[ad_1]

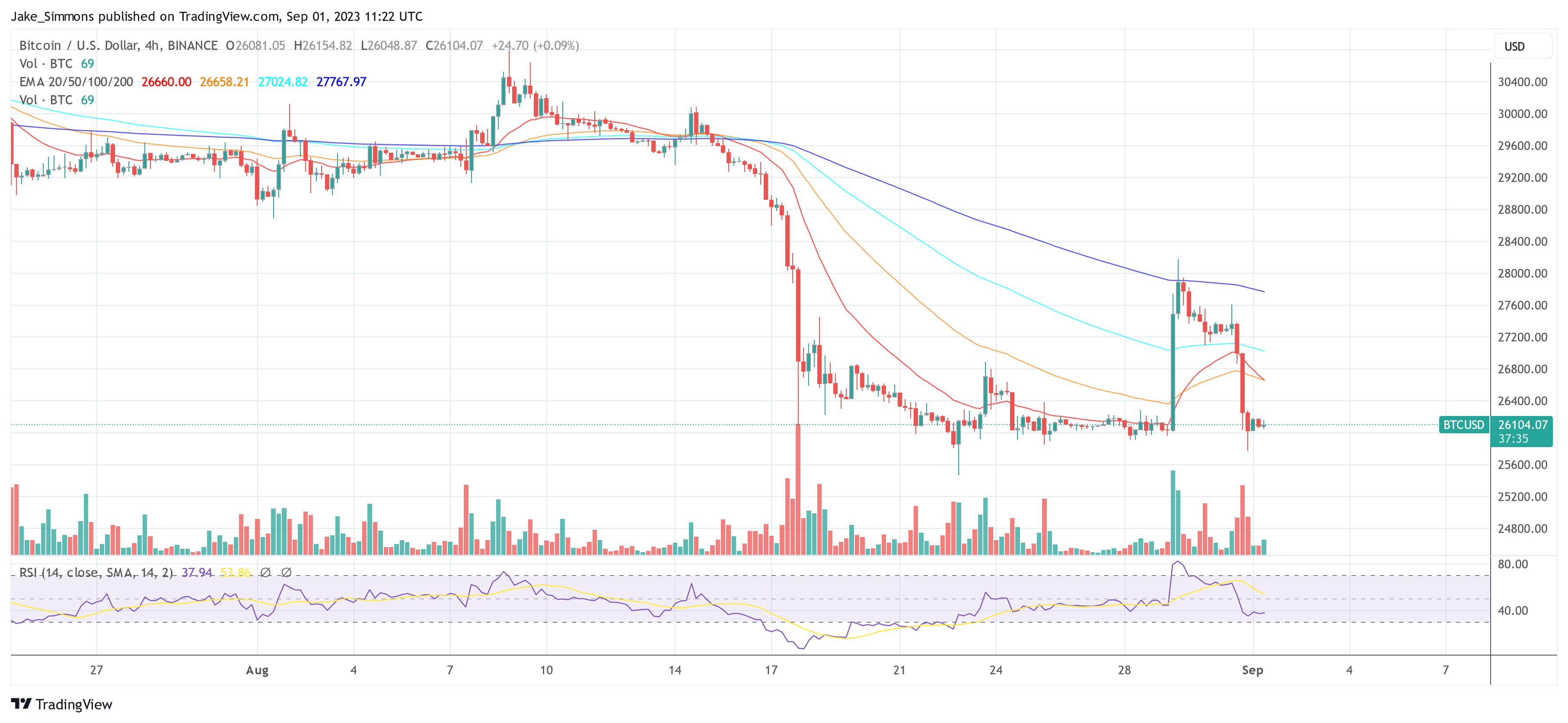

After a short-lived rally above $28,000 this week following Grayscale’s landmark court docket case victory in opposition to the US Securities and Change Fee (SEC) over the conversion of GBTC right into a spot ETF, the worth of BTC has as soon as once more settled across the $26,000 mark. This comes after yesterdays’ SEC’s determination to postpone all Bitcoin spot ETF choices for 45 days.

