[ad_1]

Bitcoin has been trending up since hitting an area low under $25,000 on September eleventh. Yesterday’s rally to $27,435 marked a ten% improve from the latest low. As NewsBTC reported, the rally was largely led by the futures market and an enormous improve in open curiosity of over $1 billion, greater than half of which was flushed out when BTC fell again under $27,000. Regardless of this, BTC is up round 7.5% from final week’s low. A motive to be bullish?

Glassnode Report Sheds Mild On Market Sentiment

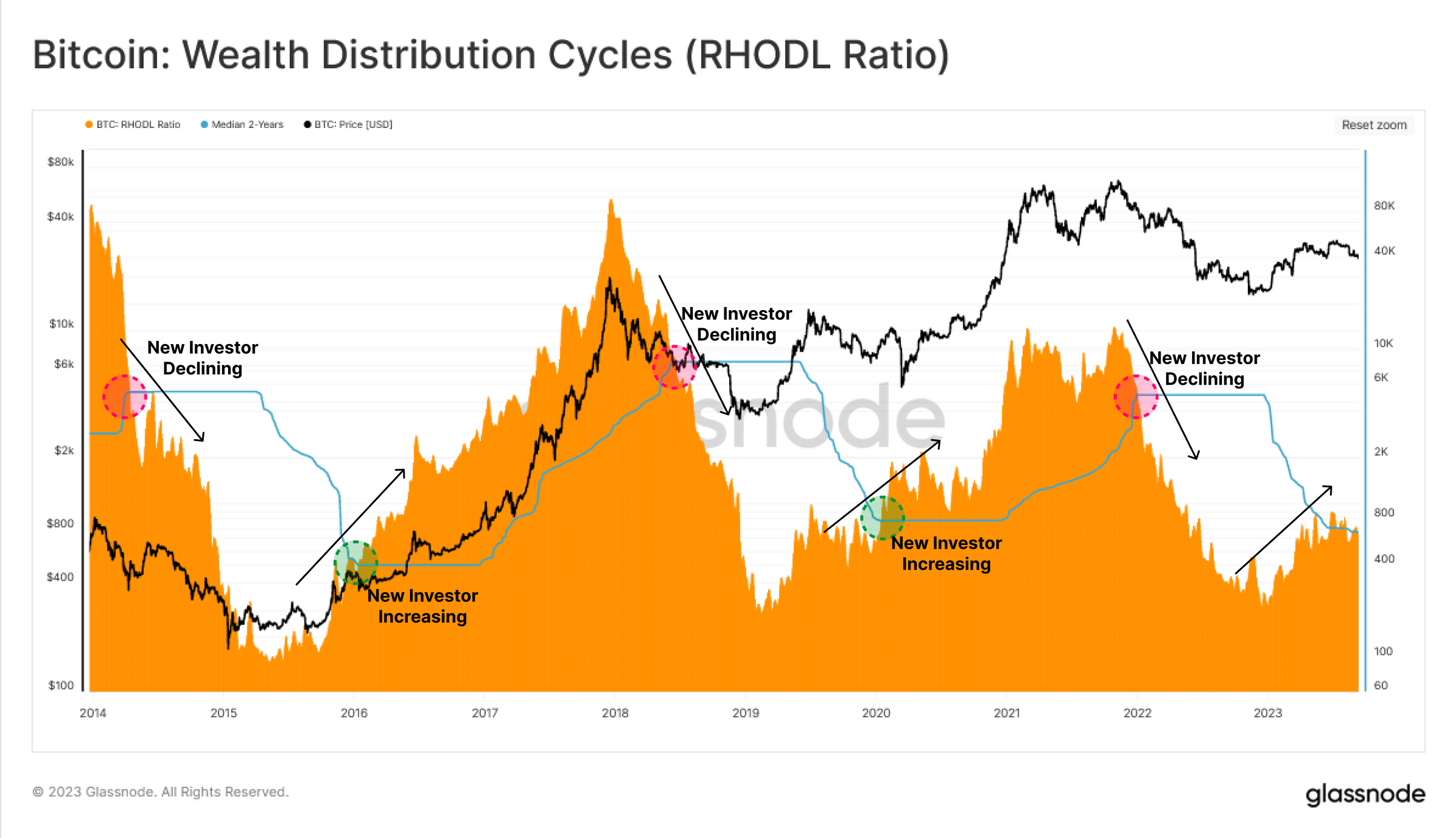

Based on Glassnode, the Realized HODL Ratio (RHODL) serves as an important market sentiment indicator. It measures the stability between investments in just lately moved cash (these held for lower than every week) and people within the arms of longer-term HODLers (held for 1-2 years). The RHODL Ratio for the 12 months 2023 is flirting with the 2-year median stage. Whereas this means a modest inflow of latest traders, the momentum behind this shift stays comparatively weak.

Glassnode’s Accumulation Pattern Rating additional elaborates on this pattern. It reveals that the present restoration rally of 2023 has been considerably influenced by investor FOMO (Worry of Lacking Out), with noticeable accumulation patterns round native value tops exceeding $30,000. This conduct contrasts sharply with the latter half of 2022, the place newer market entrants confirmed resilience by accumulating Bitcoin at cheaper price ranges.

The Realized Revenue and Loss indicators additionally reveal a posh image. These metrics measure the worth change of spent cash by evaluating the acquisition value with the disposal value. In 2023, durations of intense coin accumulation have been typically accompanied by elevated ranges of profit-taking. This sample, which Glassnode describes as a “confluence,” is just like market conduct seen in peak durations of 2021.

