[ad_1]

Litecoin is a quicker, extra environment friendly, and decrease fuel charges costing blockchain that empowers customers with seamless peer-to-peer transactions. The one purpose LTC has did not repeat the success of Bitcoin is its 4 instances bigger token quantity. Whereas the early launch of bitcoin allowed the token worth to rework right into a storage worth, an analogous pattern wasn’t seen for Litecoin.

It has turn out to be the bottom purpose for the deferment of 110 instances of market capitalization between these two comparable blockchains. Within the literal sense, LTC has created a marketplace for its token utilization primarily based on service provider acceptance and quicker transactions.

LTC has a market capitalization of $4.1 billion with a complete provide of 84 million. In comparison with the pre-crypto breakout of December 2017, Litecoin continues to be buying and selling at a premium of 24x from the January 2017 stage of $3.5.

Litecoin Value Evaluation

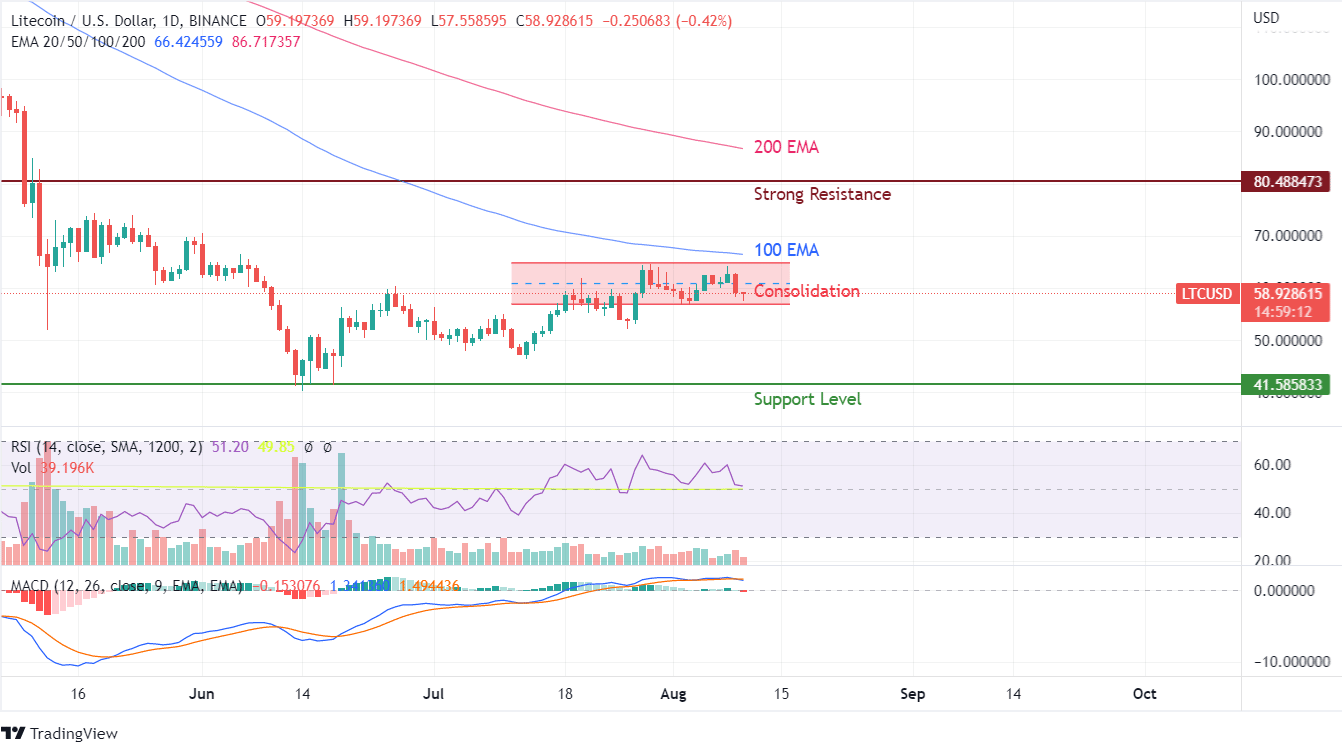

LTC coin has a robust resistance close to 100 EMA as sellers appear to have discovered a candy spot for revenue reserving. This state of affairs has turn out to be repetitive with the second such rejection within the final two weeks.

