[ad_1]

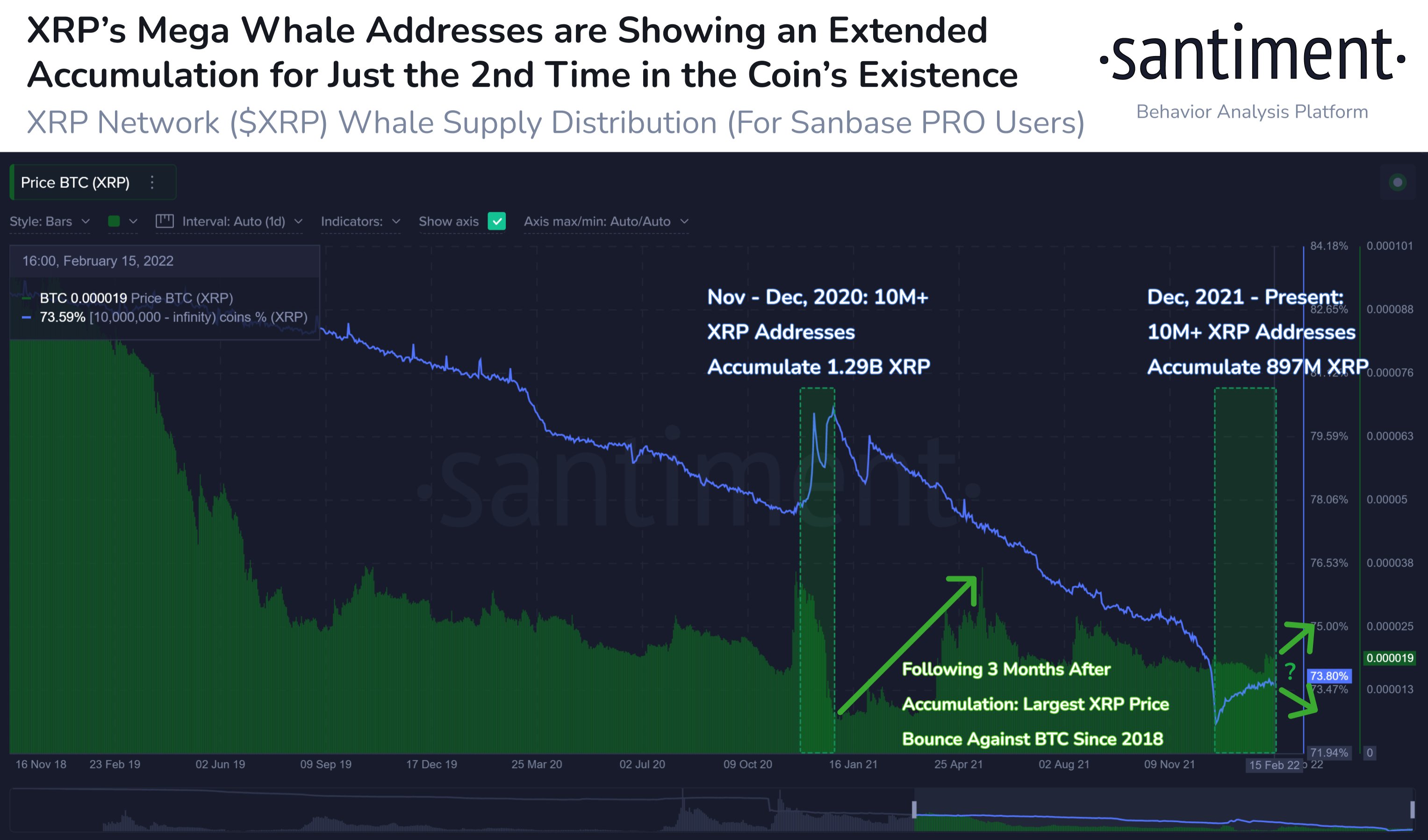

Ripple (XRP) addresses that maintain at the very least 10 million native items have returned to accumulating extra previously three months, the same situation that preceded a giant rally for the XRP/USD and XRP/BTC pairs in late 2020.

The return of XRP ‘mega whales’

A 76% spike in XRP “mega whale” addresses since December 2021 has been famous by analytics agency Santiment exhibiting that they added a complete of 897 million tokens, value over $712 million as of Feb. 18, to their reserves.

The platform additional highlighted that the XRP accumulation witnessed within the final three months was the second-largest within the coin’s existence. The primary huge accumulation befell in November–December 2020 that noticed whales depositing a complete of 1.29 billion XRP to their addresses.

Curiously. the spike in XRP provide into the whale addresses coincided with a worth bounce towards Bitcoin. The XRP/BTC change fee surged by almost 150% to as excessive as 3,502 satoshis between Nov. 1, 2020, and Nov. 24, 2020.

XRP additionally strengthened towards the greenback as with XRP/USD rallied by greater than 250% to $0.82 in the identical interval. Because of this, the current uptick in whales-led accumulation raised prospects of the same upside pattern within the XRP market, Santiment hinted within the chart above.

Nonetheless, it is important to say that XRP’s huge growth in November 2020 got here primarily within the wake of Ripple’s transfer to buy $46 million value of XRP to “assist wholesome markets.”

XRP worth holding rebound positive factors

The current bout of XRP accumulation amongst whales partially appeared alongside a restoration over the previous weeks.

XRP’s worth rebounded by as a lot as 65% to $0.91, lower than three weeks after bottoming out at $0.55 on Jan. 22, 2022. Nonetheless, as of Feb. 18, the value had fallen again to close $0.77, suggesting that bulls reeled beneath the stress of the 50-week exponential transferring common (50-week EMA; the pink wave within the chart beneath).

Cointelegraph mentioned the same pullback setup in its evaluation final week, suggesting {that a} selloff close to the 50-week EMA might set off an prolonged draw back transfer towards the 200-week EMA (the blue wave) close to $0.54.

Conversely, the setup additionally indicated {that a} decisive transfer above 50-day EMA may push the value to its multi-month descending trendline resistance close to $1.

Associated: XRP positive factors 30% after Ripple will get permission to clarify ‘honest discover protection’ vs. SEC

The value motion on shorter-timeframe charts additionally suggests an imminent rally towards $1. For example, XRP has been forming what seems to be a bull pennant setup on a four-hour chart, confirmed by an ongoing consolidation in a symmetrical triangle.

A primary rule of the bull pennant setup is that it prompts the value to go larger as soon as it decisively breaks above the construction’s higher trendline, and thus eyeing ranges above $1.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it’s best to conduct your individual analysis when making a choice.