[ad_1]

Charles Edwards, founding father of the Bitcoin and digital asset hedge fund Capriole Investments, revealed an in depth examination of Bitcoin’s present market part suggesting a bullish trajectory, doubtlessly reaching the $100,000 mark. The evaluation hinges on the identification of a Wyckoff ‘Signal of Energy’ (SOS), an idea derived from the century-old Wyckoff Technique that research provide and demand dynamics to forecast worth actions.

Understanding The Wyckoff ‘SOS’: Bitcoin To $100,000?

The Wyckoff Technique, developed by Richard D. Wyckoff, is a framework for understanding market constructions and predicting future worth actions by way of the evaluation of worth motion, quantity, and time. The ‘Signal of Energy’ (SOS) inside this technique signifies some extent the place the market exhibits proof of demand overpowering provide, indicating a robust bullish outlook.

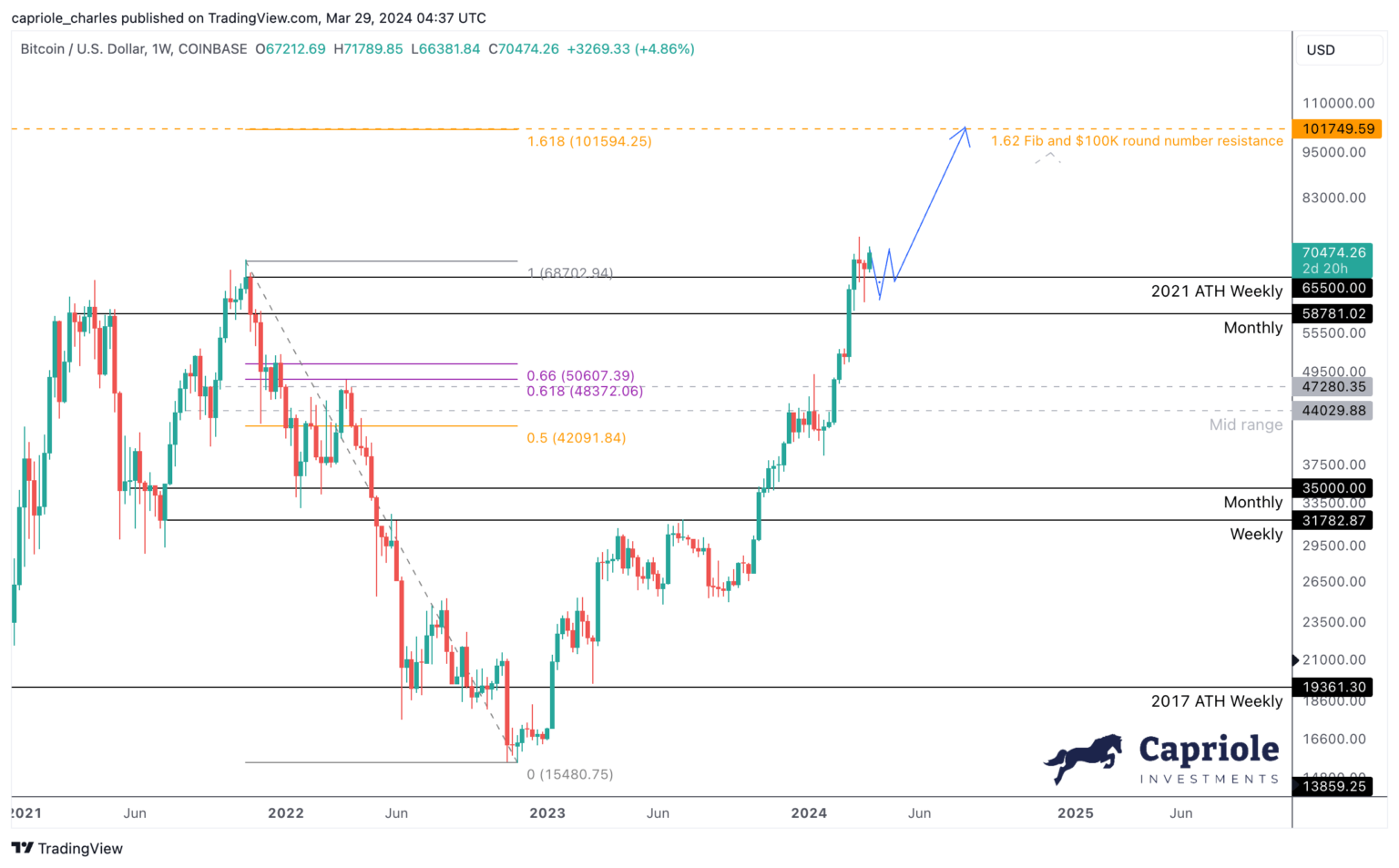

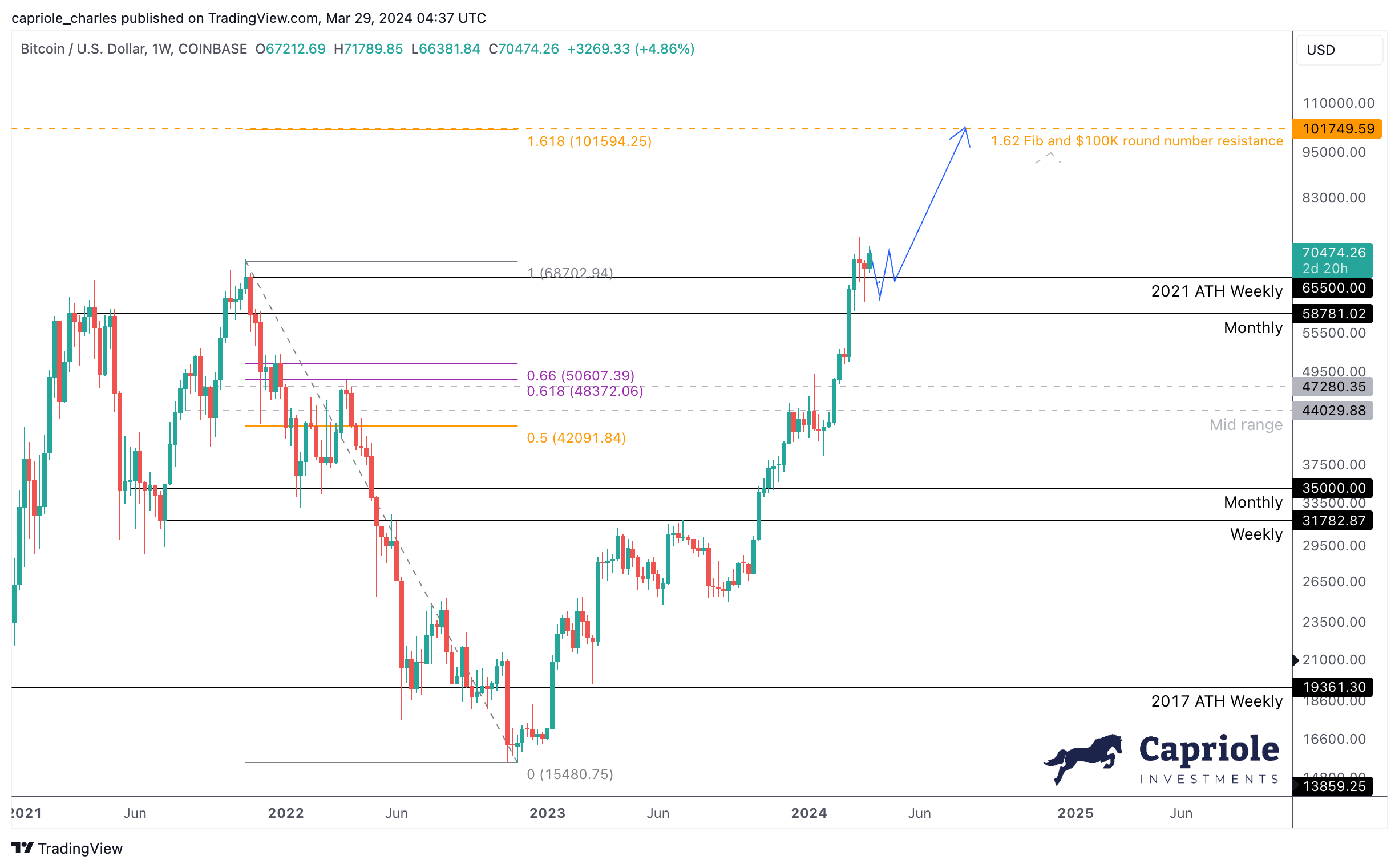

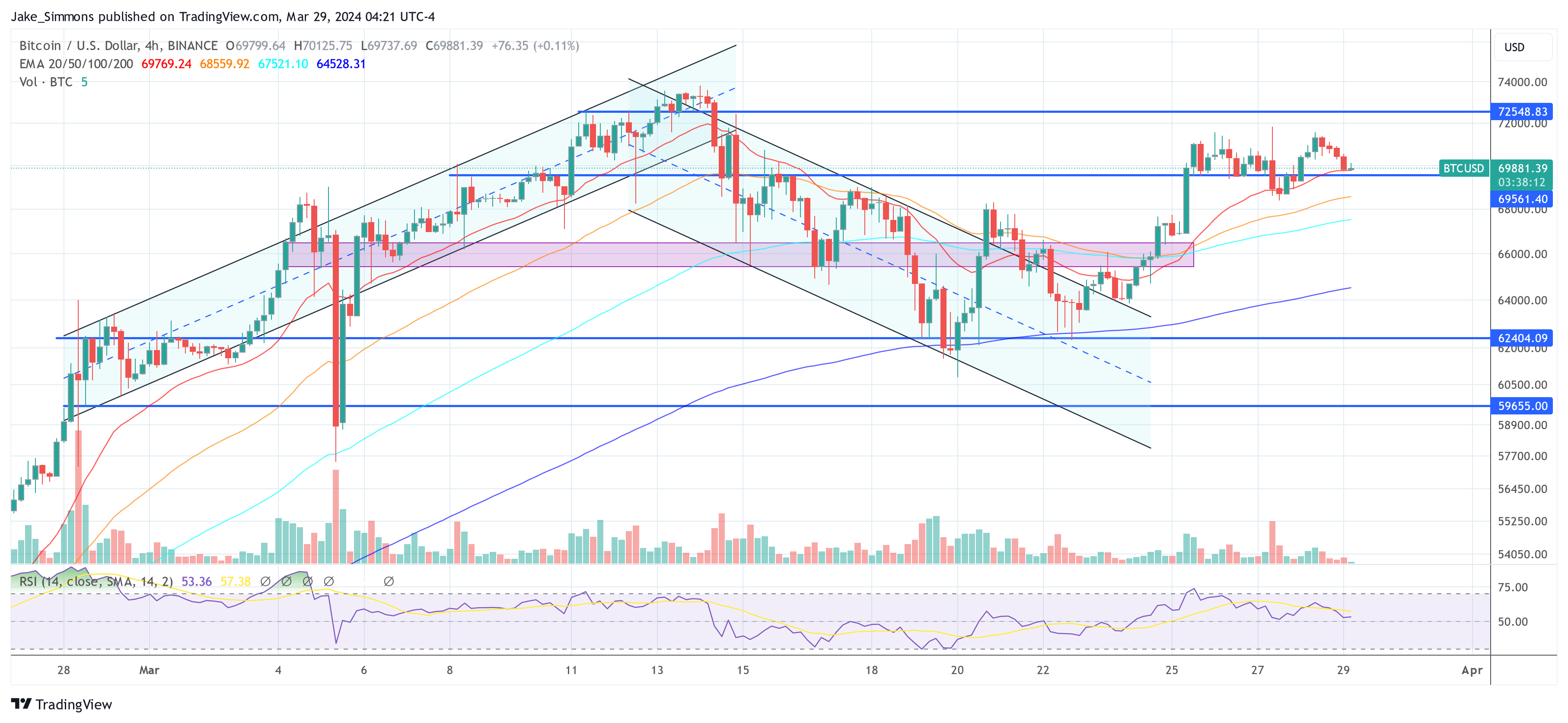

Edwards’s statement of an SOS sample in Bitcoin’s current worth actions means that the market is at a pivotal level, the place sustained upward momentum is extremely possible. In Capriole’s newest e-newsletter, Edwards provided a exact depiction of Bitcoin’s market habits, highlighting a interval of volatility and consolidation within the $60,000 to $70,000 vary.

This part was anticipated by the hedge fund. Presently, as Bitcoin ventures above its final cycle’s all-time highs, it aligns with the anticipated zig-zag SOS construction. Edwards elucidates, “It might not be shocking to see a liquidity seize at / into all-time highs […] All consolidation above the Month-to-month degree at $56K is extraordinarily bullish. It might be unusual (however not unimaginable) for worth to proceed in a straight line up.”

The “zig-zag” part additionally completely aligns with the halving cycle as BTC tends to consolidate “each months both facet of the Halving.” Edwards added that “the realities of a a lot decrease provide progress price + unlocked pent up tradfi demand will then kick-in and launch 12 months of traditionally the most effective risk-reward interval for Bitcoin.”

