[ad_1]

On-chain information exhibits exchanges have been observing latest progress of their Bitcoin reserves, an indication that promoting stress could also be growing.

All Exchanges Observe Rising Bitcoin Reserves, Besides For Coinbase

As an analyst in a CryptoQuant publish identified, solely Coinbase has seen some withdrawals lately. The related indicator right here is the “alternate reserve,” which measures the entire quantity of Bitcoin at the moment being held within the wallets of any centralized alternate.

When the worth of this metric goes up for an alternate, it means the platform is receiving a internet quantity of deposits proper now. Since one of many important causes traders switch their cash to exchanges is for promoting functions, this development can have bearish penalties for the asset’s worth.

However, a decline within the indicator implies a internet variety of cash is leaving the alternate at the moment. When extended, such a development could be a signal that traders are making withdrawals to build up the cryptocurrency, which could be bullish for the worth of BTC in the long run.

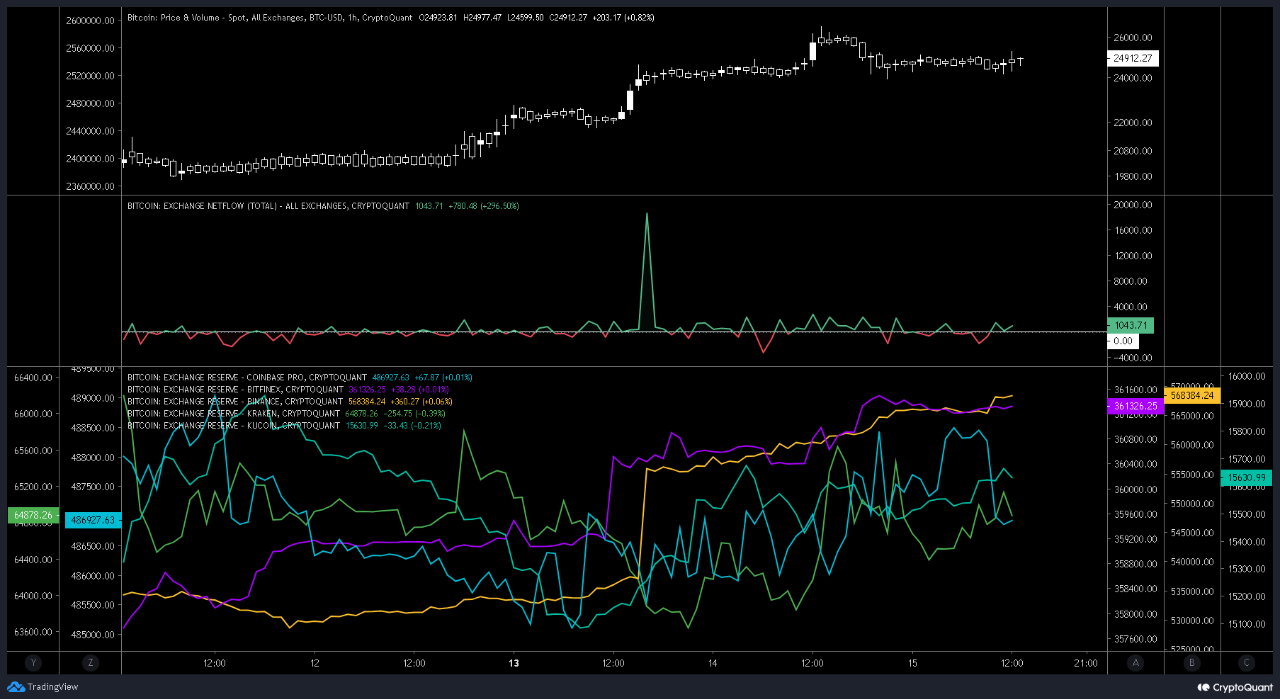

Now, here’s a chart that exhibits the development within the Bitcoin alternate reserves of the main platforms within the sector over the previous couple of days:

Many of the exchanges appear to have noticed a rise of their treasuries lately | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin alternate reserve for nearly all of those exchanges (Bitfinex, Binance, Kraken, Kucoin) has been trending up up to now few days.

The chart additionally exhibits the info for one more indicator, all alternate’s netflow, which tells us in regards to the internet change within the mixed reserve of all of the exchanges available in the market.

It regarded like when the most recent surge within the worth of the cryptocurrency began, this metric noticed a big spike, suggesting that holders rushed to deposit their cash to make the most of the profit-taking alternative probably.

