[ad_1]

TRON blockchain has showcased immense uptrend potentialities in earlier years, however even for the reason that darkish clouds emerged on cryptocurrencies, it has didn’t make a comeback. Simply as BTC and different tokens are going through rejection, so has this token succumbed to the extreme promoting strain.

Working on the delegated Proof of Stake validation course of, TRON stays amongst the group of older cryptocurrencies holding their place within the high 15 spots. TRON has a market capitalization of $4.53 Billion regardless of the adverse traits, which confirms the weak point to be affecting your entire cryptocurrency house slightly than simply TRX.

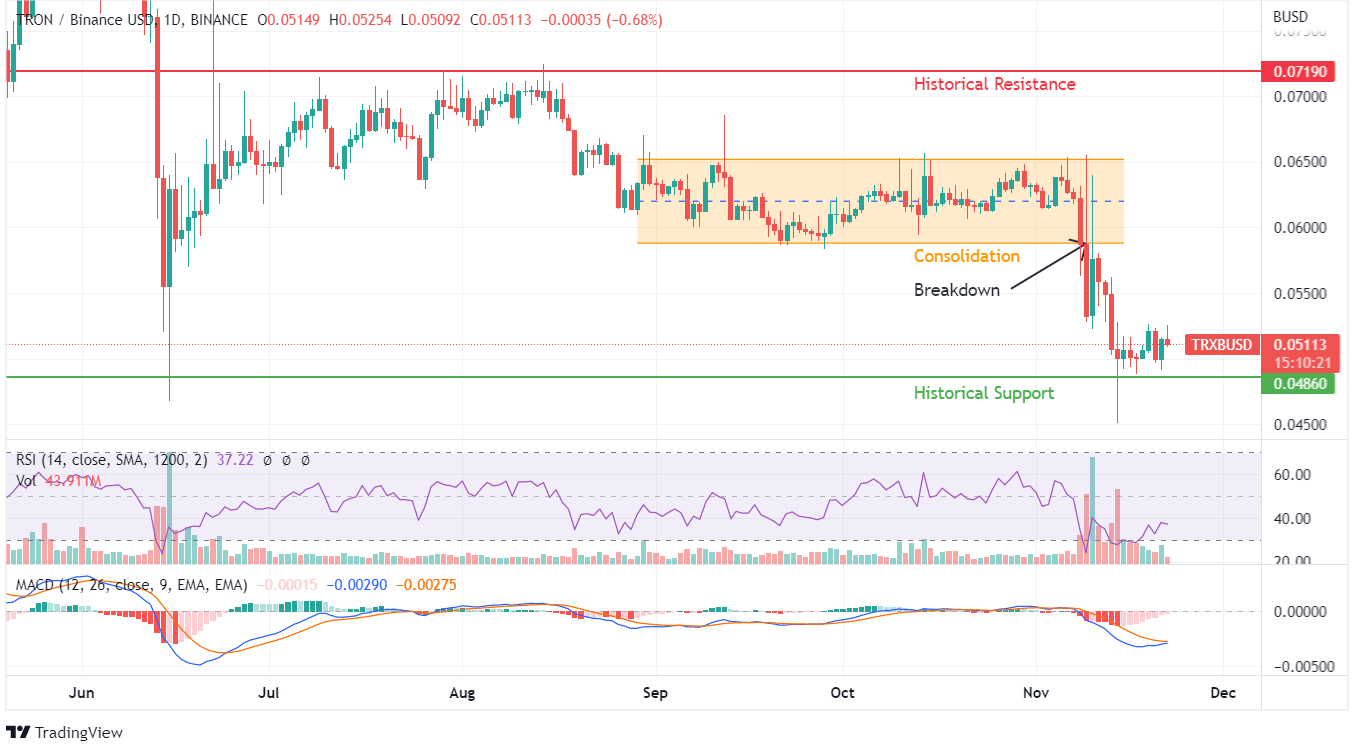

TRX fails to retrace above its historic resistance stage of $0.07. Falling again to the earlier help stage of June 2022 has created extra promoting strain on the token. The help of $0.048 may turn out to be fragile to maintain additional strain and create a brand new yr low for the token if patrons fail to take optimistic motion. Will the TRX token maintain the help? Click on right here to know!

There may be nothing extra engaging than an asset providing a number of entry zones at decrease values. Since TRX made a optimistic return on its asset class in earlier years, the expectation from this cryptocurrency has remained greater. The decline since 2021 has been hammering patrons caught in common worth whereas whales are making good earnings.

At present worth of $0.051, TRX can create a superb entry level for patrons, however the total cryptocurrency sentiment will not be aiding this in any place. Whereas RSI for TRX has jumped from oversold zones, it has didn’t create a requirement zone because the token in consolidating in a slim vary. MACD indicated the potential for a bullish crossover however didn’t convert it positively as sellers as soon as once more created a marginal decline on TRX in each day charts.

November 8, 2022, breakdown breached $0.60 and created a powerful rejection zone for the token. Consequently, patrons and holders of TRX are nowhere to be seen, and the value motion is showcasing an additional decline to new lows. The decline and promoting strain had been so intense that they managed to influence the weekly charts of November 7.