[ad_1]

The Bitcoin worth has risen by greater than 20% amid the disaster within the US banking system, which noticed three banks shut down by the US authorities and a large crash within the costs of quite a few banks. After the livid worth surge, BTC has stabilized between 24,000 and 24,8000 as of press time – however the calm may not final lengthy.

With at the moment’s launch of the Shopper Worth Index (CPI), the Bitcoin worth is historically in for a unstable day. And it’s not simply the CPI that factors in the direction of huge volatility available in the market.

Bitcoin Faces A Risky Day

Maarten Regterschot, founding father of diveonchain, outlined in a tweet that the “good combine for robust volatility” is at present evident on the subject of BTC futures information. Open curiosity is up $1.45 billion (23%). Funding charges are impartial / barely unfavourable.

Analyst James V. Straten provides that Bitcoin perp funding charges have turned unfavourable forward of CPI, whereas choices 25 delta skew counsel a bearish sentiment with places barely at a premium.

#Bitcoin perp funding charge turns unfavourable forward of #CPI.

Whereas choices 25 Delta Skew suggests bearish sentiment with places barely at a premium pic.twitter.com/4CzalHzgb3— James V. Straten (@jimmyvs24) March 14, 2023

Chinese language journalist Collin Wu additionally observed that within the final 24 hours, the notional worth of Bitcoin choices buying and selling quantity was about $2.5 billion , the second highest in historical past. Additionally it is value noting that decision choices with expiration dates on March 31 and June 30 are the biggest.

The present Deribit Bitcoin possibility place has reached 336,000, with a notional worth of about $8.2 billion, which can be a file excessive.

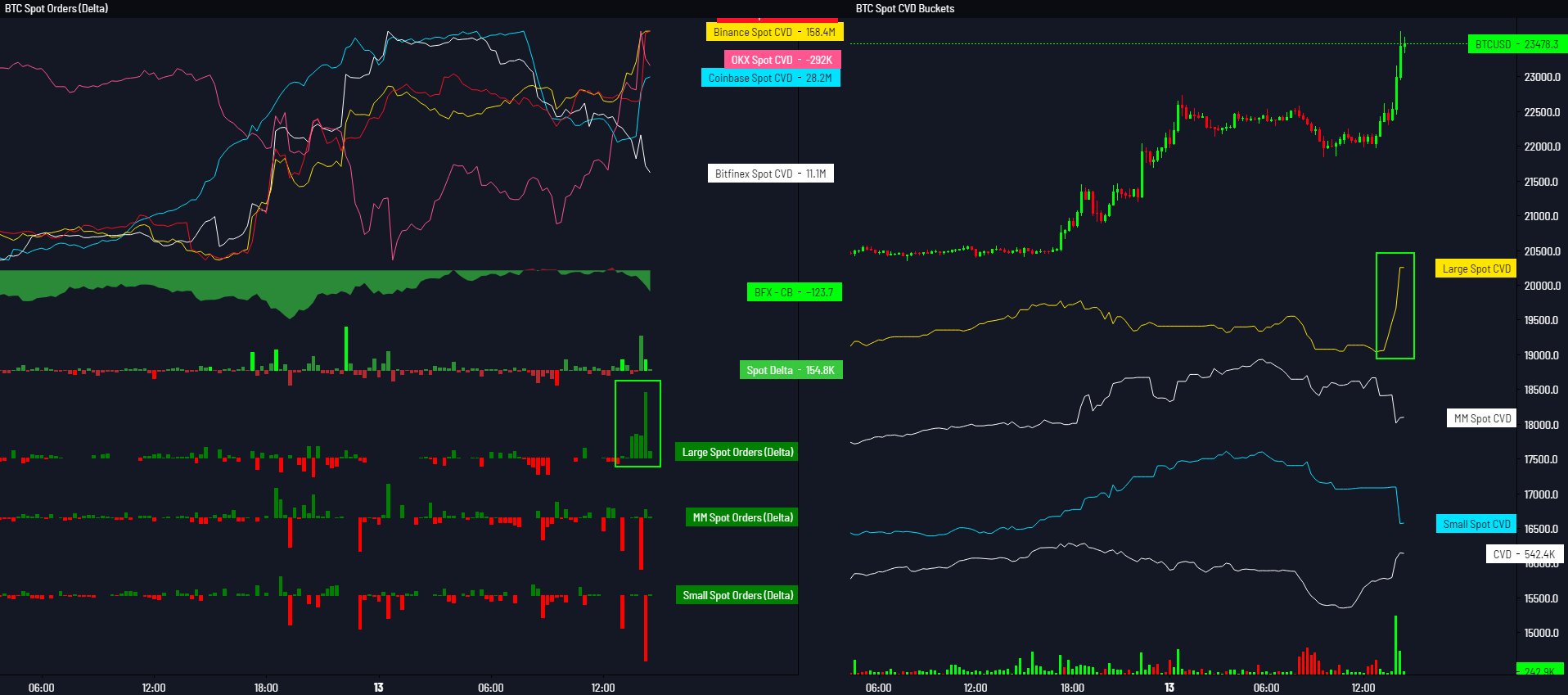

Remarkably, yesterday’s rally was pushed by the spot market. Analyst “Skew” writes that there was a big spot quantity from Asian exchanges throughout the US buying and selling hours, which was considerably uncommon. As at all times, nevertheless, it was Coinbase and Binance that paved the best way for the present market development.

Will Bitcoin Proceed Its Rally?

Additionally it is value noting that Changpeng Zhao has but to finish the introduced conversion of the Binance Restoration Fund from BUSD to Bitcoin, Ethereum, and BNB. Each “Skew” and famend analyst on Twitter @tedtalksmacro have but to watch any motion of Binance funds.

“So far as I’m conscious that $1B BUSD hasn’t been used but by CZ. That is extra capital rotation into BTC; flight to security,” Skew noted, whereas Ted added, “Yep, BNB but to maneuver. Submit CPI maybe??”

A have a look at the 4-hour chart of BTC reveals that the market should subsequent the earlier excessive of $25,200. If the value strikes easily to this space and breaks via, this might be the beginning of an even bigger rally.

All the things will possible be decided by at the moment’s CPI launch at 8:30am EST. US inflation year-over-year (YoY) is forecasted at 6.0%, final was 6.4%. The forecast for core inflation YoY is 5.5%, final was 5.6%. All the things under these numbers is prone to refuel the rally, making a breakout above $25,200 a chance.

At press time, the BTC worth seemed robust, buying and selling at $25,600.

Featured picture from Tumisu / Pixabay, chart from TradingView.com