[ad_1]

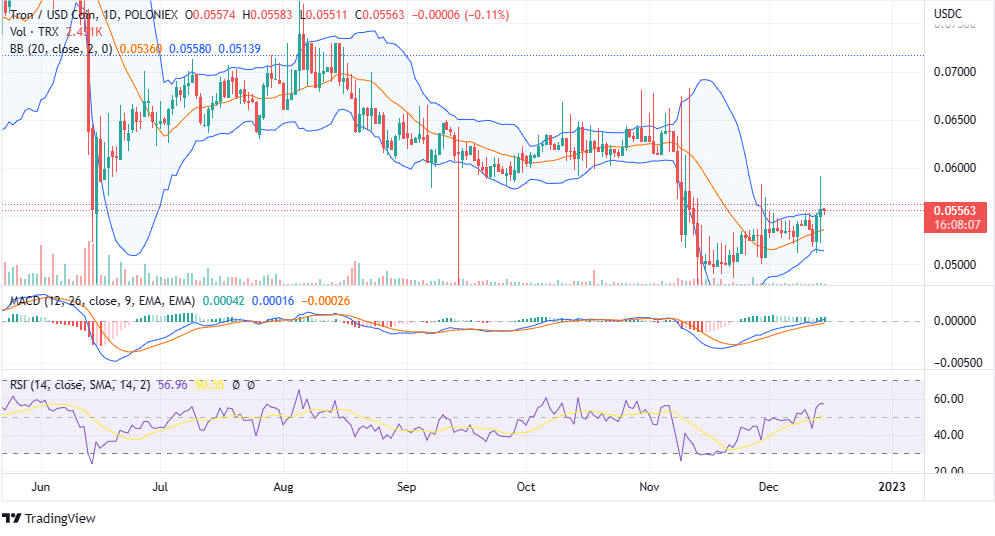

On the time of penning this technical evaluation, TRON is buying and selling round $0.055, which fashioned the yearly low of round $0.045 final month after breaking the earlier assist of $0.06. It’s attention-grabbing to notice the volatility between November 8-11. The every day chart noticed a lot volatility that means excessive promoting stress within the second week of November.

Standard technical indicators like MACD and RSI recommend bullishness with a robust up transfer towards the earlier assist of $0.06. We are able to take into account this value chart long-term bullish when it crosses the resistance of $0.075. Within the subsequent few weeks, the TRX value may consolidate between $0.06 and $0.045. Merchants can accumulate some cash for the brief time period. In response to the TRON predictions, it is a perfect time for long-term funding.

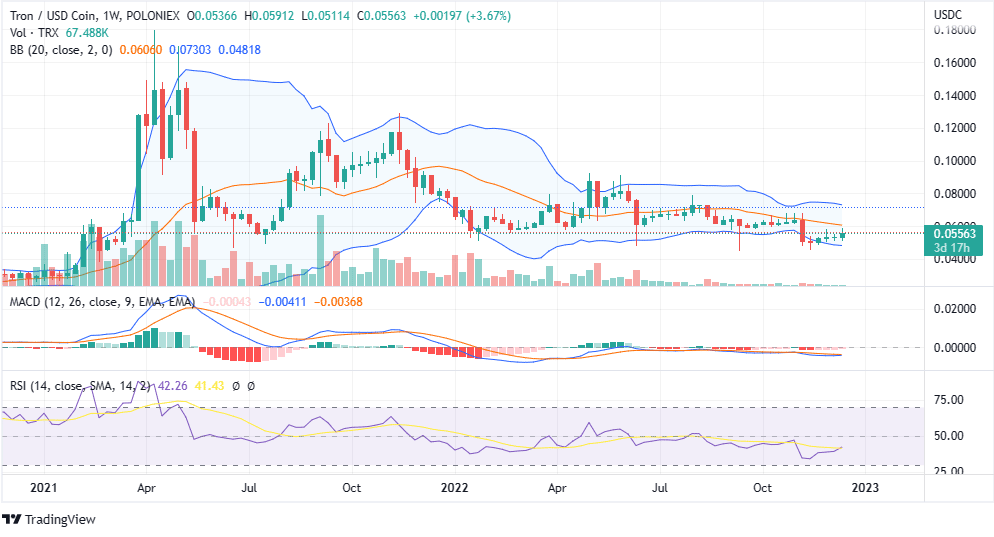

On the weekly chart, TRX/USD touched the 52-week low on the second week of June (2022); after that, it recovered from that stage however fashioned decrease highs and decrease lows within the decrease Bollinger Band, which suggests bearishness.

MACD, BB, and RSI are bearish, which can be supported by the dearth of quantity on the weekly chart. TRON fashioned 4 weekly inexperienced candles within the final 4 weeks, however all of them are indecisive Doji that don’t recommend constructive momentum for the long run.

TRX will consolidate inside a stage for the subsequent few weeks and switch bullish after crossing the resistance of $0.075. Nevertheless, it’d break the assist stage to type one other decrease low.

It isn’t a super time to speculate for the long run; you will need to anticipate the correct alternative and accumulate TRON at a lower cost.