[ad_1]

Regardless of the unstable value motion of Bitcoin (BTC), the world’s largest cryptocurrency has outperformed each different asset, together with gold. Though it’s buying and selling under its psychological milestone of $30,000 at $29,000, Bitcoin is anticipated to develop additional in 2023, because it acts as a protected haven for buyers amidst the US banking disaster.

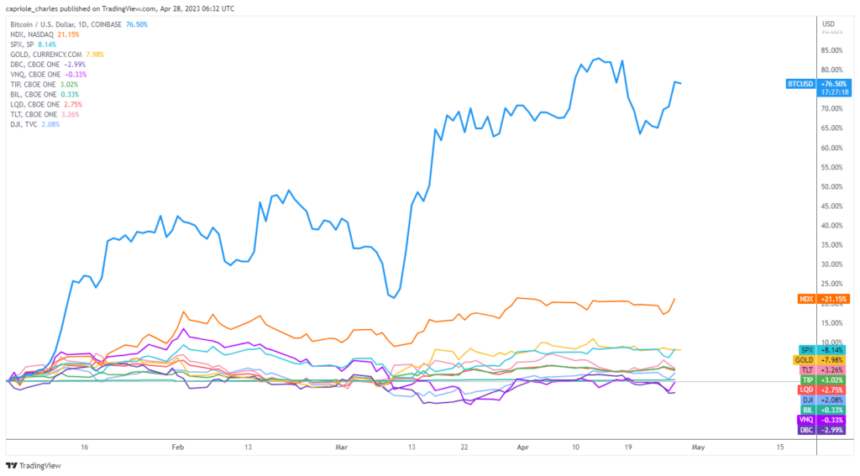

Bitcoin Reigns Supreme Because the Greatest-Performing Asset

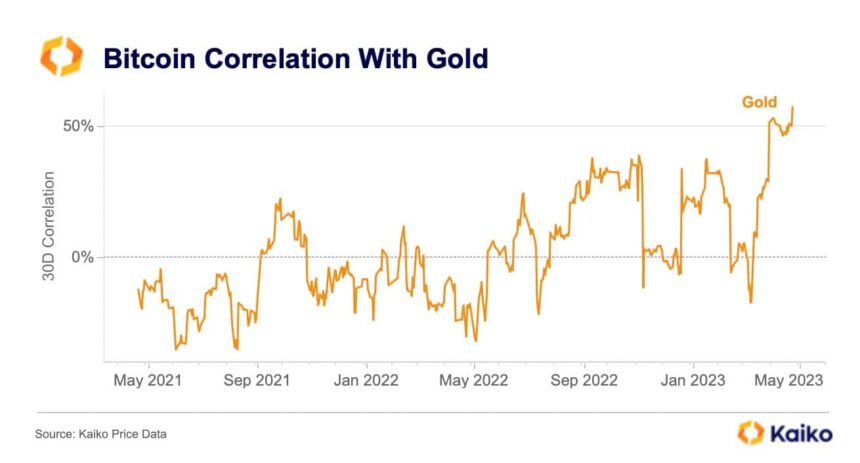

Capriole Funding, which gives analysis and evaluation on cryptocurrencies, has reported that the present market cycle favors exhausting belongings like gold, as indicated by the 200-week Gold-to-Shares ratio. This traditional indicator highlights when the market favors safe-haven belongings like gold over riskier fairness belongings. Each gold and Bitcoin have generated a few of their greatest returns throughout these phases.

Because the market continues to favor exhausting belongings, Bitcoin has emerged as the popular protected haven for wealth amidst the US banking disaster and fiat foreign money weak spot. Throughout this era of excessive correlation, Bitcoin has outperformed gold by 10X in 2023, making it the best-performing asset of the 12 months amongst main asset lessons.

The robust constructive correlation between Bitcoin and Gold has additionally elevated considerably, making them enticing choices for buyers seeking to diversify their portfolios and hedge towards financial uncertainty. With unsustainable tightening, banking crises, and de-dollarization looming, the market is popping to those safe-haven belongings to guard their wealth.

In accordance with the report by Capriole Funding, the present Bitcoin rally in 2023 is believed to be natural and spot pushed. The report highlights a key metric exhibiting whole futures Open Curiosity as a ratio of the whole Bitcoin and USDT market cap.

This metric gives perception into the market’s leverage and exhibits that the crypto market leverage peaked with the FTX fraud in November 2022. Since then, this ratio has been on a one-way downtrend, regardless of Bitcoin’s value rallying over 80% from $16,000 to $30,000. This means that there was little hypothesis out there this 12 months.

The report means that till this ratio spikes or Bitcoin dominance peaks, the foundations for sustainable value appreciation stay in place. Which means the present rally is pushed by natural demand slightly than hypothesis, which is a constructive signal for the long-term development of the cryptocurrency market.

Moreover, the report means that the lower in leverage signifies a wholesome market much less susceptible to sudden value drops. It’s because a excessive stage of leverage can typically result in market instability, inflicting sharp value swings and doubtlessly leading to a market crash.

BTC’s $30-32K Dilemma

In accordance with the report, Bitcoin is buying and selling throughout the largest technical resistance block on the chart since $20,000. This area, which ranges from $30,000 to $32,000, represents the underside of the 2021 vary and the breakdown level into the bear market that started in 2022.

Moreover, it’s a main weekly order block stage and Fibonacci extension stage from the prior cycle. $30,000 can also be a serious spherical quantity stage, representing a 50% improve from the 2017 cycle all-time-high of $20,000, and $32,000 marks a 100% appreciation in Bitcoin for the reason that FTX Fraud backside at $16,000.

Whereas Bitcoin has proven exceptional resilience in current months, it is very important notice that previous efficiency will not be an indicator of future outcomes. Nonetheless, in keeping with Capriole’s report, if Bitcoin manages to shut above $32,000 weekly, it wouldn’t be shocking to see a brand new pattern carry its value into the $40,000 mark.

Featured picture from Unsplash, chart from TradingView.com