[ad_1]

On-chain information reveals the Bitcoin estimated leverage ratio has taken a plunge just lately; right here’s what this might imply for the market.

Bitcoin’s Estimated Leverage Ratio Has Sharply Declined Just lately

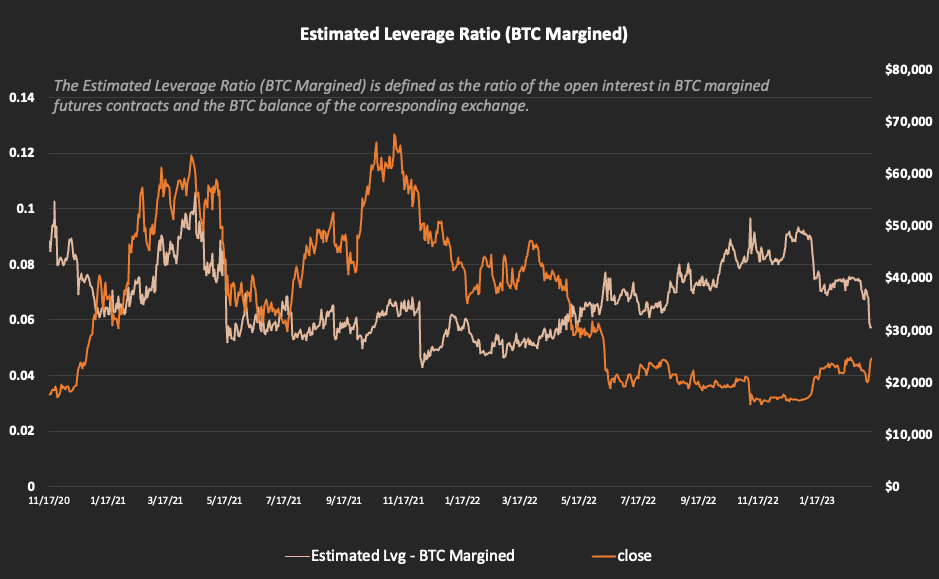

As an analyst in a CryptoQuant put up identified, the leverage has dropped out there regardless of the rally. The related indicator right here is the “estimated leverage ratio,” which measures the ratio between the Bitcoin open curiosity and the full quantity of BTC saved in all by-product exchanges’ wallets.

The “open curiosity” refers back to the whole BTC margined futures contracts at the moment open on all by-product exchanges. This metric accounts for each quick and lengthy contracts.

The estimated leverage ratio tells us the common quantity of leverage utilized by futures market customers proper now. When the worth of this metric is excessive, it means the common contract holder is taking over excessive leverage at the moment.

Such a pattern means that market individuals are getting daring and prepared to tackle a excessive danger. Typically, excessive leverage could cause the market to grow to be unstable. Thus, the value experiences excessive volatility when these circumstances type.

However, low ratio values suggest customers want to make use of extra leverage at the moment. Naturally, the value is normally calmer when this pattern is noticed.

Now, here’s a chart that reveals the pattern within the Bitcoin estimated leverage ratio over the previous couple of years:

Seems to be like the worth of the metric has sharply gone down in current days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin estimated leverage ratio had a reasonably excessive worth when the rally began in January of this yr however has since been solely taking place.

There have been two vital plunges within the metric to this point; the primary occurred simply because the rally started. This sharp decline was as a result of the sudden sharp rally liquidated the excessive quantity of quick contracts that had piled up through the bear market lows, thus wiping out numerous leverage.

This occasion was an instance of a “liquidation squeeze.” Throughout a squeeze, a sudden value transfer triggers mass liquidations that solely find yourself feeding mentioned value to maneuver additional, and thus, trigger much more liquidations within the course of.

When leverage piles up out there, squeezes grow to be extra possible. That is the rationale why the market can get extra unstable when the leverage is at elevated ranges.

The chart reveals that the opposite plunge has come simply throughout the previous couple of days, the place BTC has witnessed a excessive diploma of volatility, with the value fluctuating wildly each up and down.

This pattern of the leverage ratio solely taking place with the rally is considerably uncommon. Previous rallies have typically accompanied the indicator following an total upwards pattern due to traders FOMOing in and opening up high-leverage positions.

As for what this unusual pattern within the metric could say concerning the present Bitcoin market, the quant thinks, “latecomers who get grasping and use loopy leverages will not be right here but.”

BTC Value

On the time of writing, Bitcoin is buying and selling round $25,100, up 20% within the final week.

BTC shows volatility | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com