[ad_1]

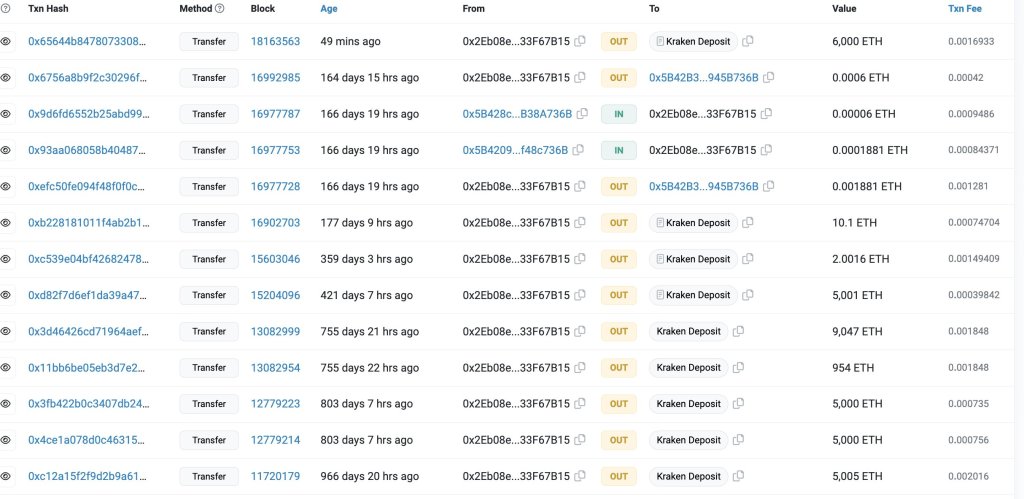

An Ethereum preliminary coin providing (ICO) participant and one of many earliest supporters of the sensible contract platform has moved 6,000 ETH price $9.96 million to Kraken, a cryptocurrency change, latest data from Lookonchain on September 18 reveals.

The unidentified whale obtained 254,908 ETH when every traded for 40.31 through the crowdfunding in 2014. This quantity is presently price over $466 million at spot charges.

Ethereum Whale Transfers Over $9.96 Million To Kraken

The nameless nature of public blockchains, together with Ethereum, makes it more durable to decipher the proprietor’s identification. Figuring out whether or not an entity or a person controls the handle can be extra complicated.

Whale transfers to a crypto change are normally thought of bearish because the ramp gives a neater swapping possibility for token holders to money out. Sometimes, crypto whales have the potential to influence the market as a result of sheer dimension of their holdings.

Accordingly, their buying and selling selections can affect costs, growing volatility. Subsequently, the latest deposit to Kraken could counsel that the whale plans to promote, taking a revenue.

On the brighter facet, the whale may very well be transferring their cash by way of an middleman, on this case, Kraken, earlier than transferring them to different platforms like Rocket Pool or Lido Finance for staking.

Within the present proof-of-stake consensus algorithm utilized by Ethereum, whales can earn annual staking rewards in the event that they lock at the very least 32 ETH. Whereas the whale can arrange a node and stake, liquidity staking suppliers like Rocket Pool permit customers to stake cash and earn staking rewards utilizing their infrastructure.

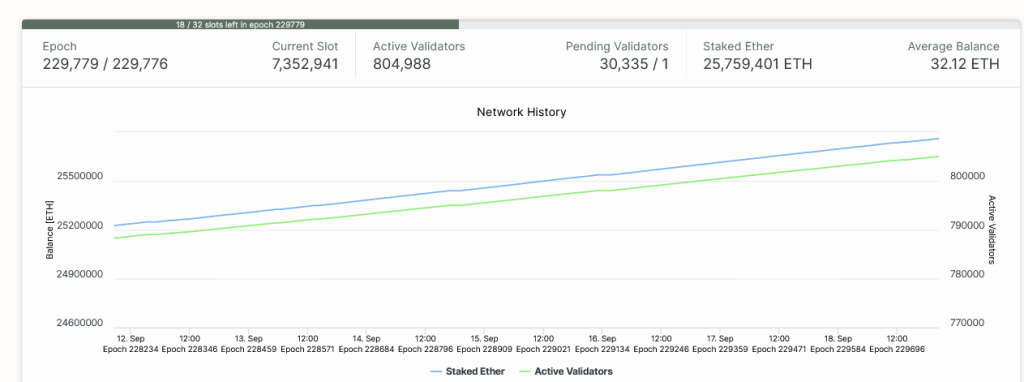

As of September 18, there are over 804,000 validators, that’s, customers who’ve locked at the very least 32 ETH working an Ethereum full node. Cumulatively, over 25.7 million ETH have been locked.

ETH Costs Recovering

As of this writing, the switch on September 18 is amid the broader restoration within the crypto market. Of observe, Ethereum (ETH) costs are up roughly 6% from September lows. Total, supporters are bullish, anticipating extra development within the days forward.

The pump additionally means bulls have reversed a few of the losses of September 11, and the present formation could anchor the subsequent leg up that would propel the coin above $1,750, or August 29 highs, and later peel again sharp losses recorded on August 17.

From the candlestick association within the every day chart, ETH stays beneath strain, dropping 23% from 2023 highs of round $2,140.

Nevertheless, since bears didn’t reverse losses of the June to July leg up, patrons have an opportunity following the rejection of decrease lows from across the 78.6% Fibonacci retracement degree of the Q3 2023 commerce vary. Presently, the September and August 2023 lows stay crucial help ranges for ETH, with the retest of August 17 lows on September 11 inflicting concern for optimistic merchants.

Characteristic picture from Canva, chart from TradingView