[ad_1]

On-chain knowledge reveals the Bitcoin alternate influx has registered its largest worth in six months, an indication that profit-taking could also be happening after the value surge.

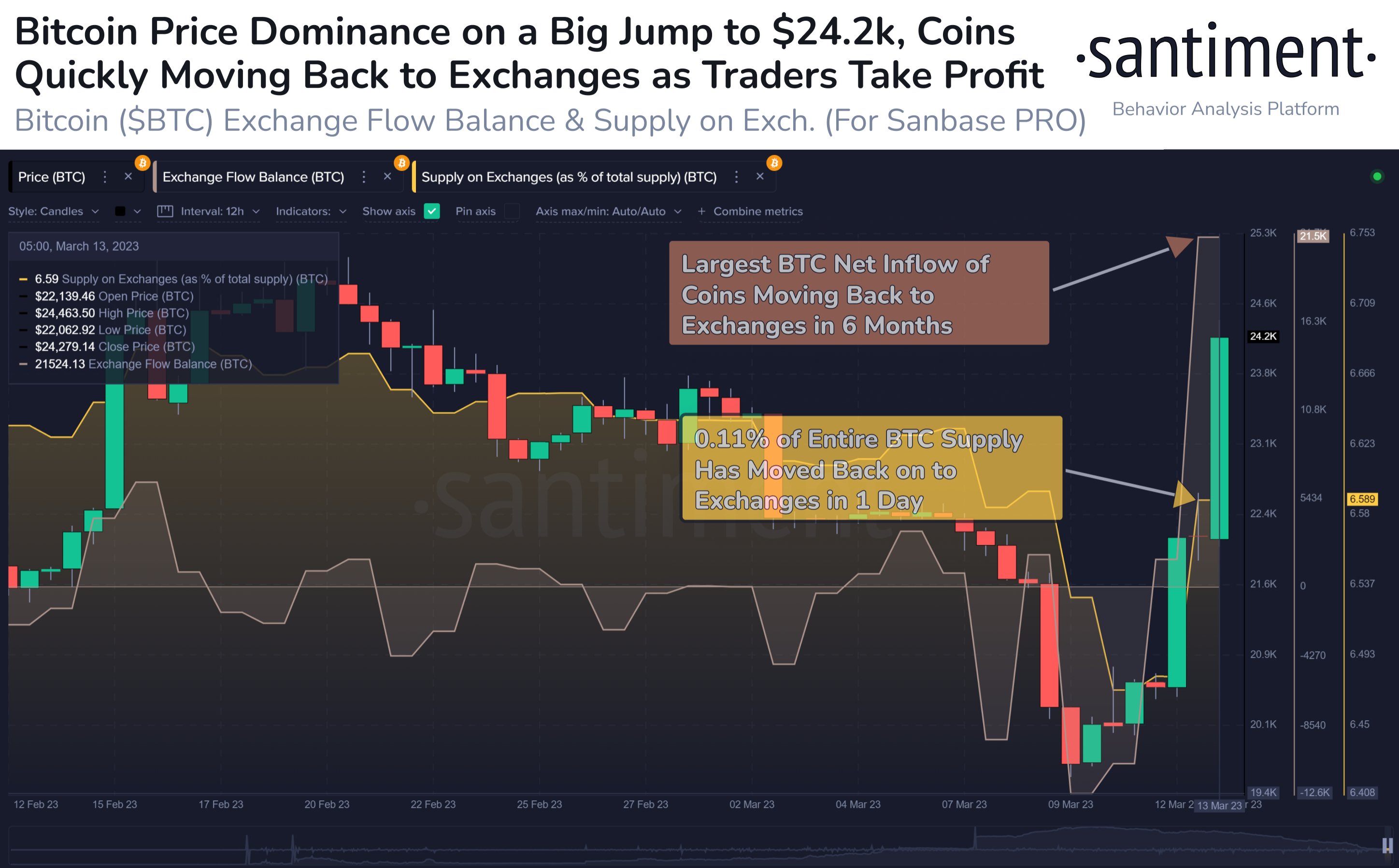

Bitcoin Trade Influx Has Spiked To Highest In Six Months

Based on knowledge from the on-chain analytics agency Santiment, a lot of cash have entered into exchanges not too long ago. The related indicator right here is the “alternate movement stability,” which measures the online quantity of Bitcoin that’s shifting into or out of the wallets of all centralized exchanges.

When the worth of this metric is optimistic, it means the inflows going down out there are presently overwhelming the outflows and a internet variety of cash are coming into alternate wallets.

As one of many foremost the explanation why a holder could deposit to an alternate is for selling-related functions, such a worth can impart a bearish impact on the value.

Alternatively, the indicator having a worth lower than zero suggests provide is being pulled out of the exchanges proper now. This type of pattern, when extended, could be a signal that traders are accumulating the asset in the mean time, and therefore, could be bullish for the BTC value.

Now, here’s a chart that reveals the pattern within the Bitcoin alternate movement stability over the previous month:

Appears like the worth of the metric has been fairly optimistic in current days | Supply: Santiment on Twitter

As displayed within the above graph, the Bitcoin alternate movement stability has shot up above the zero mark over the last couple of days. Throughout this spike, a complete of about 21,524 BTC ($524.9 million on the present alternate price) has been deposited to those platforms.

This worth of the online influx is the best noticed for the reason that September of final yr, round six months in the past. These enormous deposits have come after the value of the cryptocurrency has noticed some sturdy uptrend and has crossed above the $24,000 stage.

The chart additionally reveals knowledge for an additional indicator, the “provide on exchanges,” which tells us in regards to the share of the overall circulating Bitcoin provide that’s presently being saved in alternate wallets.

Naturally, this metric has additionally shot up because the inflows have taken place. Based on this indicator, round 0.11% of the complete BTC provide moved to exchanges with these deposits inside only a single day.

As traders have made these transfers to exchanges with the value taking pictures up, it will appear affordable to imagine that no less than a few of these deposits are being finished for taking benefit of the present profit-taking alternative.

To date, the value has continued to rise to larger ranges regardless of these inflows, suggesting that the market may need been greater than snug absorbing this promoting strain. Nevertheless, if the profit-taking continues, then the value could face some draw back within the close to time period.

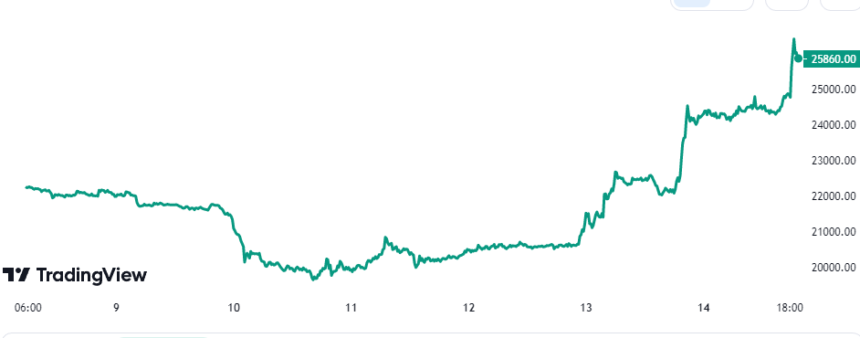

BTC Value

On the time of writing, Bitcoin is buying and selling round $25,900, up 16% within the final week.

BTC has surged over the past two days | Supply: BTCUSD on TradingView

Featured picture from Thought Catalog on Unsplash.com, charts from TradingView.com, Santiment.internet