[ad_1]

In a current sequence of tweets, Vetle Lunde, Senior Analyst at K33 Analysis, delved deep into the potential ramifications of the US Bitcoin (BTC) spot ETFs. Lunde’s evaluation means that the broader market could be considerably underestimating the transformative energy of those monetary devices.

Lunde’s assertion is rooted in 5 core reasons. He started with a daring proclamation: “The market is incorrect – and dramatically underestimates the affect of US BTC ETFs (and ETH futures-based ETFs).”

Why The Market Is Unsuitable On Bitcoin

Firstly, Lunde believes that the present local weather is ripe for the approval of US spot ETFs, suggesting that the percentages have by no means been extra favorable. As NewsBTC reported, Bloomberg specialists Eric Balchunas and James Seyffart just lately raised their Bitcoin spot ETF approval odds following the Grayscale judgment to 75% this yr, 95% by the top of 2024.

Secondly, Lunde identified that BTC value has retraced to pre-BlackRock announcement ranges. The third purpose revolves across the potential competitors and the simultaneous launches of a number of US spot ETFs. Lunde anticipates that these, if accredited, might result in sturdy inflows, probably surpassing the preliminary buying and selling days of each BITO and Goal.

For context, he highlighted that Goal noticed inflows of 11,141 BTC, and in its wake, subsequent ETF launches in Canada resulted in a whopping 58,000 BTC price of inflows inside a mere 4 months. Given the vastness of the US market in comparison with Canada, the influx potential is significantly greater.

The fourth purpose Lunde offered relies on historic knowledge from the previous 4 years. He emphasised a noticeable correlation between robust BTC funding automobile inflows and appreciating BTC costs. This relationship turns into much more pronounced during times of utmost inflows, which have traditionally contributed to important market uplifts.

The final essential level for Lunde is that on August 17 the market removed from extra leverage, as NewsBTC reported.

By The Numbers

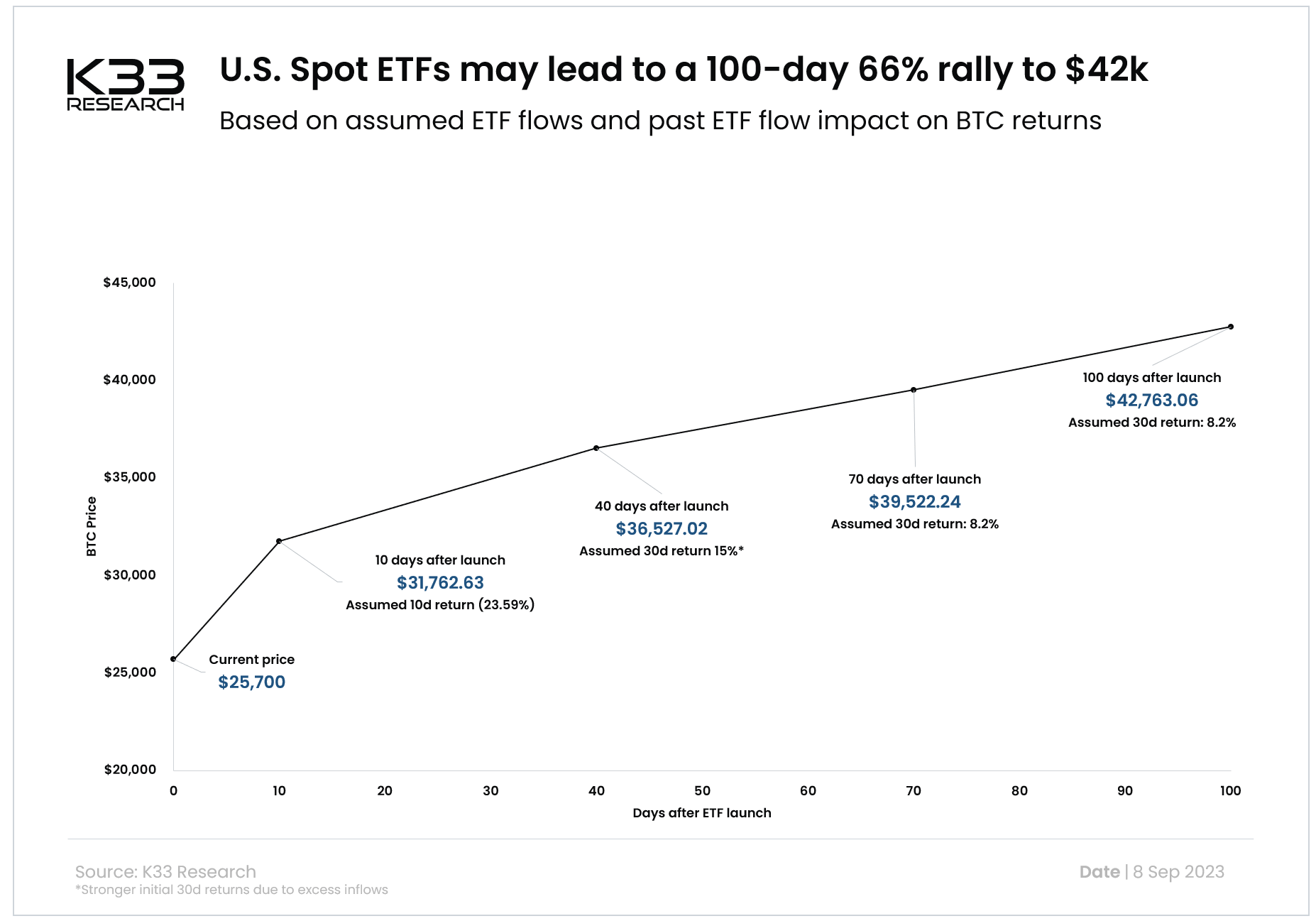

In conclusion, the analysis agency posits that US BTC spot ETFs might see not less than 30,000 BTC price of inflows of their first 10 days. Over a span of 4 months, the mixed inflows into BTC funding autos might vary between 70,000 to 100,000 BTC, pushed by US spot ETFs and rising inflows to ETPs in different international locations.

Primarily based on these circulation assumptions and knowledge from the previous 4 years, Lunde suggests a possible 66% BTC rally, concentrating on a value of $42,000. Nevertheless, he additionally cautioned that this projection relies on a “naïve assumption” and doesn’t account for different market-moving occasions.

At press time, BTC traded at $25,865.

Featured picture from iStock, chart from TradingView.com