An evaluation of Brief-Time period Holders (STH) uncovers a precarious state of affairs. A staggering majority, greater than 97.5% of the availability procured by these newcomers, is presently working at a loss, ranges unseen because the notorious FTX debacle. Utilizing the STH-MVRV and STH-SOPR metrics, which quantify the magnitude of unrealized and realized earnings or losses, Glassnode elucidates the intense monetary pressures latest traders have grappled with.

Market Confidence Stays Low

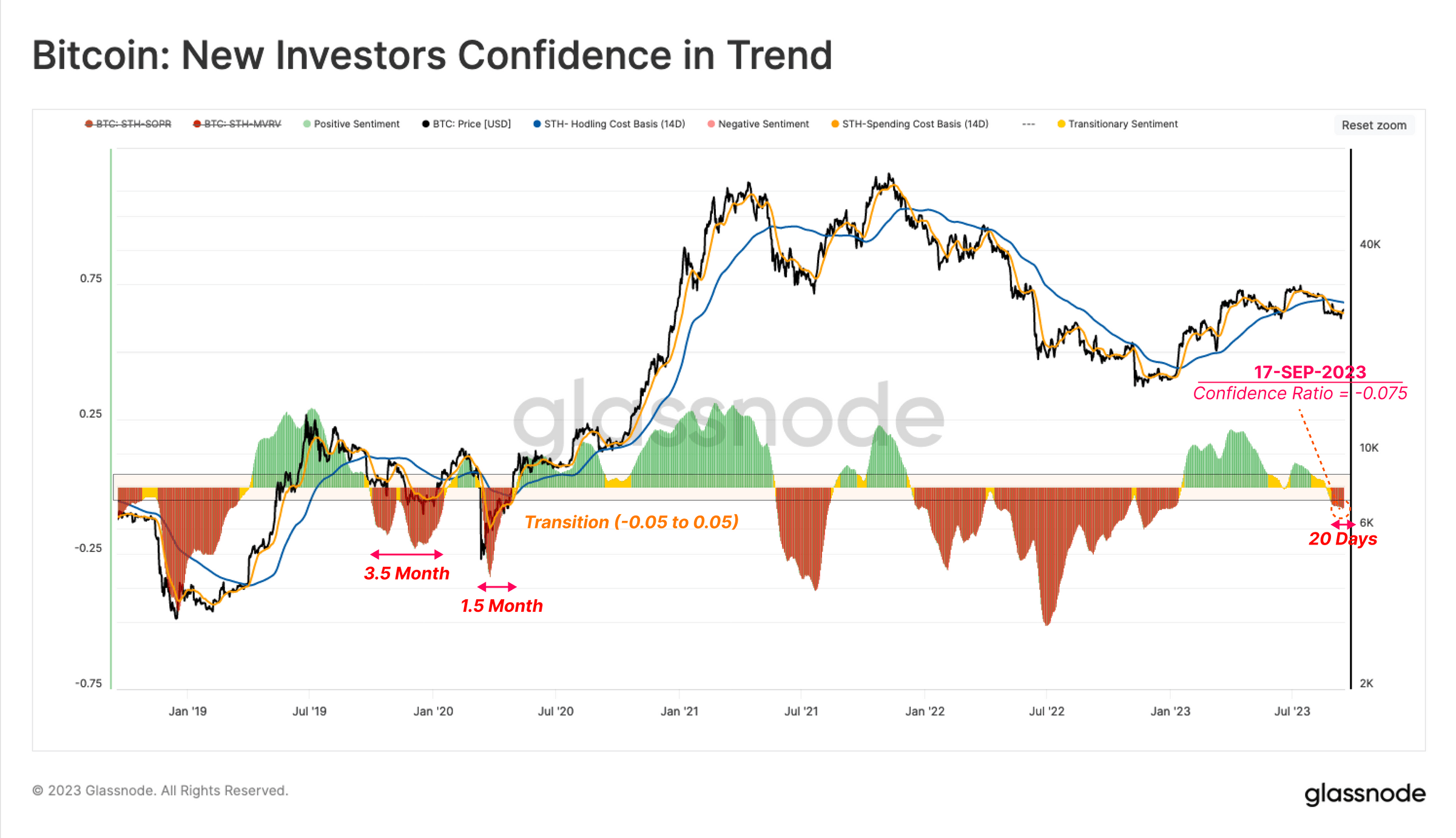

The report additionally delves into the realm of market confidence. An in depth examination of the divergence between the price foundation of two investor subgroups — spenders and holders — presents a sign of prevailing market sentiment. Because the market reeled from the value plummet from $29k to $26k in mid-August, an overwhelmingly adverse sentiment was evident. This was manifested as the price foundation of spenders fell sharply under that of holders, a transparent sign of prevalent market panic.

To supply a clearer visualization, Glassnode has normalized this metric in relation to the spot value. A vital commentary is the cyclical nature of adverse sentiment throughout bear market restoration phases, normally lasting between 1.5 to three.5 months. The market just lately plunged into its first adverse sentiment section since 2022’s conclusion.

Presently, the pattern lasts 20 days, which might imply that the top has not but been marked by the latest rally, if historical past repeats itself. Nonetheless, if there’s a sustained bounce again into optimistic territory, it may very well be indicative of renewed capital influx, signifying a return to a extra favorable stance for Bitcoin holders.

In conclusion, Glassnode’s on-chain knowledge reveals a Bitcoin market that’s presently in a state of flux. Though 2023 has seen new capital coming into the market, the inflow lacks sturdy momentum. Market sentiment, particularly amongst short-term holders, is decidedly bearish. These findings point out that warning stays the watchword, with underlying market sentiment providing blended indicators concerning the sustainability of the present Bitcoin rally.

At press time, BTC traded at $26,846 after being rejected on the 23.6% Fibonacci retracement stage (at $27,369) within the 4-hour chart.

Featured picture from iStock, chart from TradingView.com