[ad_1]

Knowledge from Glassnode reveals the Bitcoin provide has been observing a shift from wallets based mostly in America to these in Asia not too long ago.

Bitcoin Provides Held By Asian And US Buyers Have Gone Reverse Methods Not too long ago

In keeping with knowledge from the on-chain analytics agency Glassnode, an attention-grabbing dichotomy has fashioned between the completely different regional provides of the cryptocurrency not too long ago.

Glassnode has divided the Bitcoin addresses into completely different areas based mostly on the hours they’ve been making transactions in. “Geolocation of Bitcoin provide is carried out probabilistically on the entity degree,” notes Glassnode. An “entity” right here refers to a number of wallets which can be below the management of a single investor (or an investor group).

“The timestamps of all transactions created by an entity are correlated with the working hours of various geographical areas to find out the chances for every entity being situated within the US, Europe, or Asia,” explains the analytics agency.

The three fundamental areas are the US (13:00 to 01:00 UTC), Europe (07:00 to 19:00 UTC), and Asia (00:00 to 12:00 UTC). Within the context of the present dialogue, nevertheless, solely the provides based mostly within the US and Asia are related.

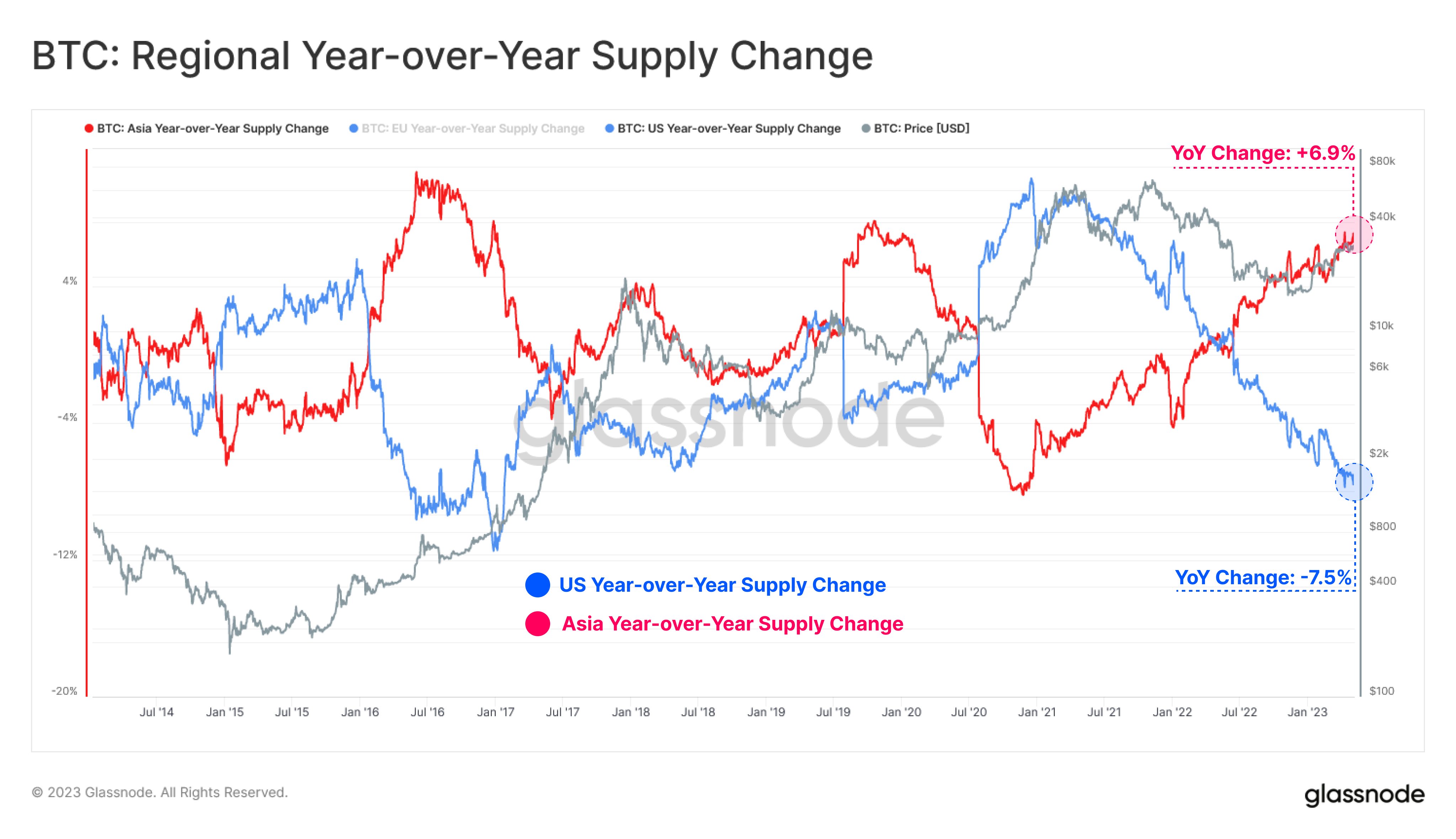

Here’s a chart that reveals the pattern within the year-over-year provide change in these two regional Bitcoin provides over the previous few years:

Seems to be just like the values of the 2 metrics have been going precisely the alternative instructions in latest months | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin provide held by the US buyers was rising sooner and sooner within the leadup to and through the bull run within the first half of 2021 because the year-over-year change was continuously going up.

The change slowed down within the second half of the 12 months, however nonetheless remained optimistic, suggesting that the provision was nonetheless rising, albeit at a slower tempo. In 2022, nevertheless, the provision began reducing, because the bear market took over and the LUNA and 3AC crashes occurred.

The year-over-year change of the US-based BTC provide has continued to develop extra detrimental since then and in the present day stands at a price of -7.5%, suggesting that the provision has shrunken by 7.5% since Could 2022.

The Asian Bitcoin provide, nevertheless, has displayed a really contrasting conduct, because it began going up simply because the American buyers began shedding their holdings.

Curiously, the tempo at which the provision held by the Asian merchants has remodeled is sort of precisely the identical as what the balances of the US-based wallets noticed (though, in fact, the change has been in the other way).

At the moment, the year-over-year change within the Asian provide stands at +6.9%. The truth that the Asian buyers have purchased an identical quantity to what the US holders have bought suggests a direct switch of cash between the 2 provides.

Now, as for why this continued transition of provide has taken place, the principle cause is prone to be the truth that the US has been tightening up rules associated to the cryptocurrency sector not too long ago.

Some of the distinguished examples of this has been the regulatory crackdown that Coinbase has noticed from the Securities and Trade Fee (SEC) not too long ago.

BTC Value

On the time of writing, Bitcoin is buying and selling round $28,200, down 1% within the final week.

BTC has surged previously day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com