From a technical perspective, Bitcoin’s foray into worth discovery territory above $70,000 is devoid of great resistance ranges. This opens a pathway to psychological and Fibonacci extension ranges, with Edwards pinpointing $100,000 as the subsequent main psychological resistance.

The 1.618 Fibonacci extension from the 2021 excessive to the 2022 low is famous at $101,750, serving as a technical marker for potential resistance. Edwards displays on investor sentiment, stating, “You can too think about fairly just a few traders can be completely happy seeing six-digit Bitcoin and taking revenue in that zone,” acknowledging the psychological affect of such milestones.

BTC Fundamentals Assist The Bull Case

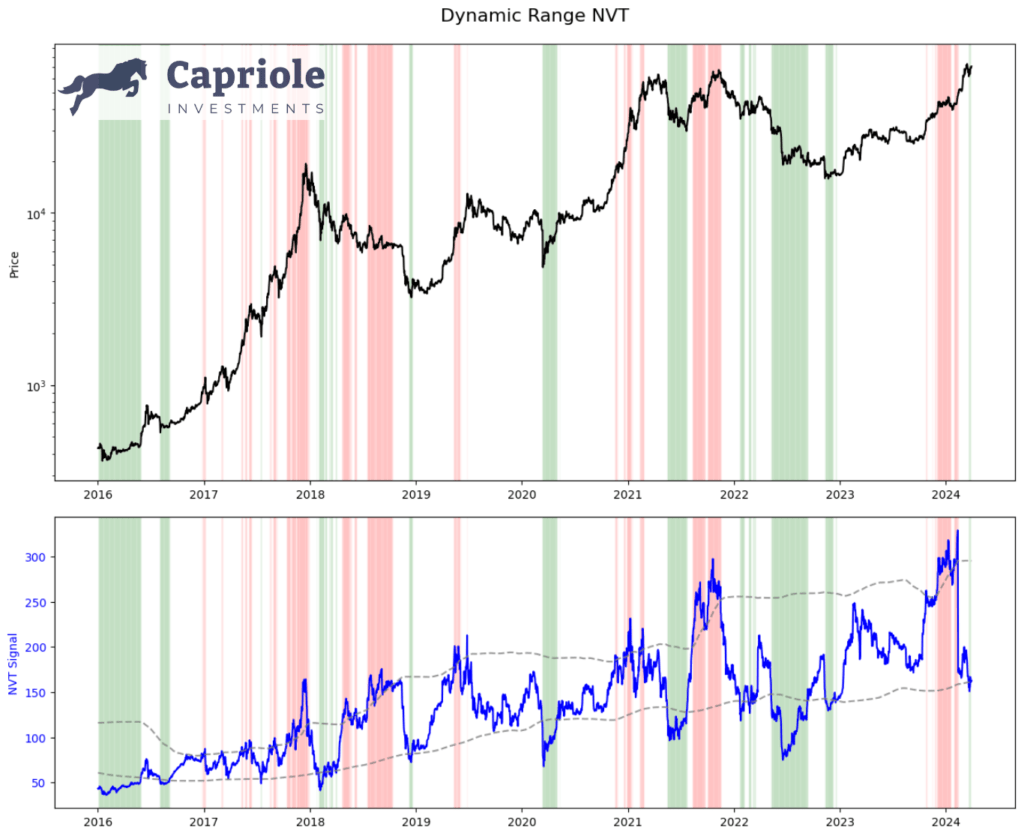

Edwards additionally delves into the significance of fundamentals, underscoring their position in offering a bullish backdrop for Bitcoin. The introduction of the Dynamic Vary NVT (DRNVT), a singular metric to Capriole, signifies that Bitcoin is presently undervalued. Edwards describes DRNVT as “Bitcoin’s ‘PE Ratio’”, which assesses the community’s worth by evaluating on-chain transaction throughput to market capitalization.

The present DRNVT readings recommend a beautiful funding alternative, given Bitcoin’s undervaluation at all-time worth highs. “What’s fascinating at this level of the cycle is that DRNVT is presently in a worth zone. With worth in any respect time highs, this can be a promising and strange studying for the chance that lies forward in 2024. It’s one thing we didn’t see in 2016 nor 2020,” Edwards remarked.

With each technical indicators and basic evaluation signaling a bullish future for Bitcoin, the anticipation surrounding the upcoming Halving occasion provides additional momentum to the optimistic outlook. Regardless of the expectation of volatility and consolidation within the brief time period, Edwards confidently states, “possibilities are beginning to skew to the upside as soon as once more.”

At press time, BTC traded at $69,981.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal threat.