[ad_1]

The Bitcoin market is experiencing a interval of adjustment following the much-anticipated launch of US spot ETFs final week. After a surge to a two-year excessive close to $49,000, the main cryptocurrency has pulled again over the previous 4 days, at present buying and selling at $42,588 with a market capitalization of $834 billion.

This correction presents a chance to evaluate the underlying dynamics and potential future trajectories of the digital asset.

ETF Approval Hype Fades: Markets React

The preliminary pleasure surrounding the ETF approval was palpable, fueling a fast value improve as buyers anticipated elevated accessibility and institutional adoption. Nevertheless, profit-taking and market uncertainty rapidly set in, pushing the value again down nearer to pre-ETF ranges.

This sample aligns with the “purchase the rumor, promote the very fact” phenomenon typically noticed in monetary markets, highlighting the excellence between anticipation and actualization.

Including to the promoting stress are current outflows from the Grayscale Bitcoin Belief. The large fund, beforehand buying and selling at a reduction because of its closed-ended construction, transformed into an ETF final week.

Nevertheless, some buyers opted to redeem their shares as a substitute of transitioning to the brand new construction, leading to a web outflow of $579 million. This implies that liquidity concerns and potential portfolio changes performed a task within the post-ETF value motion.

Bitcoin at present buying and selling at $42,619 on the each day chart: TradingView.com

Moreover, the exercise of Bitcoin miners, the decentralized community chargeable for validating transactions and producing new cash, presents one other issue to contemplate. The Bitcoin Miners’ Place Index (MPI) spiked to 9.43 on January 12, indicating a big improve in Bitcoin motion by miners.

Whereas the precise causes for this exercise stay unclear, it might probably sign profit-taking by miners who want to capitalize on the current value appreciation.

Regardless of the current correction, analysts stay divided on the short-term and long-term prospects for Bitcoin. Ali Martinez, a distinguished crypto analyst, identifies a “parallel channel” sample within the value chart, suggesting a possible retracement to $35,000 earlier than a possible rebound in direction of $50,000.

Nevertheless, Martinez additionally acknowledges the danger of additional draw back stress if miners proceed to promote their holdings.

Supply: Ali Martinez

Bitcoin Outlook: Analysts Cautious Amid Complexity

Tony Sycamore, one other market analyst, takes a extra conservative method, anticipating range-bound buying and selling between $38,000 and $40,000 within the close to future. Each analysts emphasize the significance of monitoring miner exercise and investor sentiment within the coming weeks, as these components will play a vital function in figuring out the following directional transfer for Bitcoin.

In the end, the current market dynamics spotlight the complexity of the Bitcoin ecosystem. Whereas the ETF launch represents a big milestone for institutional adoption, it’s not a assured catalyst for fast value appreciation.

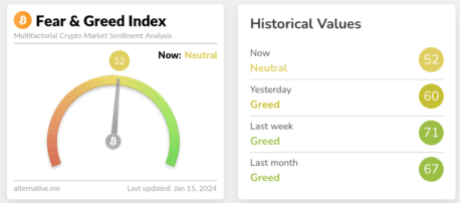

The Crypto Worry and Greed Index drops to its lowest stage in three months. Supply: Various.me

In the meantime, only a few days after the historic approval of spot Bitcoin ETFs within the US, the Crypto Worry and Greed Index has dropped again to “impartial” ranges, final seen in October 2023.

The indicator exhibits that the present market sentiment rating for Bitcoin is 52 out of 100, which is the bottom since October 19 of final 12 months, when the value of Bitcoin was buying and selling for about $31,000 on a each day common.

Featured picture from Shutterstock

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.