[ad_1]

The founder Charlie Lee launched a brand new hashing algorithm within the title of Litecoin, which presents sooner transactions than Bitcoin. Furthermore, it’s extra scalable and appropriate for P2P crypto transactions.

Now retailers not have to attend an hour for Bitcoin-based transactions and might select Litecoin in its place. Nonetheless, it isn’t a time-tested answer like Bitcoin, so a consumer ought to use Litecoin for small transactions.

It’s an open-source undertaking that runs on a Proof-of-Work consensus to confirm transactions. The variations with Bitcoin lie in scalability and transaction processing charge.

Litecoin miners remedy a mathematical drawback to confirm transactions within the blockchain. This wants big electrical energy. Bitcoin can also be going through elementary points as a result of the expense has been rising. Consequently, the revenue margin has been reducing, particularly this 12 months.

Litecoin’s MimbleWimble extension characteristic is launched to enhance community anonymity. After that, it was delisted from many crypto exchanges. The world’s largest crypto alternate Binance expressed concern in regards to the new enchancment, nevertheless it doesn’t have an effect on the worth of LTC.

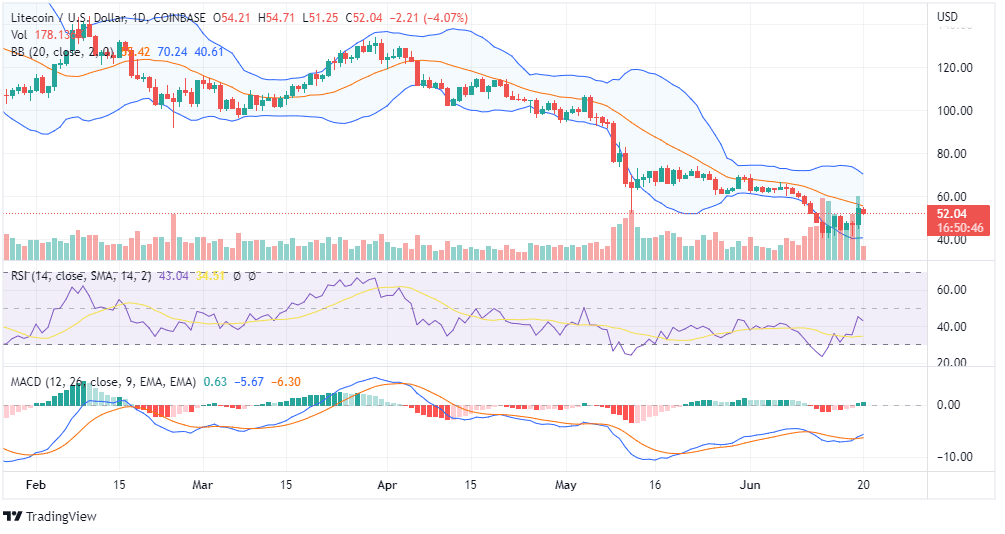

On the time of writing, LTC was buying and selling round $52.13 with a assist of $44. It would face robust resistance at round $60. We will name it a short-term bullishness if it crosses $63. In any other case, it’ll consolidate between $60 and $40.

The MACD and RSI indicators are bullish on the day by day chart, however candlesticks are forming across the baseline of the Bollinger bands. Which means it could cross the baseline and face resistance round $60 or come all the way down to the extent of $44 once more. Learn extra in regards to the Litecoin predictions to know if it’s the excellent time for funding or not.

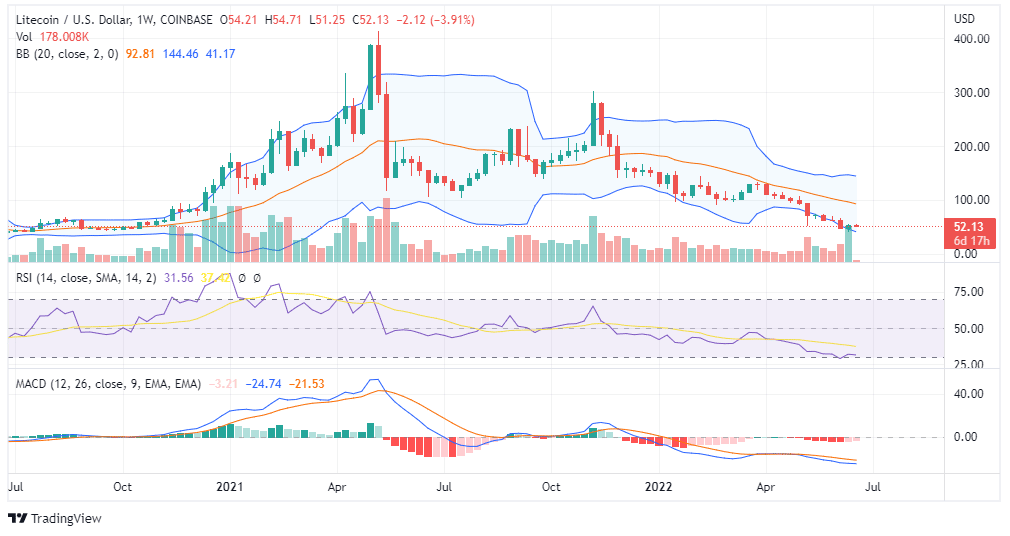

On the weekly chart, it’s long-term bearish. It might go all the way down to the $32 degree, and $100 is a robust resistance degree for the long run. It is not going to cross the resistance degree this 12 months, which suggests it’s out there at a 50% low cost. It’s a nice time to build up some cash for the long run.

The market is risky this 12 months, so it’s a dangerous funding within the quick time period. Please analyze the basics and make investments for the long run.