[ad_1]

Bitcoin worth is buying and selling round $25,000, following a meltdown throughout the banking sector. The primary ever cryptocurrency designed to permit people to be their very own financial institution, has given banks a run for his or her cash amidst a collection of financial institution runs and collapses throughout america and the globe.

Take a more in-depth take a look at the crypto worth charts you completely can’t miss.

Bitcoin Priced In Financial institution Shares Rockets To New All-Time Excessive

Bitcoin was created in 2009 throughout the aftermath of the Nice Monetary Disaster by the still-unidentified Satoshi Nakamoto. Hidden throughout the Genesis block there’s a message referencing the quilt story on The Instances in regards to the second bailout for banks.

The message made Bitcoin’s mission clear: take away the necessity for third-parties from the monetary system and free humanity from the affect of greed and the elite. Primarily, the decentralized cryptocurrency-based protocol permits anybody to be their very own financial institution, custody their very own property, and ship and obtain cash with out an middleman like a financial institution.

During the last week, a number of banks almost collapsed leading to but extra bailouts some 14 years after the launch of the primary ever cryptocurrency. The story not often adjustments, with governments and central banks fast to swoop in and cease a crises from additional creating.

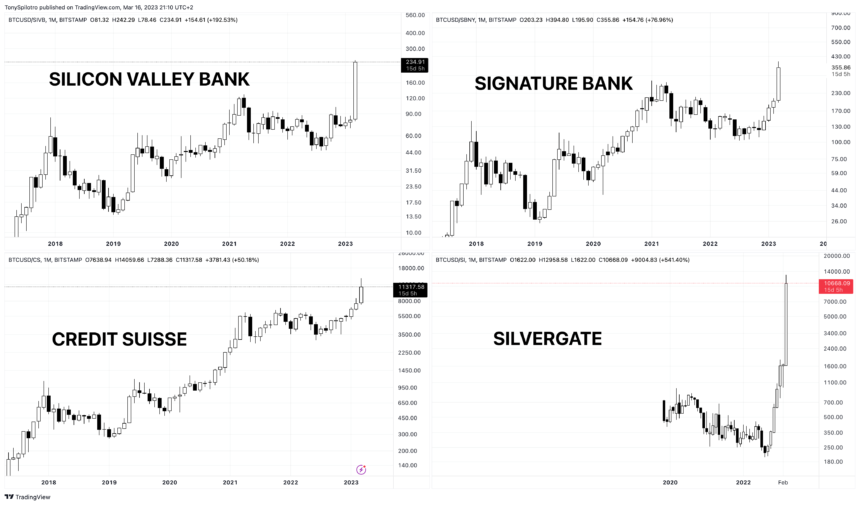

Like dominoes, a number of banks revealed main points, starting from Silicon Valley Financial institution, Silvergate, Signature Financial institution, and Credit score Suisse. Whereas the components behind every occasion varies, the top end result was the identical: prospects realized they can’t belief the banks with their deposits. Signature Financial institution’s story is a little bit bit extra complicated, and was probably shuddered because of involvement with crypto.

For the reason that ordeal started, Bitcoin has been on a tear priced in USD and different international currencies. BTC priced towards financial institution shares? Effectively, that’s a crypto worth chart you merely should lay your eyes on.

Bitcoin versus Banks | BTCUSD on TradingView.com

Historical past In The Making As BTC Turns into The Reply

The month-to-month candles within the above chart within the chart above are particularly spectacular. BTCUSD elevated 80% towards CS shares, 95% towards SBNY, 200% towards SIVB shares, and a staggering 650% towards Silvergate.

The final time BTCUSD rallied this tough towards large banks was again in Could of 2019. Bitcoin worth noticed its bear market backside about 5 months earlier than the massive transfer versus banks. This cycle, BTCUSD made its most up-to-date low in November 2022. 5 months from then can be April 2023, and already we’re seeing large actions towards the banking sector as soon as once more. May the outperformance towards banks sign a possible backside within the crypto market?

This isn’t the one manner that the primary ever crypto asset is thrashing banks. Even at costs of $25,000 per coin, Bitcoin has a bigger market cap and complete worth than even the biggest banks on the earth, like JP Morgan Chase and Financial institution of America.

Will the dominoes proceed to fall throughout the banking sector? And will this be the beginning of a brand new bullish narrative in Bitcoin? The following month might be pivotal in altering the pattern throughout crypto.

#Bitcoin Versus Banks = Fatality pic.twitter.com/VIMUoc8hcX

— Tony “The Bull” (@tonythebullBTC) March 16, 2023