[ad_1]

An analyst has defined that the most recent cooldown within the Ethereum futures market may counsel there’s potential for a worth rise to renew for ETH.

Ethereum Funding Charges Have Seen A Decline Just lately

An analyst in a CryptoQuant Quicktake put up defined that the ETH funding charges have seen a cooldown from their beforehand overheated ranges. The “funding price” refers back to the periodic charges that futures contract holders on spinoff platforms at the moment alternate with one another.

When the worth of this metric is constructive, it implies that the lengthy contract holders are paying a premium to the shorts to carry onto their positions. Such a pattern implies that almost all merchants share a bullish sentiment proper now.

Then again, the below zero signifies {that a} bearish sentiment is at the moment dominant within the futures market, because the quick merchants are overwhelming the longs.

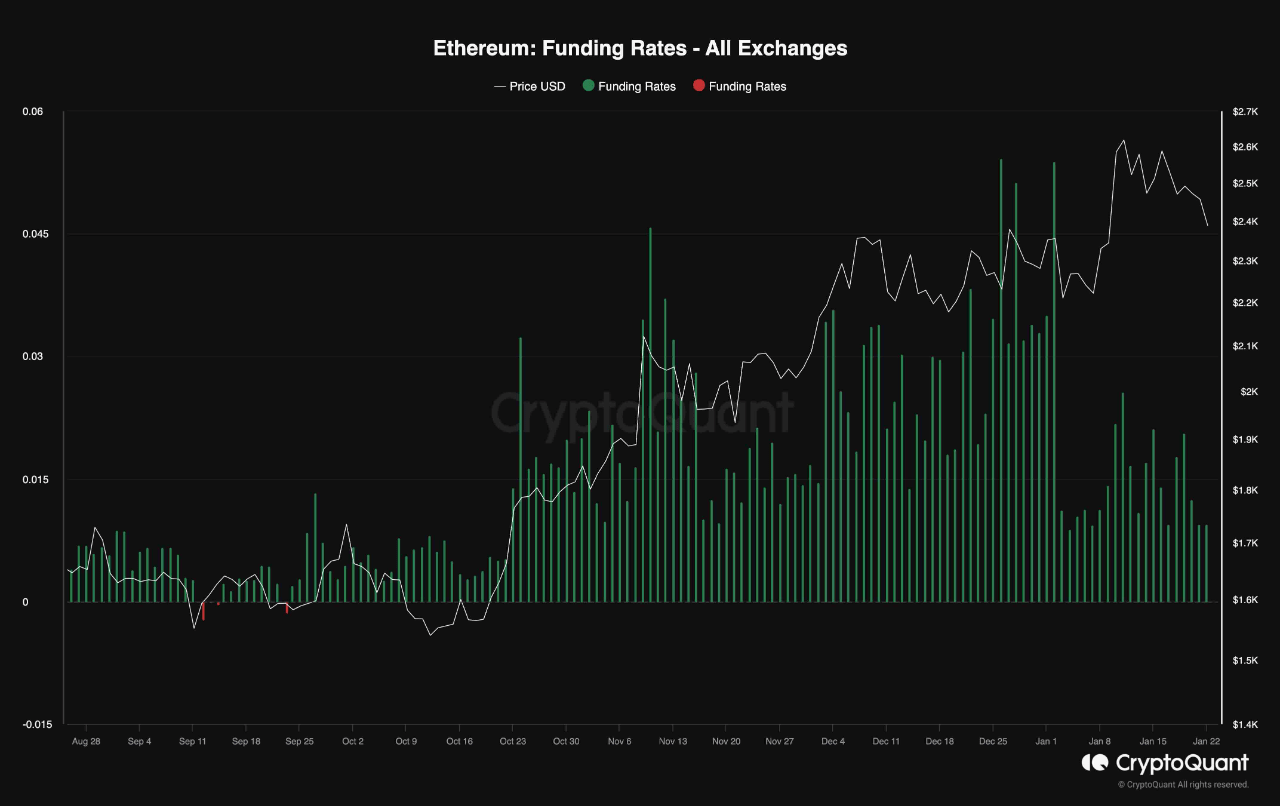

Now, here’s a chart that reveals the pattern within the Ethereum funding charges over the previous few months:

The worth of the metric appears to have been low in latest days | Supply: CryptoQuant

As displayed within the above graph, the Ethereum funding charges have been largely constructive throughout the previous few months, implying that merchants on the futures facet of the market have largely been bullish concerning the asset.

The few occasions that the metric did dip into the unfavourable inside this era didn’t grow to be something main, because the indicator solely attained low crimson values and rebounded again contained in the inexperienced territory with out an excessive amount of wait.

The chart reveals that in some phases of this lasting interval of bullish sentiment, the metric attained significantly excessive values. “Nonetheless, it’s essential to notice that elevated values in funding charges elevate considerations a couple of potential overheated state within the perpetual markets, signaling the potential for an impending long-squeeze occasion,” notes the quant.

A “squeeze” is an occasion by which a pointy swing within the worth triggers numerous liquidations, which in flip feed into this worth transfer, elongating it and inflicting additional liquidations.

When such a cascade of liquidations impacts the lengthy facet of the market (that’s, the value transfer in query is a fast drawdown), the occasion is named a “lengthy squeeze.”

Usually, the facet of the futures market most closely dominated by merchants is likelier to fall prey to a squeeze. Thus, when the funding charges are extremely constructive, an extended squeeze may be extra possible.

Just lately, although, as Ethereum has gone by way of its newest correction, so have the funding charges. Though they’re nonetheless constructive, their magnitude could now not be related to an overheated market, and the chance of an extended squeeze would have thus fallen.

“Consequently, there exists the potential for the value to renew its upward trajectory following the completion of the continuing correction stage,” explains the analyst.

ETH Worth

Ethereum has declined by round 5% throughout the previous week as its worth has now fallen below $2,400.

Seems like the value of the coin has been sliding off not too long ago | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual danger.