[ad_1]

The primary thought behind growing a decentralized platform underneath TRON was to throw away the intermediaries within the type of content-sharing platforms akin to Meta, Instagram, Fb, and YouTube. Creators right here aren’t capable of take full advantage of their developed artistic merchandise due to the overwhelming management of such corporations. TRX hosts knowledge with out creating any central authority, which makes it simpler for the creators to take full benefit of their viewers. As of August 3, 2022, TRX is value $6,371,255,142, with a token provide of 92.42 billion, which quantities to almost 95% of tokens in circulation.

This blockchain is dependent upon its modified Proof of Stake validation course of, now popularized as Delegated Proof of Stake. Regardless of being known as a much less decentralized validation course of, TRON can course of 2000 transactions per second on easy transactions, good contracts, and dApps. Being a utility-focused blockchain, the probabilities for such a platform within the Internet 3.0 revolution presents a particular profit.

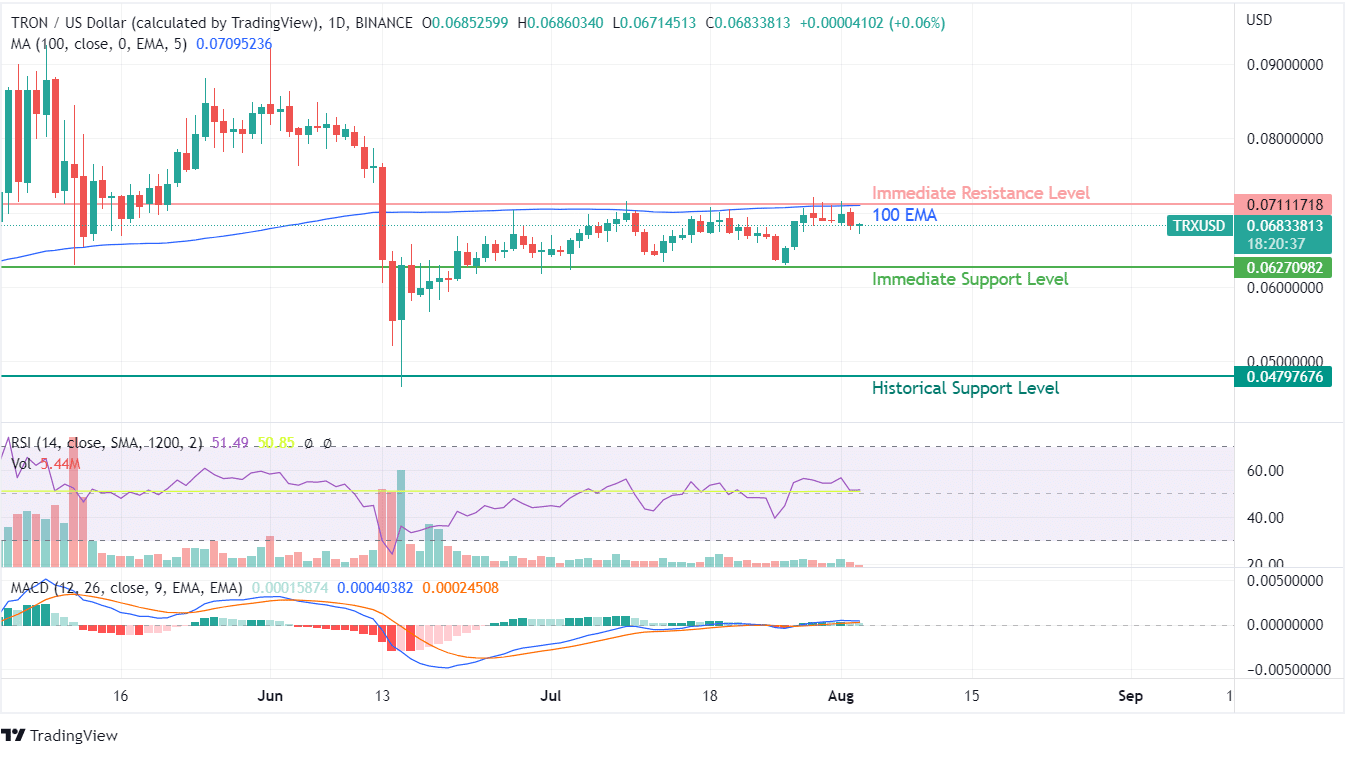

TRON is dealing with stiff resistance from the 100 Days Transferring Common. For the previous month, TRX has constantly tried to surpass this degree and start a bull run towards its earlier highs however has failed. Click on right here to know when TRX will cross the 100 DMA degree.

