[ad_1]

Bitcoin has fallen beneath the $25,000 stage throughout the previous day as on-chain knowledge exhibits indicators of elevated exercise from the whales.

Bitcoin Whale Transaction Depend Has Shot Up Just lately

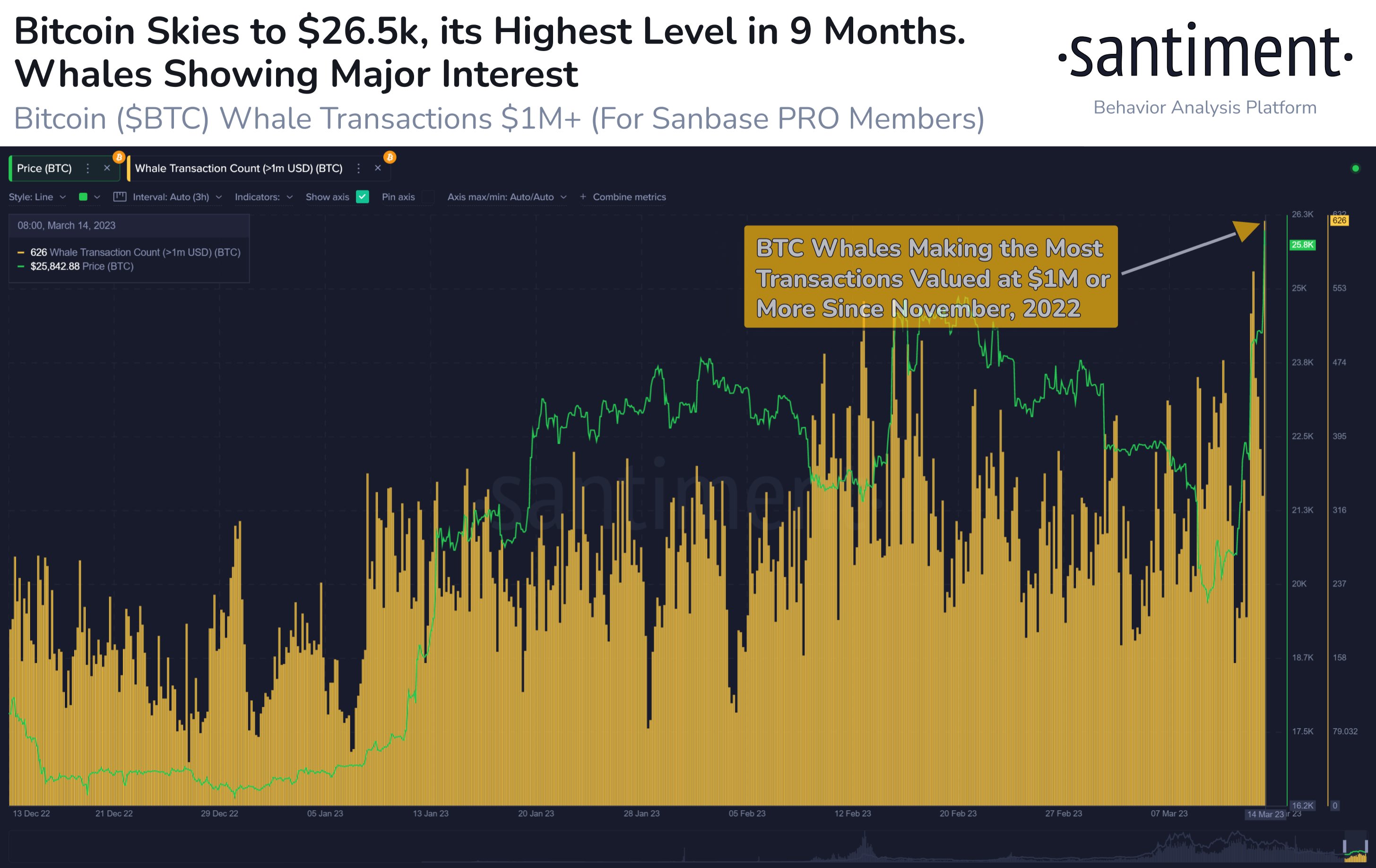

In response to knowledge from the on-chain analytics agency Santiment, whale exercise surged to the very best stage in 4 months yesterday. The related indicator right here is the “whale transaction depend,” which measures the overall quantity of transfers happening on the Bitcoin blockchain which are price at the least $1 million in worth.

When the worth of this metric is excessive, it means numerous whale transactions are occurring on the community proper now. Such a development exhibits that these humongous holders have an lively curiosity in buying and selling the cryptocurrency at present.

Because the sheer scale of cash concerned in whale transactions could be fairly massive, a sizeable variety of them occurring directly could cause noticeable ripples within the worth of the asset. Due to this cause, excessive whale transaction depend values can foreshadow excessive volatility for the asset within the close to time period.

Alternatively, when the indicator has low values, it means whales aren’t exhibiting a lot exercise in the intervening time, and thus, they could not have an excessive amount of curiosity in BTC. Naturally, this sort of development can precede a calmer market.

Now, here’s a chart that exhibits the development within the Bitcoin whale transaction counts over the previous few months:

The worth of the metric appears to have been fairly excessive in latest days | Supply: Santiment on Twitter

As proven within the above graph, the Bitcoin whale transaction depend noticed an enormous enhance in its worth as the newest surge within the worth of the cryptocurrency took form.

The indicator’s worth hit the very best worth since November 2022, about 4 months in the past, because the BTC worth peaked across the $26,500 stage, a 9-month excessive for the asset.

Because the whale transaction depend can’t differentiate between promoting and shopping for transfers, elevated values of the indicator alone are sometimes not sufficient to say what sort of habits these traders are exhibiting precisely, solely that they’re lively at present.

Although, some data can maybe be deduced by trying on the accompanying worth development. For instance, throughout the worth plunge per week or so again, the whales made numerous transfers, following which the asset hit an area low and climbed out in a pointy rise, suggesting that the transactions might have been for accumulating on the low costs.

Within the present case, nonetheless, the asset’s worth has gone downhill since whale transactions have spiked, with the worth now beneath the $25,000 mark, which can suggest {that a} respectable chunk of those transactions may need been made for promoting functions.

If so, it will prove that these Bitcoin whales probably noticed the newest worth surge as only a fast profit-taking alternative and never a push towards a long-term rise.

BTC Value

On the time of writing, Bitcoin is buying and selling round $24,700, up 12% within the final week.

Seems like the worth of the asset has shot up over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.web