[ad_1]

Litecoin is without doubt one of the oldest crypto cash out there, but it surely has struggled all through this 12 months due to uncertainty within the crypto world. It is without doubt one of the most underappreciated cash within the crypto house. Just like the inventory market, the crypto business can also be influenced by buyers’ sentiments.

Litecoin helps to transact small transactions sooner than Bitcoin. Nonetheless, illogical emotional issues with sure property like Litecoin additionally make the scenario powerful for the native coin. Litecoin, as a fork of Bitcoin, was within the prime 5 listing primarily based in the marketplace cap, however now it has been dethroned by different crypto property.

Certainly, Litecoin is a competitor of Bitcoin within the peer-to-peer fee class, however most buyers want Bitcoin as a result of it’s a time-tested and safe resolution for giant transactions, whereas they like Litecoin for small transactions as a result of it gives sooner transactions at a lesser payment.

Consultants discover that crypto buyers usually are not excited about Litecoin as a result of they’ve discovered a greater different in Bitcoin. That’s the reason LTC failed to succeed in new highs in comparison with BTC. Additionally it is supported by future and open curiosity. Litecoin’s open curiosity is decrease compared to different payment-focused blockchains.

As a result of unsure time, the crypto market has change into the worst sufferer. Many altcoins have recovered from the downtrend, however LTC is an exception. LTC has been consolidating, so many buyers lack curiosity. So it’s higher to take a look at our LTC predictions earlier than making any last shopping for resolution.

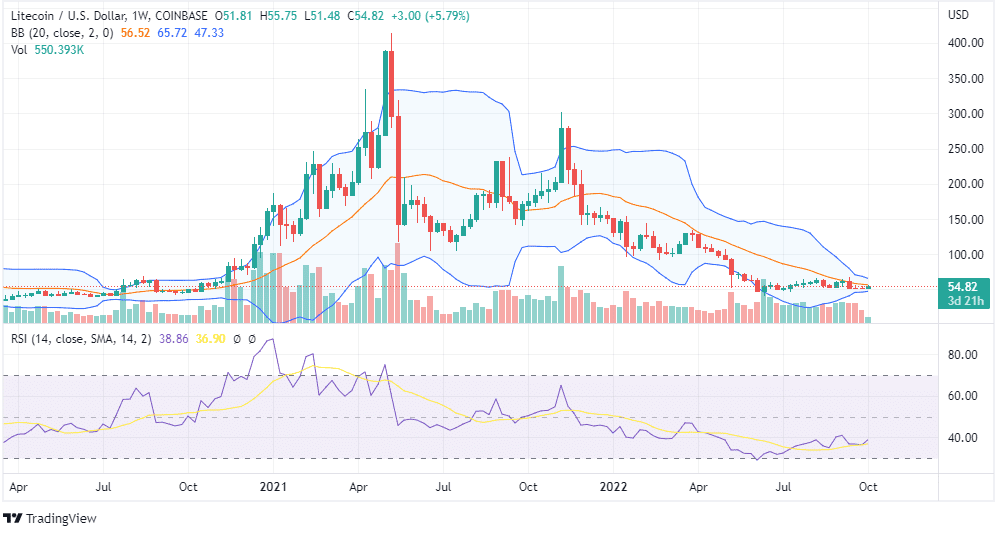

On the every day chart, we are able to discover a sideways motion in Litecoin within the final 5 months. On the time of scripting this publish, LTC was buying and selling round $54.84, consolidating between a spread of $50 and $65.

Now the every day candlesticks are forming within the higher vary of the Bollinger Bands, which suggests short-term bullishness. Additionally it is supported by RSI, which is round 50. Which means you possibly can make investments for the quick time period.

On the weekly chart, candlesticks are forming within the decrease vary of Bollinger Bands, and RSI is round 38. Within the final 5 months, RSI has hardly gone over 40, which suggests long-term bearishness on the Litecoin chart.

Which means it is best to make investments on this coin for the quick time period. Nonetheless, you possibly can contemplate it for the long run if it breaks the short-term resistance decisively. Please add it to your watch listing and monitor the value motion.