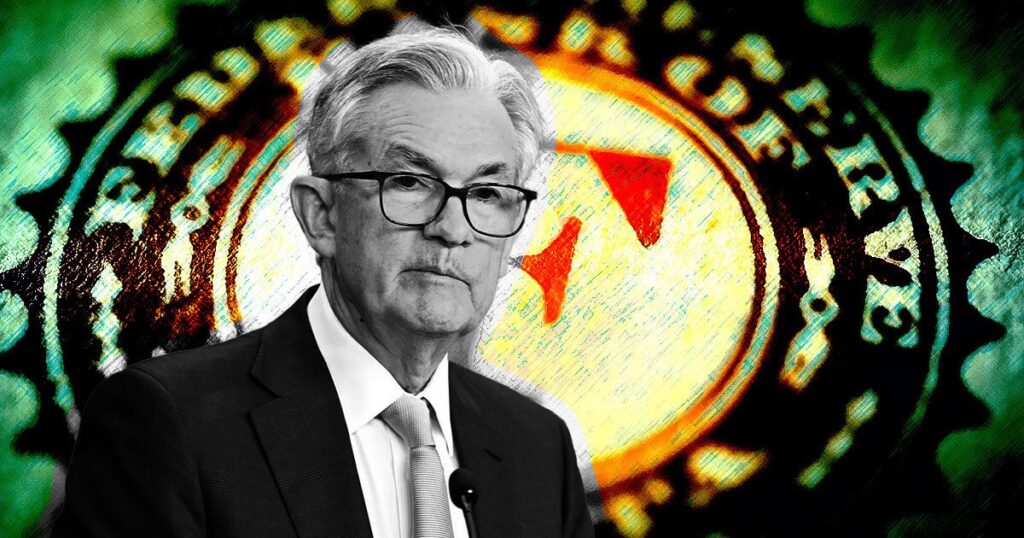

The sturdy progress of the U.S. monetary system may necessitate additional charge of curiosity will improve to mitigate inflationary pressures, in step with Federal Reserve Chair Jerome Powell.

Speaking on the Jackson Hole Monetary Symposium, an annual conference of central bankers in Jackson Hole, Wyo., Powell outlined the uncertainties surrounding the monetary outlook whereas indicating the potential need for added restrictive monetary insurance coverage insurance policies, as reported by the Associated Press.

Inflation nonetheless too extreme

No matter inflation having declined from its peak, Powell maintained that it stays excessively extreme. He further emphasised that the Federal Reserve stays watchful for indicators that the monetary system is simply not decelerating as predicted. The central monetary establishment is poised to escalate expenses further, if compulsory, and plans to maintain up a restrictive protection stage until it sees substantial proof of sustained inflation low cost in route of their 2% objective.

As Powell well-known, the monetary system has been rising at an stunning tempo, coupled with fixed consumer spending, most likely sustaining extreme inflation pressures. This comment marks a significant departure from his statements inside the earlier 12 months, the place he explicitly warned of continued sharp charge hikes by the Fed to curb hovering prices.

The Fed’s charge hikes have resulted in significantly elevated mortgage expenses, making it troublesome for Folks to afford properties or vehicles and for firms to finance expansions. No matter this—and reverse projections—the U.S. unemployment charge remained common at 3.5%, barely above a half-century low. The persistent inflation and durable employment figures underscore Powell’s concern in regards to the quick monetary progress, indicating a doable need for elevated charges of curiosity to behave as a restriction.

Reverse to expectations earlier inside the 12 months, most retailers now foresee no charge of curiosity cuts sooner than mid-2024 on the earliest. In step with Powell, the central monetary establishment’s policymakers take into account their key charge is sufficiently extreme to restrain the monetary system and funky progress, hiring, and inflation. Nonetheless, he acknowledged the difficulty in determining the necessary borrowing costs to gradual the monetary system, resulting in fastened uncertainty in regards to the effectiveness of the Fed’s insurance coverage insurance policies in decreasing inflation.

Whereas retailers and economists have confirmed elevated optimism for a “mild landing”—the Fed attaining its objective inflation charge with out inducing a steep recession—others keep skeptical.