LTC has repeated its meltdown from the higher restrict of its consolidation zone of $65. The decrease stage of this consolidation was reached in simply three days in comparison with every week throughout the first breakout try. This revenue reserving sentiment weighing on the worth of Litecoin has introduced a adverse outlook for the quick time period. For the reason that zone is roofed in a mere 12-15% of worth motion, the chance of a breakout is imminent. The outlook suggests a constructive outlook has a better chance as consumers help the decrease ranges, which is confirmed by the repeated wicks seen on the each day candles.

Throughout this mildly unstable worth motion, RSI has returned to the impartial ranges of fifty, whereas MACD has created a bearish crossover throughout this part. This indication has diminished the hopes of a constructive breakout instantly. The 100 EMA curve trades at $66, whereas the 200 EMA curve is at $87, each of which proceed to maneuver within the downtrend. Extended consolidation can pressure a formation of vertex, indicating an upcoming constructive pattern. To know extra about the way forward for LTC, discover our Litecoin worth predictions earlier than investing.

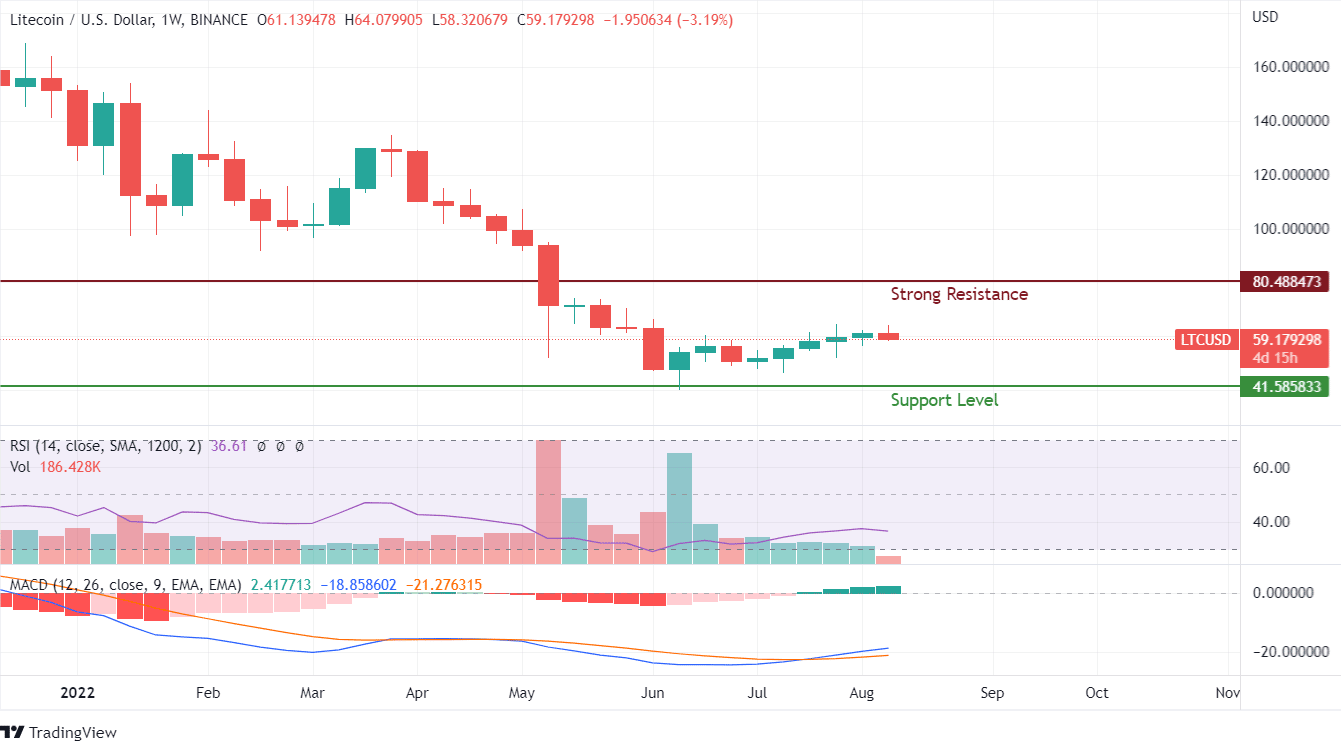

Weekly charts signify the failure of LTC in repeating earlier constructive streaks. Revenue reserving has turn out to be extra stringent at larger ranges of $65. The resistance stage of each day charts impacts even on the weekly charts with a constructive outlook on long-term worth motion.

MACD has already created a bullish crossover, which is being maintained all through the present consolidation, and revenue bookings on Litecoin. Wicks’ formation signifies revenue bookings, however holders could be in a safer zone so long as a bearish candle isn’t shaped. Though RSI has taken a dip, it provides blended sentiments concerning the attainable worth outlooks.