[ad_1]

That includes Ethereum Enchancment Proposal (EIP) 1559, the London laborious fork launched important modifications to Ethereum’s transaction charge mechanism. Customers now pay a base charge that’s subsequently burned, successfully eradicating ether from circulation ceaselessly.

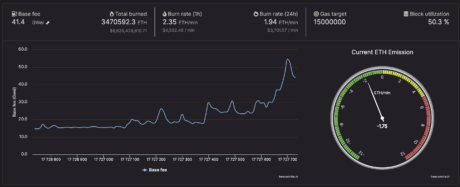

This strategy considerably impacted the token’s provide, leading to a month-to-month burn charge of roughly 146,000 ETH.

The London Onerous Fork And Its Deflationary Impression

Built-in into the Ethereum community on August 5, 2021, the London laborious fork introduced a paradigm shift within the cryptocurrency’s transaction charge construction.

By the EIP-1559, the community launched a novel mechanism that concerned the burning of a good portion of transaction charges, referred to as the “base charge.” This revolutionary strategy aimed to counterbalance Ethereum’s inflation whereas offering block rewards and precedence charges to miners.

Because of this, the bottom charge is completely faraway from circulation, resulting in a deflationary impact on the token’s provide.

The size of the burn has been huge, with over 3.46 million ETH, price $6.68 billion, annihilated because the London laborious fork’s enforcement. This interprets to a median month-to-month burn charge of greater than 146,000 ETH over the 710-day interval that adopted the improve.

146,000 ETH burned per thirty days | Supply: Beaconcha.in

Ethereum’s deflationary path successfully offset the issuance of recent tokens, curbing its provide progress by roughly 0.1% yearly.

Main Contributors To The Ethereum Burn

The principal elements driving Ethereum’s burn phenomenon embrace common ETH transfers, non-fungible token (NFT) transactions on Opensea, and actions on the decentralized alternate Uniswap.

Common ETH transfers accounted for probably the most substantial discount in provide, resulting in the incineration of practically 300,000 ETH.

Uniswap v2 follows carefully, with $56.5 million price of ETH burned because the laborious fork, whereas transfers of Tether stablecoins contributed to the destruction of $50.5 million price of ETH.

ETH value struggles to carry $1,900 help | Supply: ETHUSD on TradingView.com

Blockchain gaming platform Axie Infinity and Uniswap v3 every burned $32 million and $30 million price of ETH, respectively.

On the similar time, the variety of ETH staked within the Ethereum Beacon contract has additionally been on the rise. It’s now sitting at over 26.87 million ETH, translating to a greenback worth of $51.35 billion.

With the Ethereum provide sitting at 120.2 million, it implies that over 11% of its supply is presently locked up whereas the burn continues to take cash out of circulation.

Each of those developments mixed may see the circulating provide of the digital asset scale back drastically, resulting in an increase within the value of ETH as time goes on.

ETH is presently buying and selling at a value of $1,903 on the time of this writing, representing a 0.72% enhance within the final day.

Featured picture from iStock, chart from TradingView.com