[ad_1]

Of their newest market replace, QCP Capital, a crypto asset buying and selling agency headquartered in Singapore, has dissected the current Bitcoin worth actions, attributing the rally to macroeconomic components slightly than the much-anticipated approval of a spot ETF. To recall, the Bitcoin surged from $34,500 to virtually $36,000 on Wednesday.

The Essential Motive For The Bitcoin Worth Rally

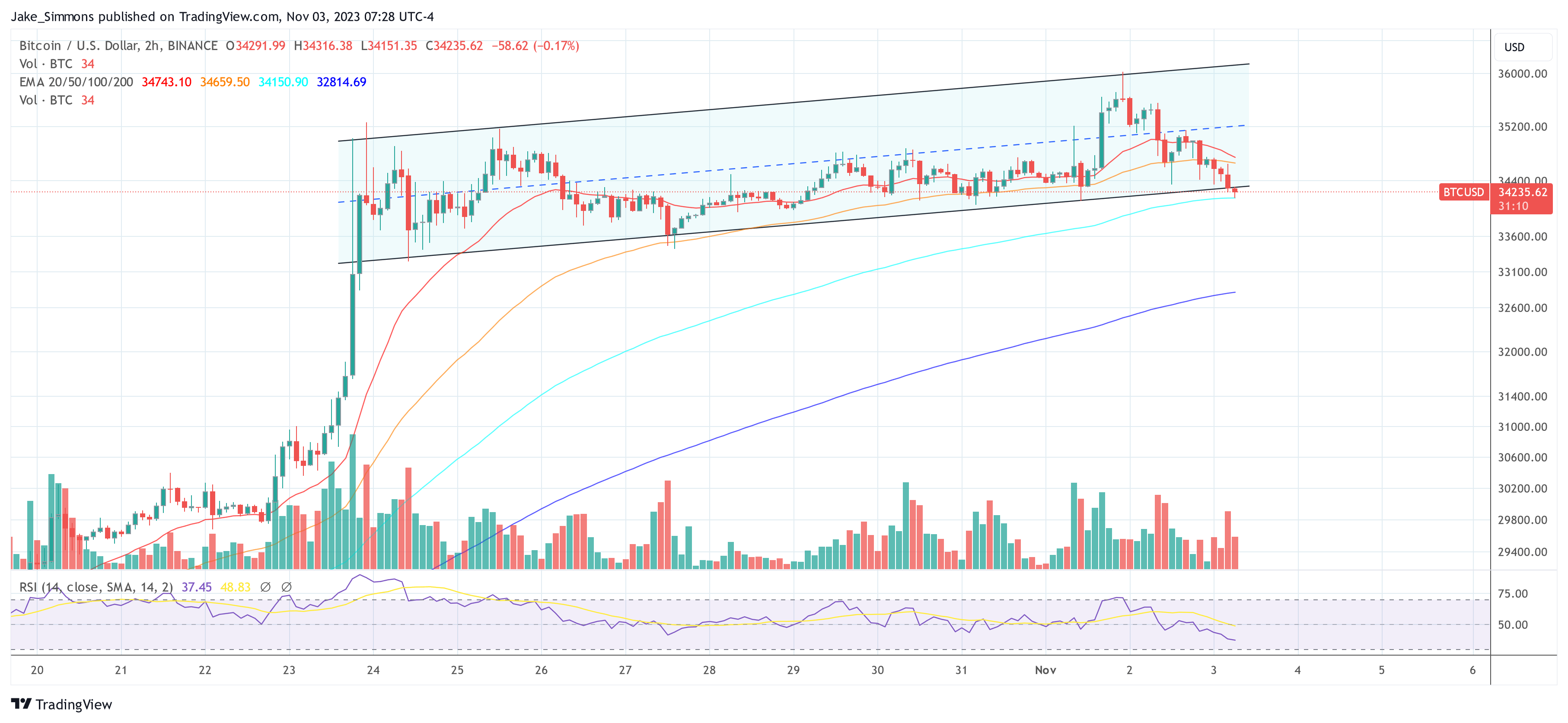

The agency’s technical evaluation highlighted that Bitcoin reached the 38.2% Fibonacci retracement stage at $35,912 and touched the higher channel trendline earlier than retreating, a transfer that was keenly noticed by market contributors.

QCP Capital’s report states, “This newest rally, nonetheless, was much less about spot ETF developments and extra about macro forces.” These macro forces have been recognized following a dovish stance from the Federal Open Market Committee (FOMC) and a smaller than anticipated Treasury Q1 provide estimate, which led to a big drop in bond yields. This, in flip, has had a bullish impact on danger belongings, together with Bitcoin and the broader crypto market.

Nevertheless, the agency additionally had a phrase of warning, saying, “Whether or not this marks the beginning of a brand new international fairness and bond uptrend stays to be seen, because the macro image primarily stays unchanged, outdoors a correction of overly bearish bond sentiment.”

The agency additionally famous the Bitcoin derivatives market, the place “perp funding, and time period forwards, implied volatility and danger reversals throughout the curve proceed to stay or lengthen additional at excessive elevated ranges.” This means a market bracing for a big transfer, with by-product merchants positioned for a possible upside breakout that hinges on the approval of a spot ETF.

Wanting on the broader monetary panorama, the bond market has been experiencing notable fluctuations. Lately, the 30-year Treasury yield has reached one other 16-year excessive, climbing above 5%. This stage of yield has not been seen since 2007, and it represents an increase of over 4 proportion factors in simply three years. Such actions within the bond market are essential for the Bitcoin and crypto market as they have an effect on the danger sentiment amongst buyers.

Nevertheless, Bitcoin is at the moment following the instance of gold as a protected haven asset. ”The market is beginning to worth within the Fed’s overtightening and weakening economics. Mixed with geopolitical tensions + battle, the necessity for QE sooner or later is rising quickly. That is inflicting insurance coverage belongings (Gold, Bitcoin) to completely rip in unison,” Carpriole Funding’s Charles Edwards remarked lately.

In abstract, QCP Capital’s insights into Bitcoin market dynamics versus present bond market traits recommend that whereas the Bitcoin market is influenced by a wide range of components, together with hypothesis about exchange-traded fund approval, macroeconomic indicators similar to bond yields play a bigger position in figuring out market sentiment and worth motion than different pundits imagine.

At press time, Bitcoin was buying and selling at $34,235 and prone to breaking out of the established uptrend channel to the draw back. If that occurs, low worth ranges might come subsequent.

Featured picture from iStock, chart from TradingView.com