[ad_1]

Bitcoin rallied above $35,000 on the again of the euphoria of the potential approval of a Spot Bitcoin ETF. Though the rally appears to have cooled off, a specific crypto analyst’s prediction means that the bulls may get pleasure from whole dominance quickly sufficient in what’s going to see the flagship cryptocurrency rise to $45,000.

Bitcoin’s Incoming Part May See It Hit $45,000

In a publish shared on their X (previously Twitter) platform, crypto analyst CryptoCon shared his prediction on Bitcoin’s future trajectory. The analyst talked about that Bitcoin was at the moment on the “Mid-Cycle section 4,” which occurs to be the interval the place the crypto token is heading nearer to the “Cycle Mid-Prime,” which at the moment positions Bitcoin to rise above $45,000.

CryptoCon’s prediction appears to be made primarily based on the Fibonacci buying and selling technique, as evident within the accompanying chart, which he shared in his publish. The chart breaks down Bitcoin’s historic worth knowledge into 4 cycles, specifically: Cycle 1 (2010-2014), Cycle 2 (2015-2018), Cycle 3 (2019-2022), and Cycle 4 (2023-2026).

Supply: X

The Phases In These Cycles

These cycles are additional divided into 5 phases, which CryptoCon appeared to focus extra on. These phases embody Part 1 (Cycle Lows), Part 2 (Transition from Cycle Lows), Part 3 (First Transfer out of the Lows), Part 4 (Transition to Cycle Mid-Prime), and Part 5 ( Cycle Mid-Prime).

CryptoCon famous that Bitcoin’s worth often hits section 5 shortly as soon as section 2 is over (about two months after, in keeping with the analyst), and if that’s the case as soon as once more, then $45,000 may very well be quickly. If that doesn’t occur, he foresees that Bitcoin may face resistance on the high of the transition, the place it’s at the moment priced at $36,368.

As to when all this might occur, he famous that October represents the primary month after section 2 ended. Due to this fact, the market may see the mid-top section may occur as quickly as November when Bitcoin will possible hit and rise above $45,000.

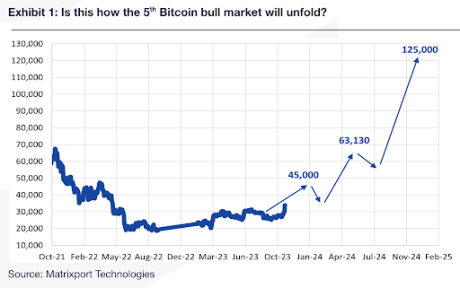

Curiously, CryptoCon’s prediction coincides with that of the crypto platform Matrixport, which estimates that Bitcoin may hit $45,000 between November this yr and April 2024. Of their report, Matrixport goes on to make a bolder declare that Bitcoin may hit $125,000 by December 2024.

Supply: Matrixport

Bitcoin Halving Or Institutional Adoption?

Completely different crypto analysts have continued to make predictions about Bitcoin’s future trajectory even because the Bitcoin Halving attracts nearer. A few of these analysts have credited the occasion because the catalyst that may spark the huge surge in Bitcoin’s worth. Others consider that the launch of a Spot Bitcoin ETF alongside institutional adoption is what’s going to make Bitcoin hit new highs.

In the meantime, some ponder that the market could already be priced in as to any impending approval of a Spot Bitcoin ETF, as this can be a basic case of “purchase the rumor, promote the information.” If that’s the case, many predict that we may see a decline when the ETFs launch on account of large sell-offs from merchants and buyers trying to notice their good points.

BTC maintains above $34,000 | Supply: BTCUSD on Tradingview.com

Featured picture from Shutterstock, chart from Tradingview.com