[ad_1]

On-chain knowledge exhibits the Bitcoin Binary Coin Days Destroyed (CDD) has stayed low not too long ago. Right here’s what this says concerning the present market.

Bitcoin Binary CDD Has Remained At Very Low Ranges Not too long ago

In accordance with knowledge from the on-chain analytics agency Glassnode, this indicator attained excessive values in the course of the 2021 bull run. To grasp the CDD metric, the idea of “coin days” must be checked out first.

At any time when 1 BTC stays stationary on the blockchain for 1 day, it accumulates 1 “coin day.” If a coin that has remained unmoved on the community for some time, which means that it has gathered a sure variety of coin days, is now all of the sudden transferred, its coin days counter would naturally reset again to zero.

The coin days it had beforehand been carrying are stated to be “destroyed.” The CDD indicator measures the entire variety of coin days being reset all through the community on any given day.

When this indicator has a excessive worth, it implies that numerous coin days are being reset available in the market presently. Typically, this type of pattern is an indication of motion from the “long-term holders” (LTHs).

This group contains buyers which were holding their BTC since at the least 155 days in the past, so these holders are inclined to accumulate giant numbers of coin days. Due to this motive, every time they make transfers, the CDD registers a spike.

Within the context of the present dialogue, the CDD itself isn’t of curiosity, however a modified model of it referred to as the Binary CDD is. This indicator principally tells us how the CDD presently compares with the historic common worth of the metric.

As is already apparent from its identify, this indicator can solely attain two values: 0 and 1. It has a price of 0 if the CDD is beneath the historic common, whereas it’s 1 when the metric is above it.

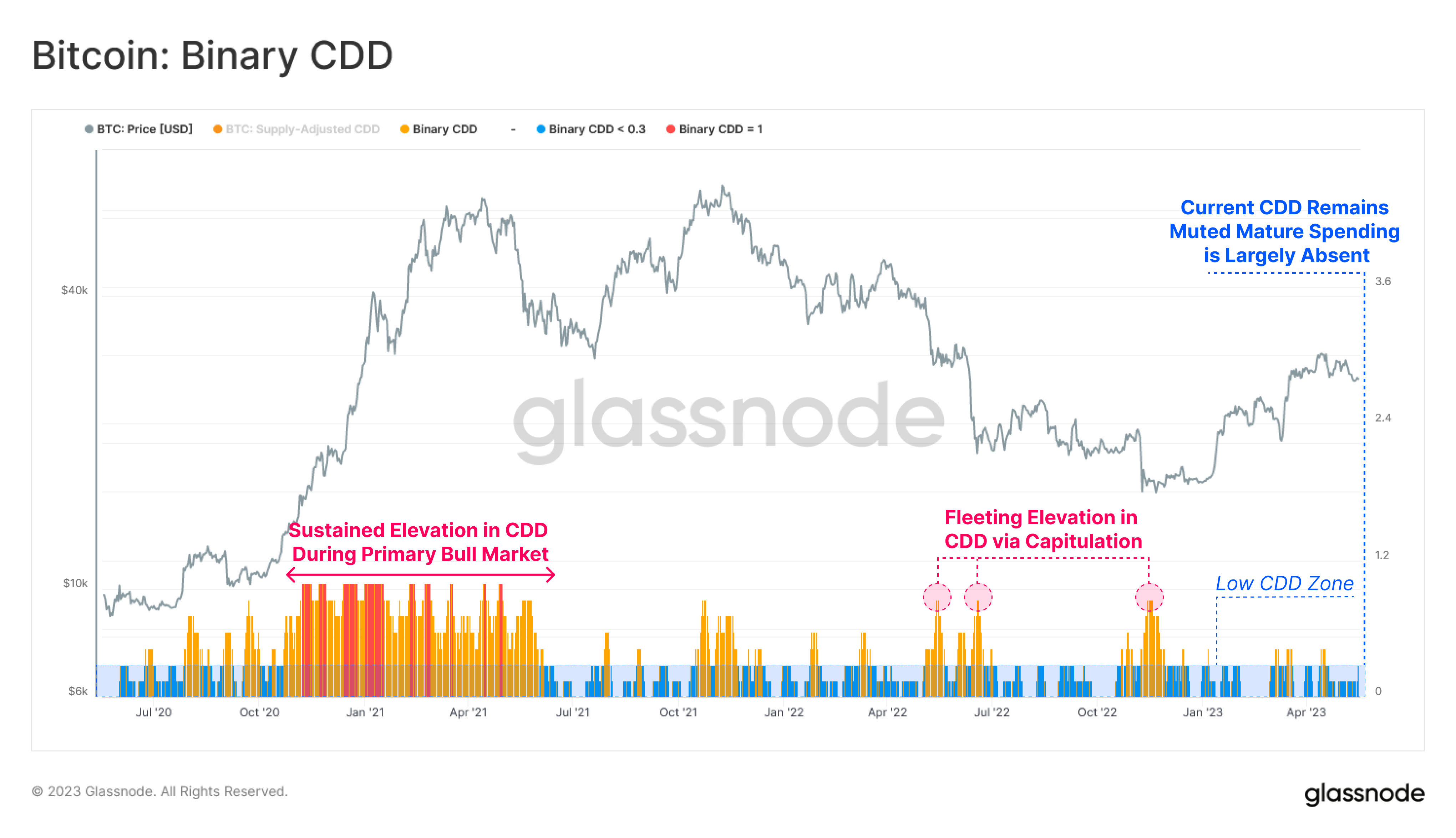

Now, here’s a chart that exhibits the pattern within the 7-day common Bitcoin Binary CDD over the previous couple of years:

The worth of the metric appears to have been low in current days | Supply: Glassnode on Twitter

As proven within the above graph, the 7-day common Bitcoin Binary CDD has had a reasonably low worth for some time now. This implies that there hasn’t been any important destruction of coin days available in the market not too long ago.

Naturally, which means the LTHs haven’t been making any strikes out of the extraordinary, regardless of the value observing a notable enhance throughout the previous couple of months.

The LTHs are typically probably the most resolute bunch available in the market, so transfers from them can have important implications for the sector since they’re an indication that even these holders might have been pressured to promote.

The Bitcoin bull run in the course of the first half of 2021 noticed the 7-day common Binary CDD keep close to 1, implying that the LTHs had been promoting in full pressure. As this hasn’t been the case within the rally to date, it seems that the present earnings aren’t sufficient to maneuver these diamond fingers, and they’re seemingly anticipating higher alternatives afterward.

These buyers persevering with to carry such a bullish conviction might be constructive for the value in the long run.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,300, down 1% within the final week.

The asset continues to consolidate | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Glassnode.com