[ad_1]

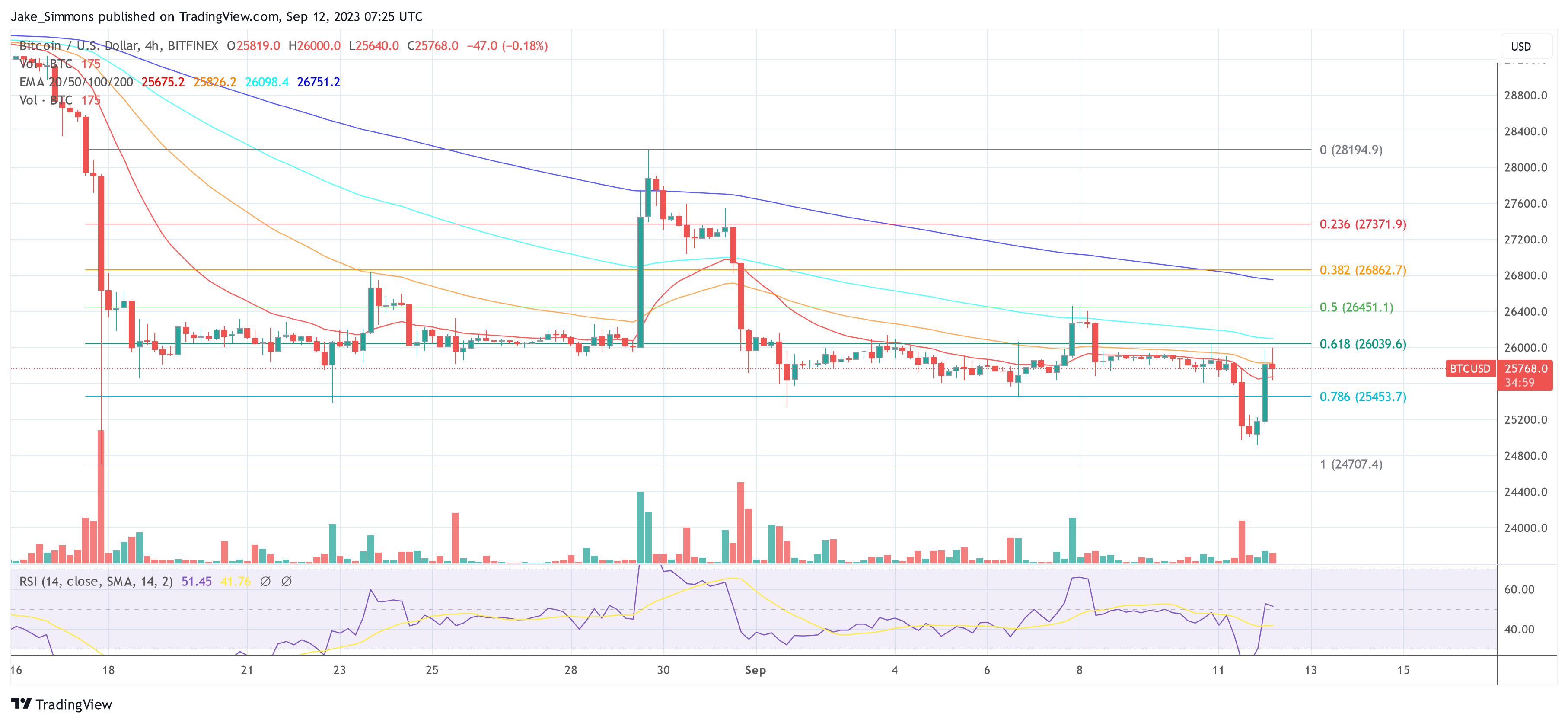

In a swift turnaround from yesterday’s dip, Bitcoin (BTC) surged to just about $26,000 throughout Asian buying and selling hours on Tuesday. This restoration, which noticed the BTC climb from $25,210 to $25,973 in a mere half-hour (from 3:00 am to three:30 am UTC), was not pushed by any particular information occasion. As a substitute, the dynamics throughout the Bitcoin futures market performed a pivotal position.

Why Has The Bitcoin Value Bounced Upwards?

Famend analyst Skew provided a technical perspective on the worth motion, referring to it as a “textbook quick squeeze.” Delving deeper into Skew’s evaluation, he identified a transparent divergence within the Cumulative Quantity Delta (CVD) of perpetual contracts (or “perps”) with the precise value. In buying and selling, a divergence between CVD and value can sign a possible reversal. On this context, whereas sellers have been making an attempt to push the worth under $25,000, the CVD indicated that purchasing strain was mounting.

Moreover, the futures market had a excessive variety of quick positions relative to the open curiosity (OI), and the funding fee was adverse. A adverse funding fee sometimes implies that shorts are paying longs, indicating a bearish sentiment. Regardless of makes an attempt to drive the worth down, Bitcoin was reclaiming its swing lengthy value stage at $25,300 and failed to keep up the bearish pattern within the decrease time-frame (LTF).

The spot market, the place property are purchased and bought for quick supply, was displaying indicators of a bullish construction change, with costs steadily shifting greater. Skew recommended that the end result of those elements led to a brief squeeze, the place those that wager in opposition to the market (quick sellers) are pressured to purchase again into the market to cowl their positions, additional driving up the worth.

