[ad_1]

Bitcoin is edging nearer to the $50,000 mark after per week of excessive bullish value motion, a degree not seen since December 2021. Amidst this value surge, the variety of Bitcoin addresses in revenue has now crossed over 90%.

In keeping with knowledge from IntoTheBlock, 91% of Bitcoin addresses are at the moment worthwhile. This implies the overwhelming majority of holders and buyers have an incentive to proceed holding, notably as the following halving for Bitcoin miners approaches.

91% Of Bitcoin Addresses Now In Revenue As Worth Nears $50,000

Bitcoin has had an eventful week when it comes to value motion. The world’s largest crypto lately grew by 14.4% to succeed in $48,500 on February 11, its highest level in 26 months. This value spike, though extremely welcome, appeared to have taken most buyers abruptly contemplating it was coming off 4 weeks of unimpressive motion after the debut of spot Bitcoin ETFs within the US.

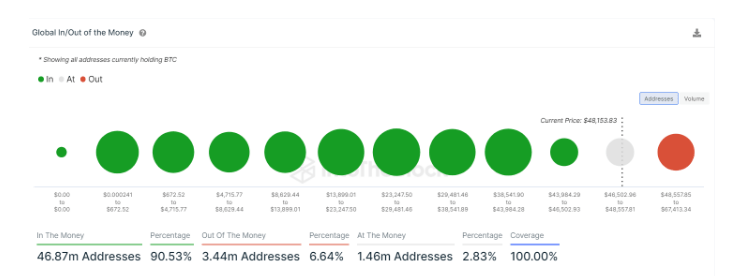

Notably, IntoTheBlock’s “International In/Out of the Cash” profitability metric reveals that the overall variety of addresses in revenue is now at 46.87 million addresses, representing 90.53% of the overall addresses. On the similar time, 3.44 million addresses representing 6.64% are nonetheless posting losses, whereas 1.46 million addresses representing 2.83% of the overall addresses are on the cash or break-even level.

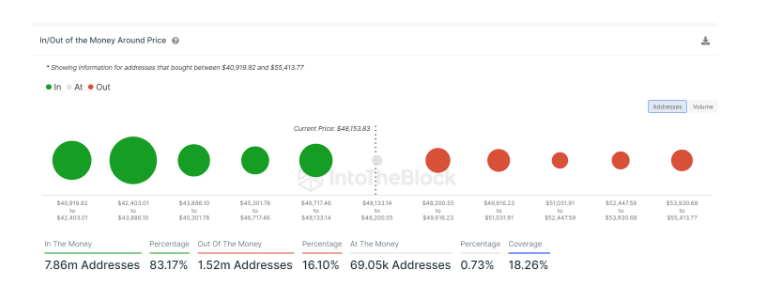

Equally, IntoTheBlock’s “In/Out of the Cash Round Worth” metric which follows addresses that purchased between $40,919.92 and $55,413.77, reveals {that a} majority (83.17%) of addresses are in revenue. It is a vastly bullish sign and reveals that almost all of Bitcoin holders are effectively within the cash. As the worth continues climbing because the crypto approaches the $50,000 mark, an increasing number of addresses are prone to transfer into revenue.

Bitcoin Set To Maintain Shining

With over 90% of Bitcoin addresses now in revenue and the worth nearing $50,000, it’s clear this bull run nonetheless has room to run. The bullish motion final week noticed BTC closing over $44,000 on the weekly timeframe for the primary time within the present market cycle.

BTCUSD at the moment buying and selling at $48,354 on the every day chart: TradingView.com

BitMEX Analysis lately reported that spot Bitcoin ETFs now have over $10 billion value of BTC beneath administration. There’s a excessive chance that the worth of the highest coin proceed to surge if the exercise surrounding these exchange-traded funds (ETFs) continues at this tempo.

Bitcoin ETF Stream – ninth Feb

All knowledge out. Sturdy day at $541.5m of internet influx

Invesco had an outflow, the primary non-GBTC product to have an outflow day pic.twitter.com/UCFDVAaKD3

— BitMEX Analysis (@BitMEXResearch) February 10, 2024

One other catalyst for a sustained value enhance is the upcoming halving. Traditionally, Bitcoin bull runs main as much as every halving have all the time trended up and gone parabolic after the halving occasion. An analogous development might see the crypto asset reaching $60,000 earlier than the following halving in April and $100,000 earlier than the top of the 12 months.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site completely at your individual danger.