[ad_1]

On-chain information reveals the Bitcoin circulation price has continued to be low lately, one thing which may be unhealthy information for the present BTC rally.

Bitcoin Circulation Has Remained Low Regardless of Current Value Surge

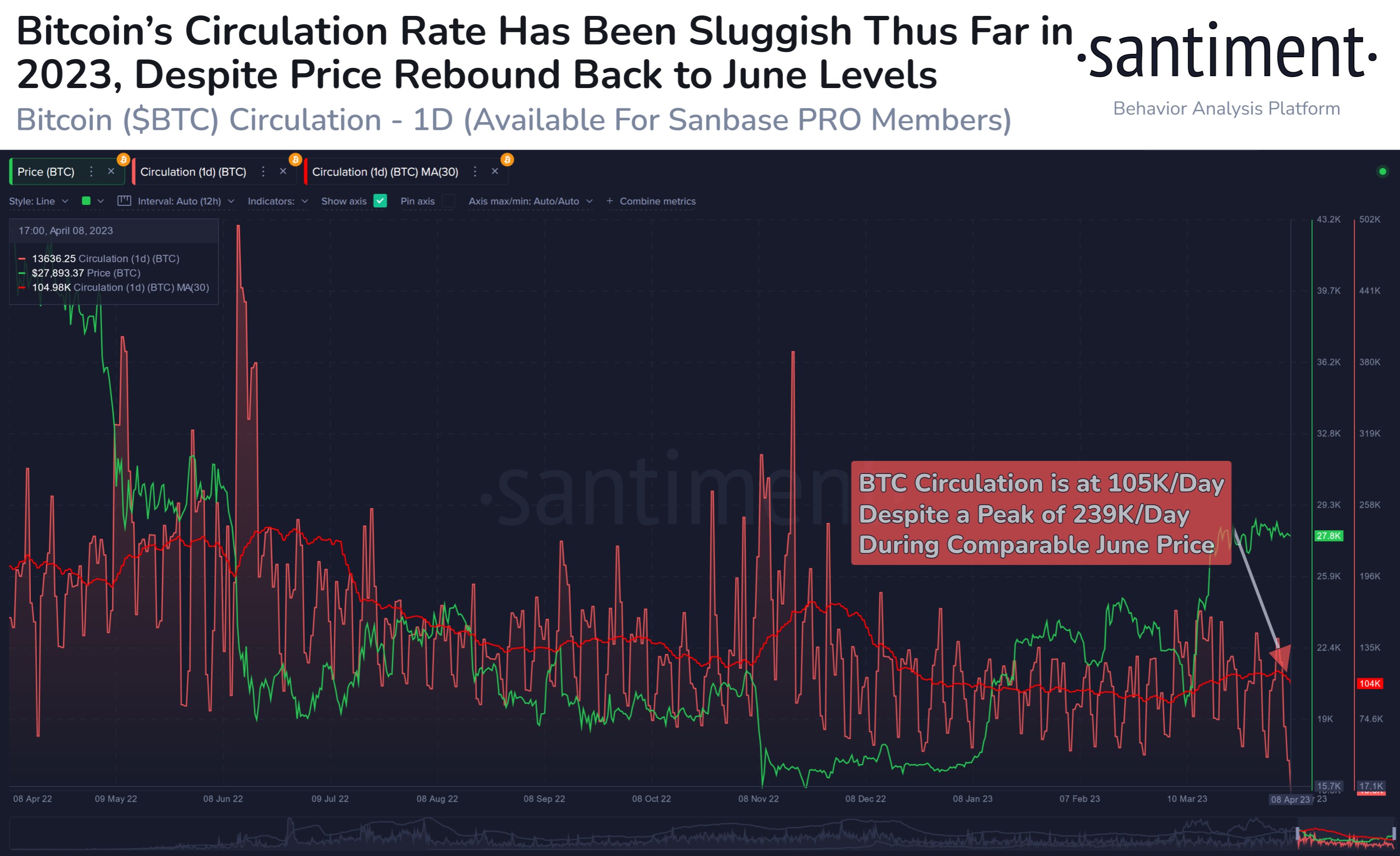

In line with information from the on-chain analytics agency Santiment, 105,000 BTC is shifting per day at the moment. The related indicator right here is the “circulation,” which measures the distinctive each day variety of Bitcoin tokens which are displaying some motion on the blockchain.

Because the metric solely counts distinctive cash, it implies that if a token has been shifted on the community a number of occasions in a single day, its motion will nonetheless contribute just one unit towards the circulation indicator.

The explanation the metric has this restriction is that a lot of the identical cash transfer round loads on the chain on any given day, with solely a handful of traders being accountable for their actions. Many such transactions are relay transfers and different duplicate actions, which don’t even have a lot relevance to the market.

Thus, if the indicator counted simply the pure variety of tokens being moved round, no matter whether or not they have been distinctive or not, an inaccurate image relating to the chain exercise could seem.

When the worth of the circulation is excessive, it means a lot of distinctive tokens are seeing some transaction exercise proper now. Such a development implies the blockchain is probably going observing participation from a excessive quantity of distinctive customers.

Now, here’s a chart that reveals the development in Bitcoin circulation, in addition to in its 30-day shifting common (MA), during the last yr:

Appears like the worth of the metric has been fairly low in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the Bitcoin circulation has remained at comparatively low ranges for fairly some time now. The 3AC collapse again in June 2022 and the FTX crash in November 2022 was the final couple of situations the place the indicator hit some excessive values.

These surges within the metric weren’t surprising, as crashes of this type usually appeal to a lot of new customers to the community (and get up some dormant previous ones), thus resulting in a spike within the distinctive variety of tokens being moved throughout wallets on the blockchain.

Identical to crashes can power folks to make some strikes, rallies may also have an analogous impact on the community. Nonetheless, even though the present rally began again in January of this yr, the Bitcoin circulation hasn’t proven any vital uptick up to now.

In line with the 30-day MA of the metric, cash are being moved at a price of 105,000 per day, which is 56% lower than the one-year highs seen again in June 2022.

“When searching for validation of mid/long run bull runs, utility must be rising,” explains Santiment. Because the utility of the cryptocurrency hasn’t elevated lately, it’s doable that the rally could run out of steam earlier than lengthy.

BTC Value

On the time of writing, Bitcoin is buying and selling round $28,300, down 1% within the final week.

BTC has been shifting sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.web