[ad_1]

Amid a latest downturn within the broader crypto market, the idea of “shopping for the dip” has as soon as once more surfaced, tempting merchants and traders with the prospect of snagging belongings at decrease costs. Nevertheless, warning is the watchword from Markus Thielen, CEO of 10x Analysis, a high analyst within the crypto house.

Thielen’s newest advisories recommend that the present market circumstances could not but be ripe for the optimistic technique of dip buying.

The Foundation Of Bearish Sentiment

Thielen’s latest evaluation, launched earlier right this moment, underscores a bearish outlook on flagship cryptocurrencies Bitcoin (BTC) and Ethereum (ETH), advising that it might be untimely to purchase the dip.

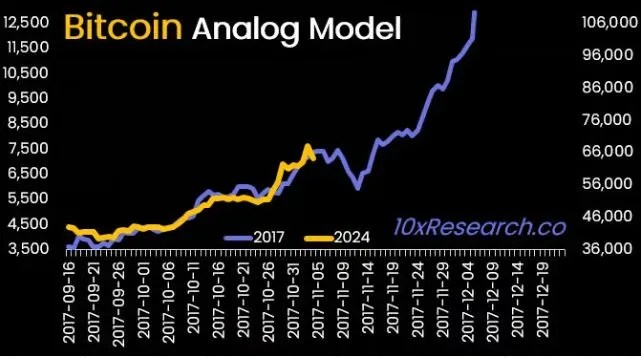

This steerage is rooted in a complete strategy to market evaluation, combining analog fashions, data-driven predictive fashions, and goal evaluation.

On the coronary heart of Thielen’s cautionary stance is an in depth report outlining the elements contributing to the agency, 10x Analysis’ bearish outlook on Bitcoin and Ethereum.

Regardless of a seemingly enticing worth level for these cryptocurrencies, Thielen believes the market has not but bottomed out, suggesting additional declines earlier than any important rally.

The report pinpoints $63,000 and $60,000 as crucial help ranges for Bitcoin. A breach beneath $60,000, Thielen warns, might precipitate a fall into the $52,000-$54,000 vary.

But, regardless of these short-term bearish indicators, Thielen stays optimistic about Bitcoin’s potential, envisioning a climb to heights of over $100,000 inside the 12 months. Thielen famous:

Shopping for this dip remains to be too early. Technically, we nonetheless anticipate Bitcoin to commerce beneath 60,000 earlier than a extra significant rally try is began. Primarily based on the earlier new excessive indicators, we might paint a rosy image of 83,000 and 102,000 upside targets, however in the meanwhile, we’re extra centered on managing the draw back.

The Crypto Market’s Vital Juncture

The present state of the crypto market displays a tense anticipation of the upcoming central financial institution bulletins from the US Federal Reserve.

This choice is predicted to considerably affect financial coverage and, by extension, the cryptocurrency market. Significantly, insights from crypto futures alternate Blofin recommend that the result of this announcement might sway market sentiment considerably.

In the meantime, the market reacts in real-time, with Bitcoin barely rising 2.4% previously 24 hours however nonetheless exhibiting a notable decline over the previous week. Including to the complexity of the market dynamics are observations from Alex Krüger, a revered determine in macroeconomics and cryptoanalysis.

Krüger attributes the latest worth collapse to a number of elements, together with market over-leverage, the unfavourable sentiment ripple from Ethereum, and speculative fervor round sure altcoins. These components mix to color an image of a market at a crossroads, with important volatility and uncertainty forward.

Causes for the crash, so as of significance

(for individuals who want them)

#1 An excessive amount of leverage (funding issues)

#2 ETH driving market south (market determined ETF not passing)

#3 Damaging BTC ETF inflows (cautious, information is T+1)

#4 Solana shitcoin mania (it went too far)— Alex Krüger (@krugermacro) March 20, 2024

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.