[ad_1]

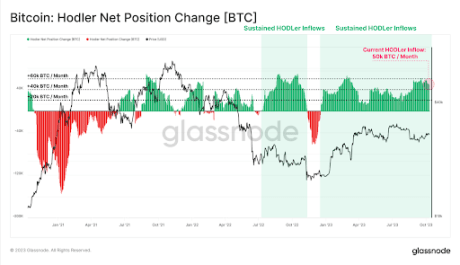

A brand new report from Glassnode, an on-chain analytical agency, has buttressed current knowledge indicating Bitcoin holders are including to their holdings. These long-term Bitcoin buyers, usually generally known as “HODLers,” don’t look like phased by the current volatility in Bitcoin’s worth.

In line with on-chain knowledge, long-term holders have been quickly amassing Bitcoin, including greater than 50,000 BTC every month to their holdings.

Month-to-month Accumulation Of BTC Value $1.35 Billion

Bitcoin is presently displaying indicators of slowing down, as its worth simply dipped beneath $27,000. It might seem that short-term speculators are largely guilty for the persistent promoting strain, as knowledge exhibits whale buyers are seeing this chance to purchase extra BTC at a reduction fairly than safe income.

In line with Glassnode’s HODLer Internet Place Change metric, long-term holders are buying a mean of fifty,000 BTC price $1.35 billion on the present worth of Bitcoin each month.

One other metric, the Lengthy-Time period Holder Provide, which measures the quantity of BTC’s market cap with holders, additionally reached an all-time excessive of 14.859 million BTC. This implies 76.1% of the whole circulating provide has not moved previously 5 months. Consequently, 94.8% of the whole Bitcoin provide has not moved previously month.

Supply: Glassnode

To again up this knowledge of elevated accumulation, in style crypto analyst Ali Martinez shared chart knowledge from Santiment displaying Bitcoin whales have bought round 20,000 BTC for the reason that starting of October, price roughly $550 million.

At this price, the variety of BTC vaulted by holders is poised to cross 50,000 in October. This elevated accumulation means that long-term holders stay assured in Bitcoin’s long-term potential and see this worth correction as momentary.

#Bitcoin whales have bought round 20,000 $BTC for the reason that starting of October, price roughly $550 million! pic.twitter.com/47ZePiaIII

— Ali (@ali_charts) October 10, 2023

BTC worth falls beneath $27,000 | Supply: BTCUSD on Tradingview.com

Bitcoin Provide Tightens

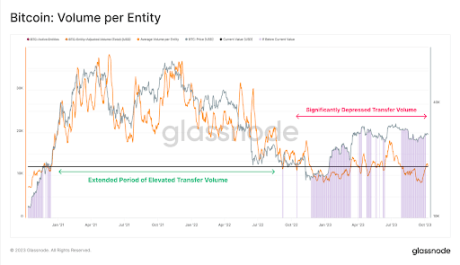

In line with Glassnode, solely 11.5% of BTC’s circulating provide modified arms within the final 3 months, indicating a chronic inactive interval of on-chain exercise. That there are fewer transactions means that buyers are unwilling to promote on the present worth because the trade awaits approval of spot Bitcoin ETFs.

Supply: Glassnode

If this present development holds, then the present downtrend may very well be short-lived, particularly if sentiment amongst smaller merchants additionally turns towards shopping for. A predominantly maintain mentality would give the asset time to get better and set up vital help that serves as a bounce-off level for one more rally.

Bitcoin is presently buying and selling at $26,766 and is down by 1.31% in a 24-hour timeframe because it approaches the subsequent main help close to the $26,500 stage. If sufficient massive gamers accumulate at these decrease costs, it might set up a worth flooring as bulls push the value again up.

As crypto analyst James Straten factors out, Bitcoin might leap 50% as a part of the correlation between the Grayscale Bitcoin Belief and the value of BTC.

Featured picture from Shutterstock, chart from Tradingview.com