[ad_1]

TRON is a decentralized, open-source cryptocurrency based in 2017 by the TRON Basis. It’s a platform that permits customers to publish, retailer, and personal knowledge whereas permitting them to share content material on a decentralized community. TRON makes use of a Delegated Proof of Stake (DPoS) consensus mechanism, permitting customers to take part within the decision-making technique of the TRON community by electing tremendous representatives.

DPoS can doubtlessly course of transactions quicker than different consensus mechanisms, resembling Proof of Work (PoW), as a result of the validation course of is streamlined, and the community can obtain the next diploma of consensus extra shortly.

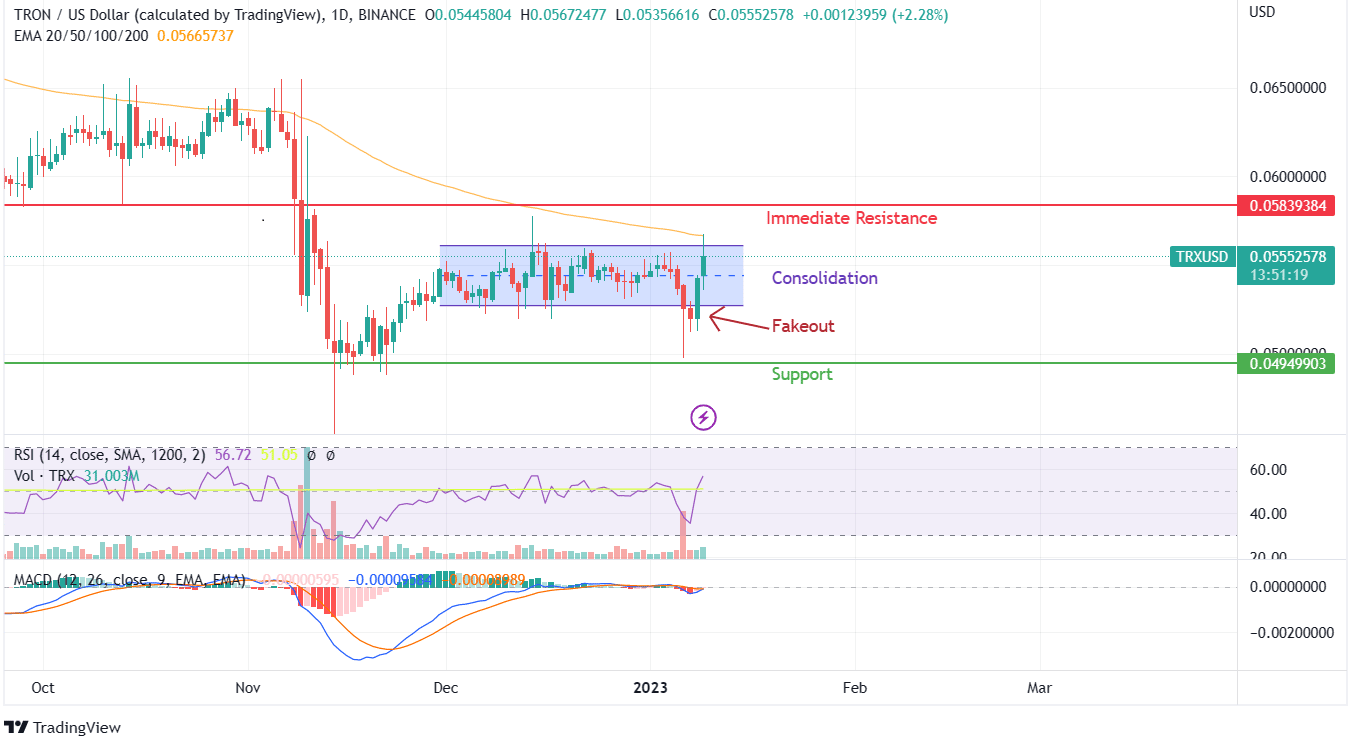

2023 has already begun on a optimistic word, however TRX managed to discover a bearish pattern even on a brand new starting. Nonetheless, patrons quickly returned the token and took it from the decrease band of its consolidation zone to the higher band in two days. With the token holding the fifteenth spot on the listing, the great days for TRX are removed from being over.

After witnessing the promoting depth in November 2022, TRX has gained a few of its misplaced floor. With constant breakouts and overreaching transferring averages, TRX would quickly take a look at a brand new excessive in comparison with the peaks of 2022. Discover extra particulars about numerous ranges TRON would face as resistance and help ranges.

The technical indicators have discovered a brand new rally level on short-term worth motion from the intensive shopping for spree witnessed on Jan 6. The ensuing high-wick candle prompted patrons to take command of this demand zone, and costs quickly jumped considerably within the subsequent three days.

Whereas the next day was a impartial candle with a crimson physique, the weekend created a newfound demand for TRX tokens available in the market. A brief revenue reserving stance has been created attributable to hitting the 100 EMA curve.

Whereas worth action-based resistance lies just some % above the 100 EMA curve, the time is ripe for a turning level occasion. As fakeout for TRX token subsided, the correct potential and energy of shopping for mode could be ascertained shortly.

The value bounce has improved technicals resembling MACD and RSI with an enormous margin. Quick-term help is round $0.049, and the resistance is seen at $0.0566 and $0.05839. Overcoming the 100 EMA curve would signify a bullish rally to proceed. As a dealer, it’s important to think about the potential dangers and rewards of investing for going all in.