The value motion prior to now two weeks has been constrained by marginal volatility. Since dealing with the resistance from sellers at $0.07, TRON created 4 totally different wicks whereas the decrease values are getting supported with a shopping for sentiment. The help degree for this worth momentum is $0.062, and stronger shopping for motion was witnessed at $0.047. The shopping for sentiment based mostly on the present worth motion of $0.0683 has pushed the worth of RSI right down to 51 from its latest peaks of 57. The MACD indicator, however, is rooting for consolidation, which the TRX token is presently present process.

The TRON worth momentum appears to have confronted stiff resistance on the $0.07 degree, which shall be key to additional upside motion within the coming days. Failure to breach this degree within the subsequent few weeks might lead to revenue reserving or lack of curiosity on the a part of patrons as they might get trapped in a caught transaction for for much longer.

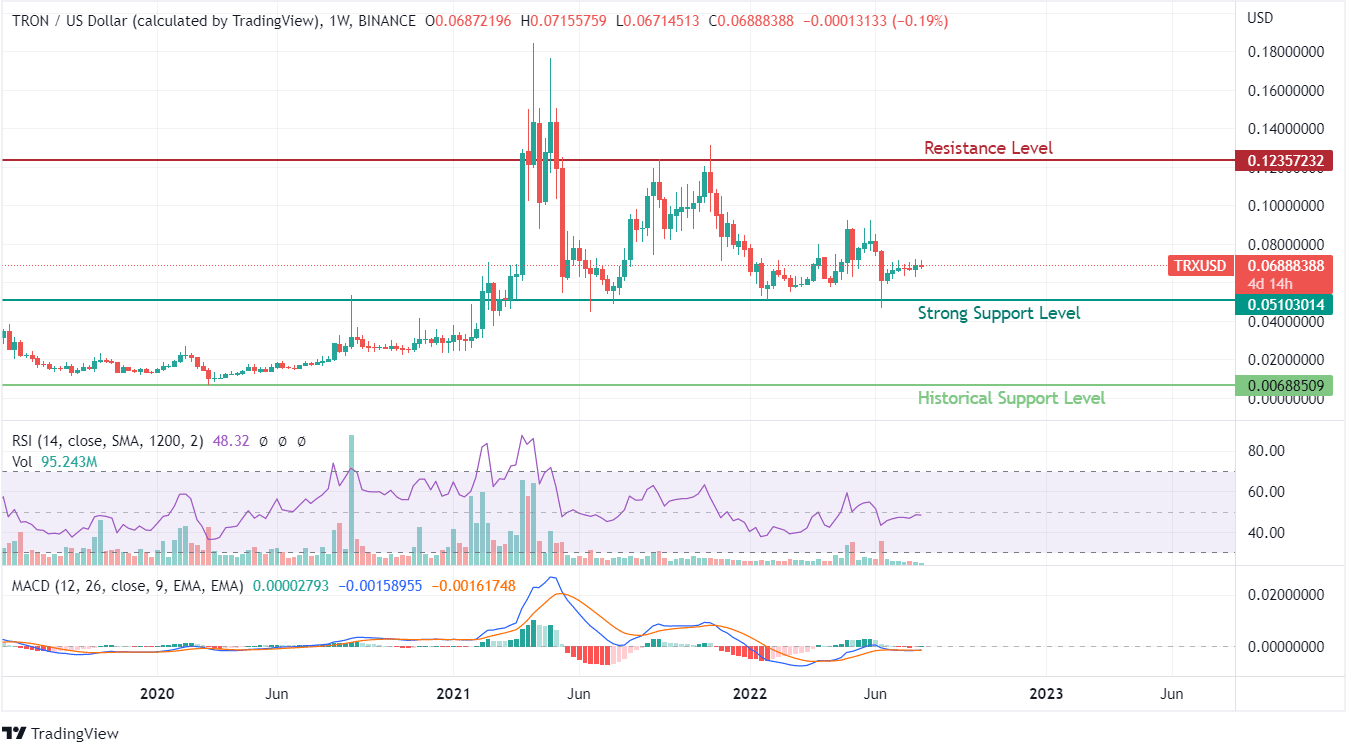

On long-term charts spanning over two years, TRON comes out as a constructive yelling token that has grown tremendously since March 2020. RSI throughout this whole rally interval has maintained its place above the midway or impartial mark, with MACD buying and selling barely above the quick ranges.

Historic help ranges for weekly charts can be found at $0.00688, whereas the every day chart resistances are nonetheless going stronger, as the identical degree has helped TRX surpass the sellers twice in simply 2021.