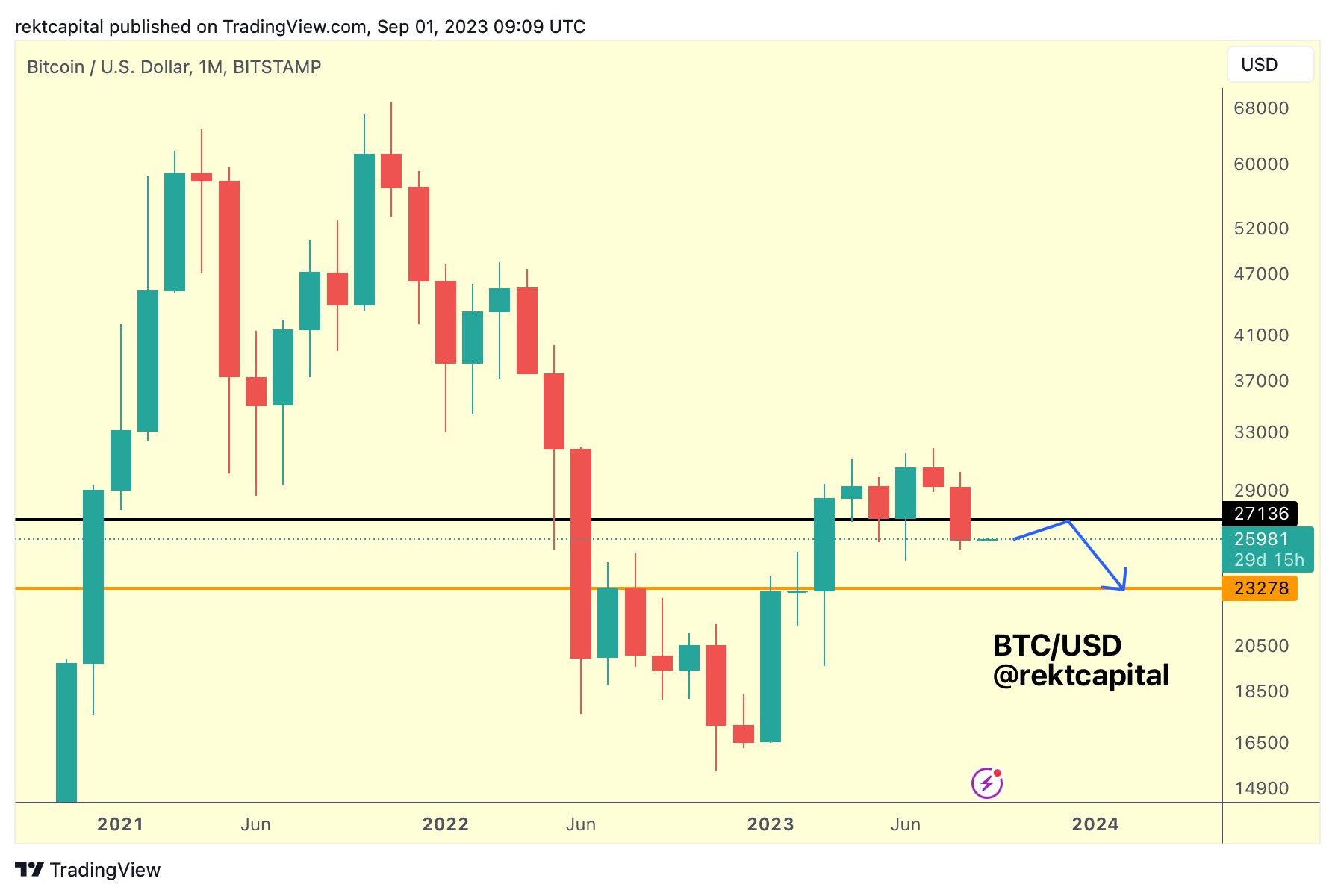

Famend crypto analyst, Rekt Capital, has weighed in on the scenario with a sequence of tweets that present perception into Bitcoin’s potential trajectory for the upcoming month. Because the analyst remarks, Bitcoin has registered a bearish month-to-month candle shut for the month of August as a result of yesterdays’ worth plunge.

Bitcoin Worth Prediction For September 2023

In a sequence of tweets, Rekt Capital defined, “BTC closed beneath ~$27,150, confirming it as misplaced assist. It’s doable BTC might rebound into ~$27,150, perhaps even upside wick past it this September. However that may seemingly be a aid rally to verify ~$27,150 as new resistance earlier than dropping into the $23,000 area.

