[ad_1]

It’s time for the U.S. to implement intelligent, progressive, and specific digital asset regulation.

The Securities and Change Charge’s present bills in opposition to Coinbase and Binance have launched the controversy on digital asset classification to a boiling degree, and I think about it demonstrates that the group isn’t outfitted to handle digital property competently.

Included inside the suits are lists of over 15 digital property the SEC claims cross the Howey Check out and are thus securities. With a view to succeed inside the swimsuit, SEC Chair Gary Gensler told CNBC,

“All we’ve to point is that one in every of [the tokens listed by the exchanges] is a security they usually have to be accurately registering.”

However, when reviewing the alleged securities listed by the exchanges, there isn’t some extent out of the black swan that was the Terra-Luna collapse (save for a passing reference inside the Binance swimsuit.) Binance presently nonetheless lists LUNA along with the normal token LUNC, whereas Coinbase listed wrapped LUNA (wLUNA) and nonetheless has it on the market by the use of the Coinbase Pockets. Terra Luna’s failure worn out tens of billions of {{dollars}} from the crypto market cap and led to specific particular person consumers dropping large portions of money.

The SEC moreover invokes tokens shopping for and promoting on FTX as part of their argument that Coinbase is inside the fallacious. Throughout the lawsuit, the itemizing of SOL on FTX.US is launched as part of the proof claiming that Solana is a security. An almost related half will be included inside the Binance swimsuit.

At this degree, it’s well-known that FTX and its executives had a very well-known presence on Capital Hill and that SBF and his cohorts established personal or working relationships with quite a few members of the U.S. authorities, Gensler included. U.S. shoppers misplaced large sums when that alternate failed, leaving numerous members of the federal authorities with an embarrassing observe doc of getting snuggled as a lot as alleged fraudsters and the uncomfortable actuality of attending to disgorge themselves of their substantial advertising marketing campaign donations.

The U.S. has failed on crypto regulation

Coinbase has been publicly requesting steering on digital asset regulation for years. “The SEC is one the place we’ve truly struggled over the last few years,” mentioned Coinbase CEO Brian Armstrong in a Twitter Home earlier this yr, implying an intransigence at that firm not encountered elsewhere.

Armstrong outlined that Coinbase had tried to contact the SEC to debate the regulatory panorama to no avail until the SEC significantly requested to go to Coinbase last yr. Coinbase had “30 conferences over the past 9 months” with the SEC, which was alleged to culminate in a gathering the place solutions will be given.

However, Armstrong alleged that the SEC canceled the meeting the day sooner than it was alleged to happen and despatched a Wells Uncover to Coinbase the subsequent week. 9 weeks later, it sued the alternate for quite a few securities authorized tips violations.

Digital Property mentions in Congressional File

Whereas there was a considerable improve in congressional train on digital property over the last few years, with over 1,065 mentions of the time interval inside the doc. Nevertheless, precise progress on digital asset regulation has been excruciatingly gradual.

Digital property had been first talked about in a Senate listening to from 2000 titled “Utah’s Digital Monetary system and the Future: Peer-to-Peer and Totally different Rising Utilized sciences,” by which they’d been likened to “databases.”

Digital property had been moreover talked about in a 2001 Congressional listening to by the Vitality and Commerce Subcommittee on Commerce, Commerce, and Shopper Security. John Schwarz, the President and CEO of Reciprocal, Inc., argued that “securing digital property and stopping undesirable digital intrusion is the same as defending personal and doubtless nationwide integrity.”

Whereas Schwarz was talking about digital data akin to mp3 audio and mp4 films, it’s the primary official level out of the time interval now making headlines.

The time interval was cited typically yearly until 2019, when digital asset mentions surged to 21, along with the proposed funds, Managed Stablecoins are Securities Act and the Preserve Massive Tech Out Of Finance Act.

By 2022 there have been 598 mentions of the time interval “Digital Property,” along with 22 funds, 14 Congressional Hearings, and over 500 mentions in Congressional calendars. This yr, in 2023, there have solely been 68 mentions thus far, the congressional calendar assortment being an important clarification for the drop, falling from 501 to solely eight mentions.

Developments in Digital Asset utilization

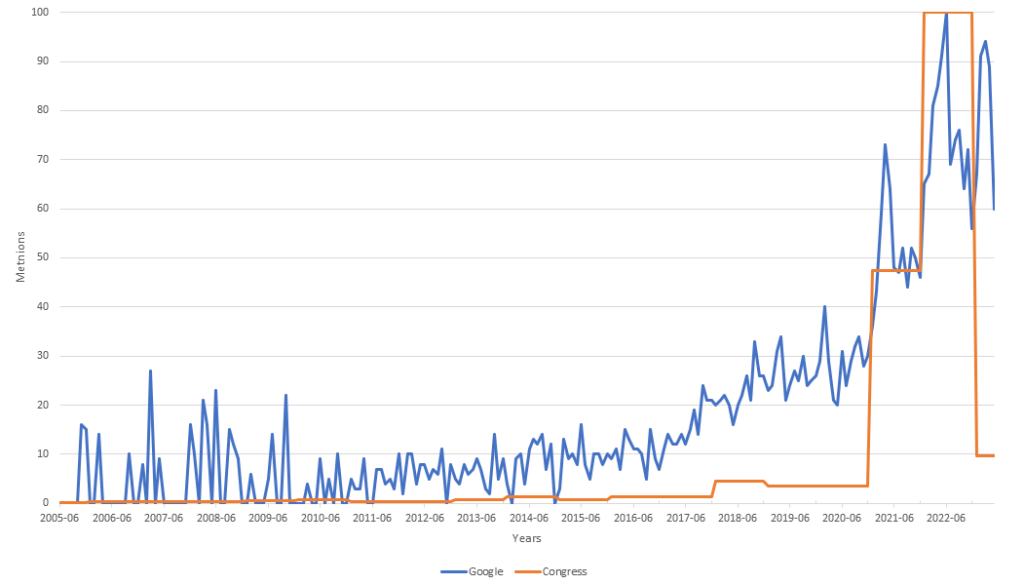

I in distinction the “Digital Property” mentions on Govinfo.gov’s Congressional and Federal databases to the search amount of the similar time interval on Google from 2005 to the present.

The normalized chart beneath reveals curiosity by the use of Google Search selecting up from spherical 2017, whereas it took until 2020 for the U.S. Authorities to increase the utilization of the time interval on the doc.

Throughout the chart, the data is scaled to a typical reference degree, allowing for simple comparability and analysis of the completely totally different data items. Notably, there was an extreme decline in mentions on the official public doc for “Digital Property” to solely 9.7 at a time when Google Search guests is above 60.

Curiosity from Google Search seems to have usual a double excessive, with a peak in 2021 and a lower extreme firstly of 2023. The technical analysts of the world would counsel such a movement is a bearish indicator if this was a stock or token chart.

Moreover, curiosity from Congress has merely fallen off a cliff, with mentions falling from 598 in 2022 to solely 58 six months into 2023.

Why?

Has dialog on digital property been moved off the official public doc into once more channels and social media? Was the surge in 2022 related to an urgent should define Digital Property?

If that had been the case, then why are firms who’re (publicly) begging for steering on digital asset regulation being sued by the SEC?

Partially two of this three-part operate, we’ll uncover the implications of the SEC’s actions and uncover totally different approaches to crypto regulation that might revenue the commerce and its consumers.

Adjust to CryptoSlate on Twitter or be part of our Telegram channel to be notified when the second half is on the market.