[ad_1]

Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) would possibly run into strong headwinds this yr.

McGlone tells his 58,800 Twitter followers {{that a}} US monetary recession might be going coming shortly and it’d drag down risk belongings like Bitcoin and completely different cryptos.

“Notably Opposed Liquidity vs. Bouncing Bitcoin – Recessions typically portend struggling risk belongings and reduce charges of curiosity as central banks add liquidity. Cryptos are tops in risk, with Bitcoin the smallest concern. It’s unlikely the US will stay away from monetary contraction by year-end, in accordance with Bloomberg Economics, nonetheless futures current the Fed further inclined to take care of climbing.

Respecting the rules of liquidity, which was notably unfavourable on the end of 1H (first half of the yr), our bias is the long-anticipated recession will add typical headwinds, considerably to cryptos and shares that bounced.”

McGlone moreover says Bitcoin would possibly perform equally to how gold carried out via the Good Recession of 2008 when it declined 30% sooner than taking off on a rally.

“The graphic reveals Bitcoin’s upward trajectory going via a major – the NY Fed’s probability of recession from the yield curve at its largest since 1982. That gold dropped about 30% from its peak in 2008 sooner than rallying might need implications for its digital descendent in 2H (second half of the yr).”

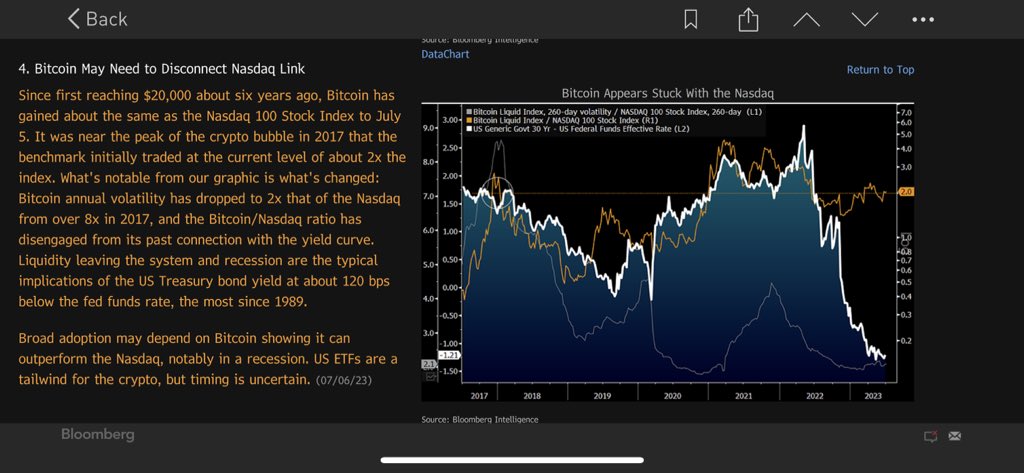

However, McGlone says that if Bitcoin would possibly decorrelate from the Nasdaq 100 (NDX) it’d end in broader adoption that may help the king crypto perform stronger all through a recession.

“Bitcoin May Should Disconnect Nasdaq Hyperlink – Since first reaching $20,000 about six years up to now, Bitcoin has gained concerning the equivalent as a result of the Nasdaq 100 Stock Index to July 10. It was near the peak of the crypto bubble in 2017 that the benchmark initially traded on the current diploma of about 2x the index. What’s notable from our graphic is what’s modified:

Bitcoin annual volatility has dropped to 2x that of the Nasdaq from over 8x in 2017, and the Bitcoin/Nasdaq ratio has disengaged from its earlier reference to the yield curve. Liquidity is leaving the system and recession are typical implications of the US Treasury bond yield at about 120 bps beneath the Fed funds value, basically probably the most since 1989. Broad adoption would possibly depend on Bitcoin displaying it’d most likely outperform the Nasdaq, notably in a recession.”

McGlone moreover highlights how approval of Bitcoin spot exchange-traded funds (ETF) would possibly current BTC with a giant tailwind all through a recession, nonetheless it’s unclear when the U.S. Securities and Commerce Payment (SEC) will determine on the pending capabilities.

“US ETFs are a tailwind for the crypto, nonetheless timing is not sure.”

Bitcoin is shopping for and promoting for $30,369 at time of writing, down 0.7% over the past 24 hours.

Don’t Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Study Price Movement

Observe us on Twitter, Fb and Telegram

Surf The Day-to-day Hodl Mix

Featured Image: Shutterstock/Alexander56891/Sensvector