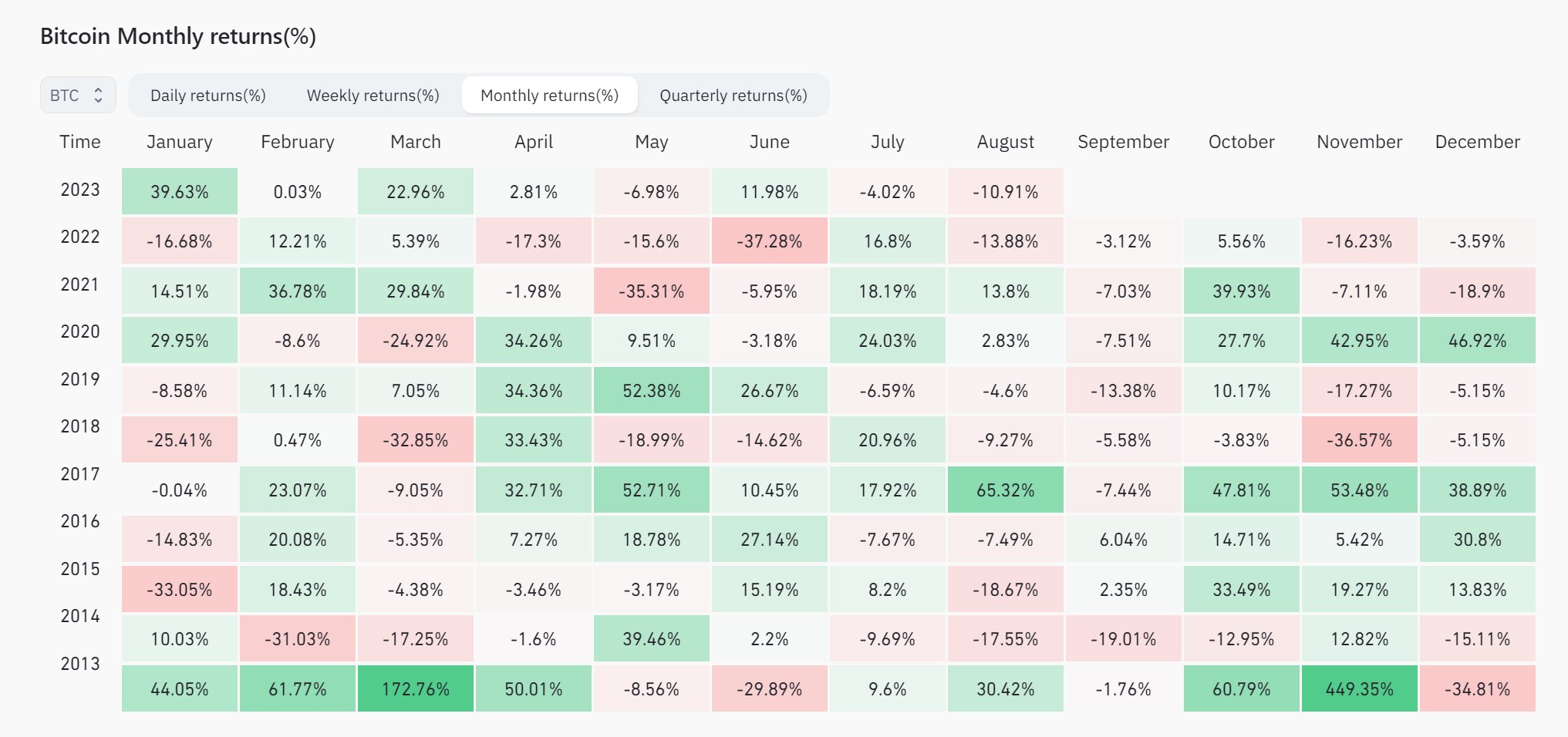

Traditionally, September has not been notably sort to Bitcoin, with the month recording the least variety of positive-returning months at simply two, and at present being on a 6-year negative-returning streak.

Rekt Capital delves deeper into this pattern, stating, “A continuously recurring draw back quantity for BTC within the month September is -7%. If BTC have been to drop -7% from present worth ranges this month, worth would retrace to ~$24,000.”

Nevertheless, in accordance with the evaluation by the analyst, the subsequent main month-to-month degree is sitting at ~$23,400. This implies that worth perhaps doesn’t cease at -7% if BTC can’t acquire new momentum. As a substitute, BTC might doubtlessly draw back wick -10% in complete to succeed in that subsequent main month-to-month degree.

The analyst additional elaborated on the historic efficiency of Bitcoin in September, noting, “September – constructive or detrimental month? Sometimes, we are inclined to see a detrimental month for BTC in September. Nevertheless, for essentially the most half BTC sees single-digit drawdown in Septembers. 8 out of 10 of the previous Septembers have skilled draw back. Solely 2 months noticed small, single-digit beneficial properties within the month of September (+2% in 2015 and +6% in 2016).”

Worst Case State of affairs

Drawing parallels with earlier years, Rekt Capital highlighted that essentially the most recurring drawdown in September has been a -7% dip, as noticed in 2017, 2020, and 2021. Nevertheless, he additionally identified that Bitcoin solely noticed double-digit retracement in 2019 (-13%) and in 2014 (-19%). The latter, being a bear market yr, may not be the very best comparability for 2023, which is shaping as much as be a bottoming out yr, akin to 2019 or 2015.

Addressing the looming query of one other potential crash in September, the analyst opined, “In 2019 BTC noticed a -13% retrace however we additionally have to understand that BTC simply noticed considered one of its worst-ever August drawdowns at -16%. It’s unlikely that Bitcoin would expertise extreme back-to-back drawdown each in August and now in September as effectively.”

Concluding his evaluation, Rekt Capital shared his private forecast, “I believe a drawdown of round -7% to -10% September might moderately happen from present ranges. This may see worth drop to ~$24,000 – $23,000.”

Remarkably, there may be unlikely to be a Bitcoin spot ETF determination in September, which could be the largest catalyst for the market in the meanwhile. The subsequent deadlines for filings by Bitwise, BlackRock, Constancy and the others is October 16 and 17. Solely an motion by the SEC after the misplaced lawsuit in opposition to Grayscale might present a shock occasion. Nevertheless, there are at present no deadlines or statements from the SEC if and when they are going to perform the ruling.

At press time, BTC traded at $26,104.

Featured picture from Finextra Analysis, chart from TradingView.com