Skew’s evaluation primarily highlights that whereas there was a bearish sentiment with many merchants betting in opposition to Bitcoin, underlying indicators have been hinting at a possible bullish reversal. For merchants, the quick purpose post-squeeze is to reclaim $26,000.

TheKingfisher supplied a extra succinct take, hinting on the quick squeeze and its impression on those that have been betting in opposition to Bitcoin: “See you round excessive lev shorters. BTC Cleared them once more.”

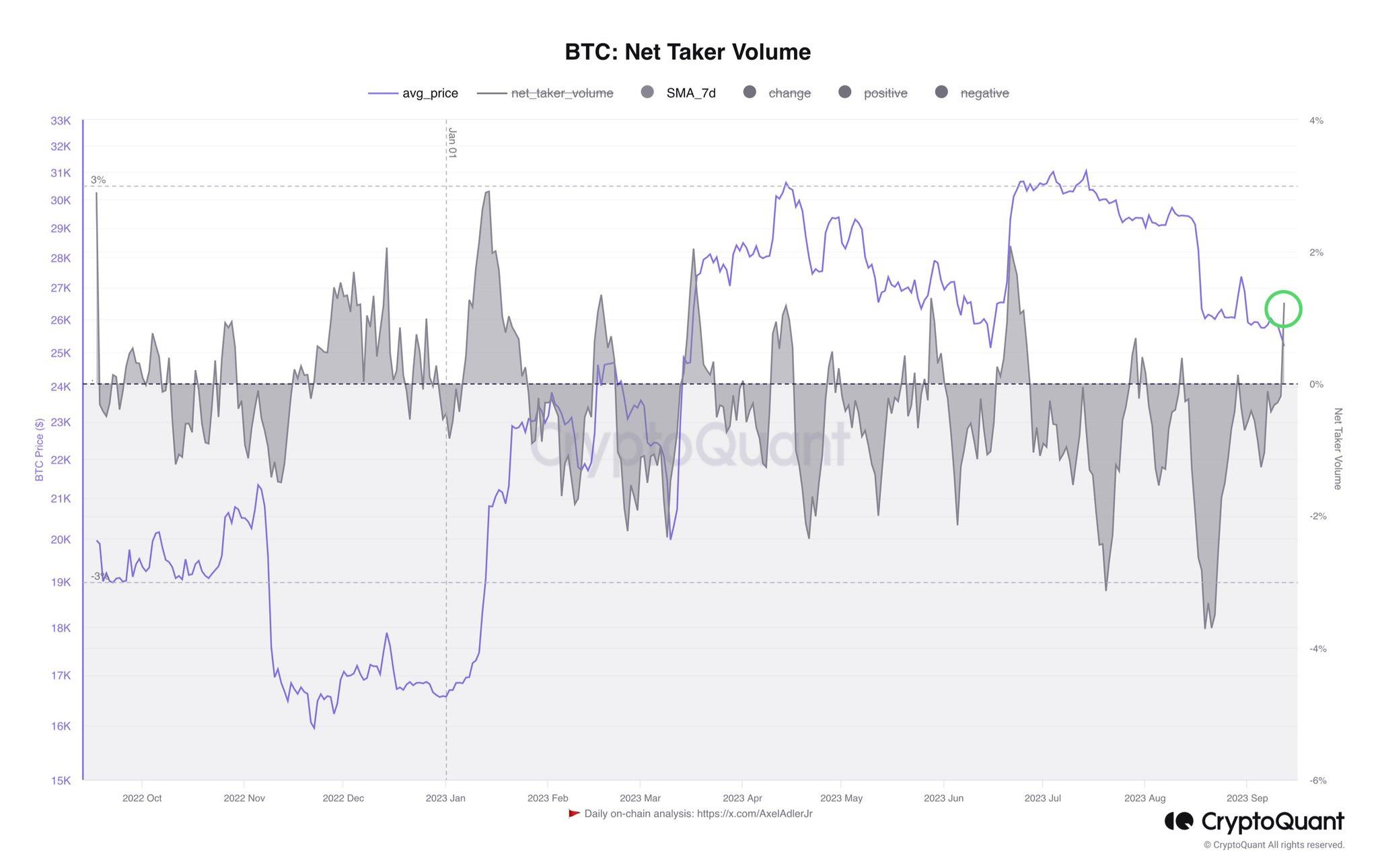

Axel Adler Jr. make clear the broader market sentiment, noting, “Merchants don’t plan to go any decrease. Web Taker Quantity has risen by 9.79%. Over the previous yr, this can be a new document for the steadiness of open Taker orders with lengthy positions.”

Regardless of the fast value motion, the quick squeeze’s magnitude was comparatively modest. Coinglass information reveals that about $12.32 million in BTC shorts have been liquidated. For context, probably the most vital quick liquidation occasion within the final three months occurred on August 17, amounting to $120 million, when BTC briefly dipped to $24,700 earlier than making a fast restoration above $26,600.

The decline in open curiosity in futures on the foremost exchanges was additionally quite small. Based on Coinglass, open curiosity fell from $10.66 billion to $10.65 billion. This slight decline means that few merchants needed to shut their bets, with funding charges turning optimistic, signaling a shift from bearish to bullish sentiment.

At press time, BTC stood at $25,768.

Featured picture from Millionero Journal, chart from TradingView.com