Whereas this constructive netflow didn’t instantly translate to the worth, the continued stream of smaller deposits which have occurred within the final day or so since then does appear to have produced a noticeable impact on Bitcoin, because the asset has declined beneath the $25,000 stage now.

It’s additionally doable that a few of the earlier massive deposits had been made prematurely, and as soon as the coin touched ranges above $26,000, these traders pulled the set off and dumped their holdings, therefore the delay within the worth decline.

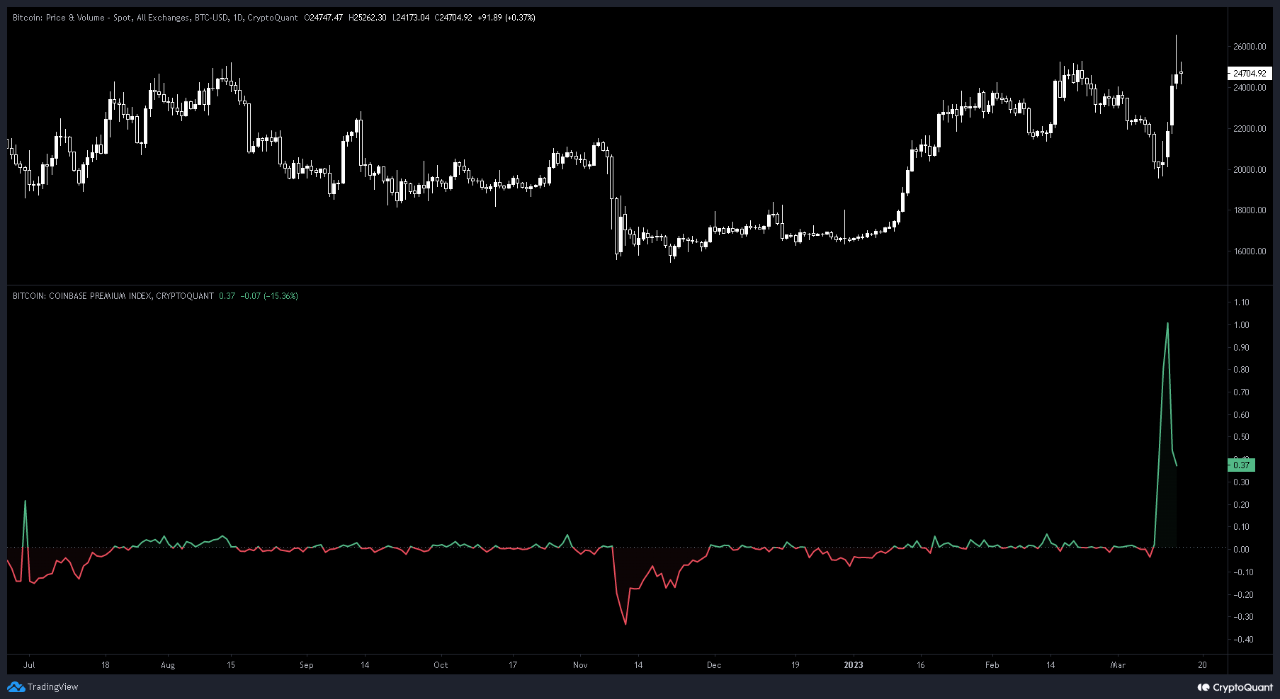

The cryptocurrency alternate Coinbase, nevertheless, is a platform that has seen a internet quantity of withdrawals in the previous couple of days. This means that doable shopping for has been happening on the alternate, and certainly, the Coinbase Premium Index can also verify so.

Appears to be like just like the metric has had a really constructive worth in the previous couple of days | Supply: CryptoQuant

The Coinbase Premium Index measures the distinction between the Bitcoin worth listed on Coinbase and that on Binance. From the chart, it’s obvious that this indicator turned very constructive lately, which signifies that BTC had the next worth on Coinbase than on Binance in the course of the spike, suggesting that the platform noticed the next diploma of shopping for stress.

A few of these cash purchased on the alternate forward of the worth surge at the moment are being withdrawn from the platform’s wallets, therefore the downtrend within the alternate reserve.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $24,200, up 10% within the final week.

BTC has declined after the surge | Supply: BTCUSD on TradingView

Featured picture from Becca on Unsplash.com, charts from TradingView.com, CryptoQuant.com