[ad_1]

The provision of Bitcoin (BTC) on Over-the-Counter (OTC) desks has sharply decreased, with stories suggesting that at one level, solely about 40 BTC have been out there on the market. This information has important implications for the market and will herald a brand new period in BTC buying and selling dynamics.

OTC Desks Had 40 Bitcoin Accessible On Wednesday

Caitlin Lengthy, the CEO and founding father of Custodia Financial institution, supplied an eye-opening account of the present state of the OTC Bitcoin market. Via a sequence of posts on X (previously Twitter), Lengthy noted, “The #HODLgang has principally held…I hung out in NYC over the previous couple of days and it’s clear why the Bitcoin worth spiked this week: there was virtually no BTC out there on the market on the large OTC desks.”

Echoing Lengthy’s observations, Samuel Andrew, a famous determine within the crypto house, added, “OTC desks are almost dried up. Little or no Bitcoin out there that’s simply accessible to satisfy demand. BlackRock and Constancy are shifting dimension in methods crypto has by no means seen earlier than.” Lengthy added:

Solely ~40 BTC have been out there on the market at any worth at one level on Wednesday, I used to be instructed by a reputable supply…

This shortage of BTC on OTC desks is just not an remoted incident however a part of a broader development indicating a major shift available in the market. Glassnode, a number one blockchain knowledge and analytics agency, reported that Bitcoins held by OTC desks are at their lowest degree in 5 years. Though Glassnode tracks solely a portion of the OTC market, the information factors to a transparent development of dwindling BTC availability.

What This Means For BTC Worth

The implications of this development are manifold. Firstly, it suggests a possible provide shock within the Bitcoin market, pushed by elevated demand from institutional traders and enormous firms trying so as to add Bitcoin to their portfolios, in addition to the introduction of spot Bitcoin ETFs. This provide shock may result in a shift in worth discovery from OTC desks to public exchanges, the place the true market worth of Bitcoin shall be decided extra transparently.

The scarcity of Bitcoin on OTC desks additionally signifies that giant traders and ETFs like BlackRock and Constancy, who historically purchased Bitcoin in bulk at a reduction by way of these desks, might not have this selection. This might additional drive demand on public exchanges, probably resulting in important worth actions.

Analysts are already speculating on the attainable outcomes of this case. Alessandro Ottaviani, a outstanding analyst, suggested, “After at present, god candles ($10k within the each day), earlier than the halving are attainable and sensible.”

This sentiment was echoed by Francis Pouliot, CEO of Bull Bitcoin, who remarked on the self-correcting nature of the market: “OTC desks like http://BULLBITCOIN.COM by no means run out of Bitcoin. The worth goes up, and other people promote. If individuals don’t promote, the value goes up extra.”

Adam Again, a Bitcoin OG and cypherpunk, provided a bullish outlook, stating, “$100k by halving day. Individuals beginning to consider. Bears, leveraged shorts rekt, scared-off, revenue take restrict orders moved upwards or simply deleted to wait-and-see; OTC desks out of cash, each day $500m / 10k BTC ETF purchase partitions. This may hole upwards quick. 51 days to go [until Halving].”

In conclusion, the depletion of BTC provide on OTC desks marks a pivotal second for the market. With the upcoming halving occasion in April and institutional curiosity at an all-time excessive, the stage is about for probably unprecedented actions within the Bitcoin market.

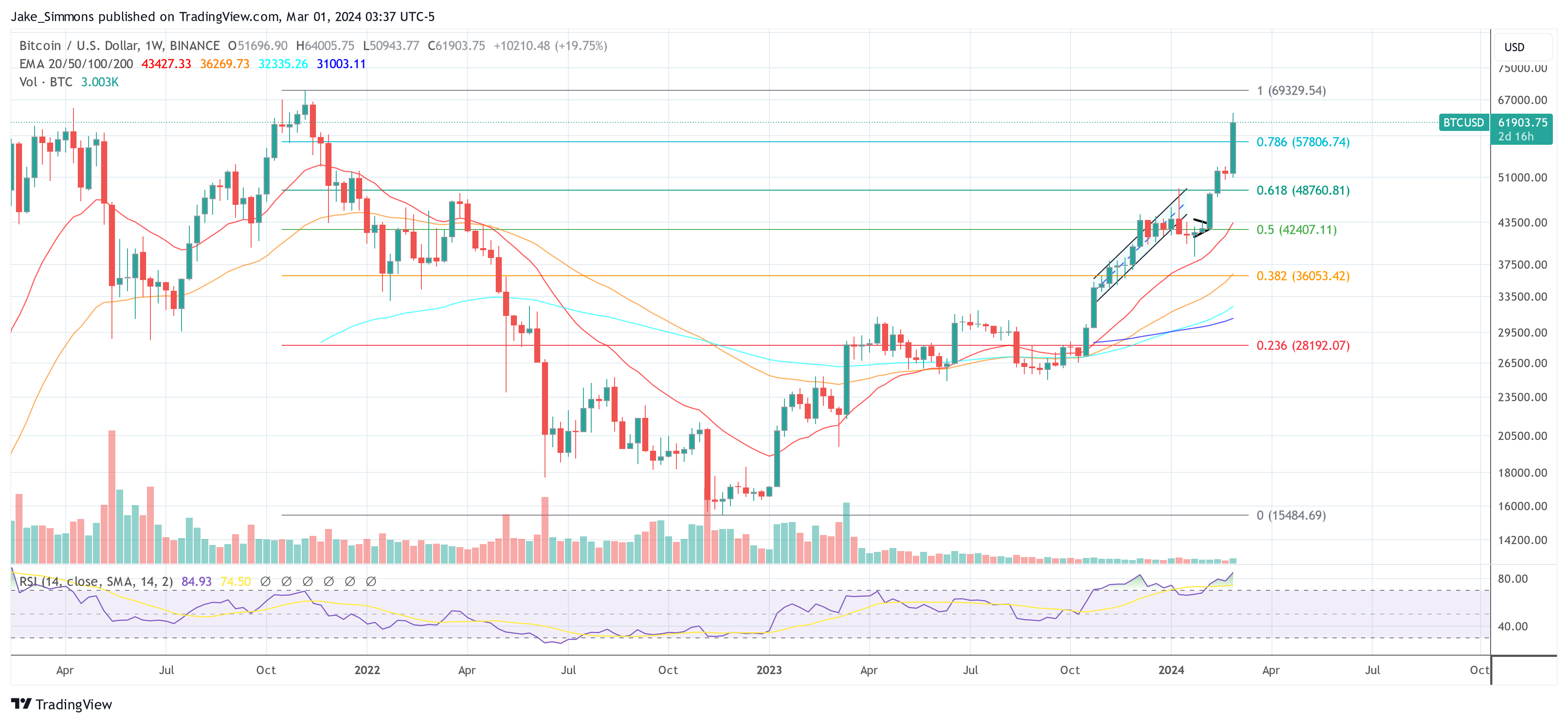

At press time, BTC traded at $61,903.

Featured picture created with DALLE, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal threat.