[ad_1]

Ethereum costs stay beneath $2,000 months after the community initiated EIP-1559, trackers on March 28 reveal.

Ethereum Costs Trending Under $2,000

ETH, the native foreign money of Ethereum, is at present buying and selling at $1,717, secure on the final day and week however retracing from current highs of round $1,850.

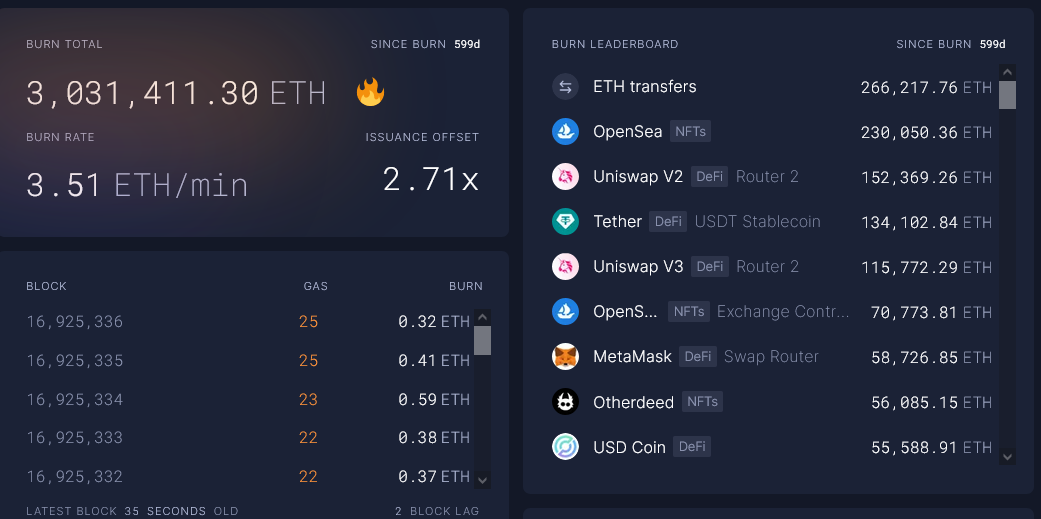

The community has burnt over 3 million ETH from fuel charges for the reason that activation of Ethereum Enchancment Proposal (EIP) 1559 in August 2021, a transfer that progressively makes the coin deflationary. Nevertheless, regardless of this, the coin has been unable to interrupt above $2,000 since Could 2022.

EIP-1559 was an intervention by the developer neighborhood to scale back the provision of ETH and it was a brand new manner for Ethereum to calculate course of transaction charges, successfully adjusting the charge market and making fuel extra predictable. Earlier, Ethereum used an public sale system the place miners prioritized transactions tagged with excessive charges.

In EIP-1559, the crew agreed to introduce a base charge and a “tip” for each fuel charge paid in a transaction. The bottom charge is what everybody transacting on Ethereum should pay. Notably, this charge will likely be adjustable relying on community demand and could be burned.

On the identical time, the transactor would give a “tip” to the block validator as an incentive to incorporate their transaction in a block. This charge is elective, and solely those that need their transactions to be included in blocks quicker will pay.

Ethereum Worth On March 28 | Supply: ETHUSDT On Binance, TradingView

Over 3 Million ETH Burned Since August 2021

From August 2021, when Ethereum launched EIP-1559, the community has burned over 3 million ETH. On the identical time, over 69,450 ETH has been destroyed for the reason that Merge, when Ethereum formally transited to a proof of stake system, switching off miners.

Contemplating the present tempo of ETH burning, the coin has been deflationary by 0.1% yearly. Proponents are bullish that ETH won’t ever be inflationary once more, a transfer that might push costs even greater within the months and years forward.

The tempo of ETH burning will depend on community exercise. Over the months, particularly in the course of the 2022 bear run, ETH and token costs crashed, as DeFi and NFT actions additionally fell. The whole worth locked (TVL) in DeFi stays lower than half the peaks of 2021, whereas NFT buying and selling is subdued even with the restoration of asset costs in Q1 2023.

Trackers on March 28 point out that ETH transfers contribute to the majority of cash destroyed since EIP-1559. From August 2021, customers transferring ETH between addresses have contributed to 266,217.50 ETH being destroyed.

In the meantime, due to NFTs, primarily by means of OpenSea, 230,050 ETH have been burned, with 152,369 ETH destroyed from Uniswap’s buying and selling actions.

Function Picture From Canva, Chart From TradingView