[ad_1]

On-chain knowledge from Santiment reveals Bitcoin sharks and whales collected round $821.5 million within the asset throughout the latest dip within the worth.

Bitcoin Sharks And Whales Have Added 40,557 BTC To Their Holdings Just lately

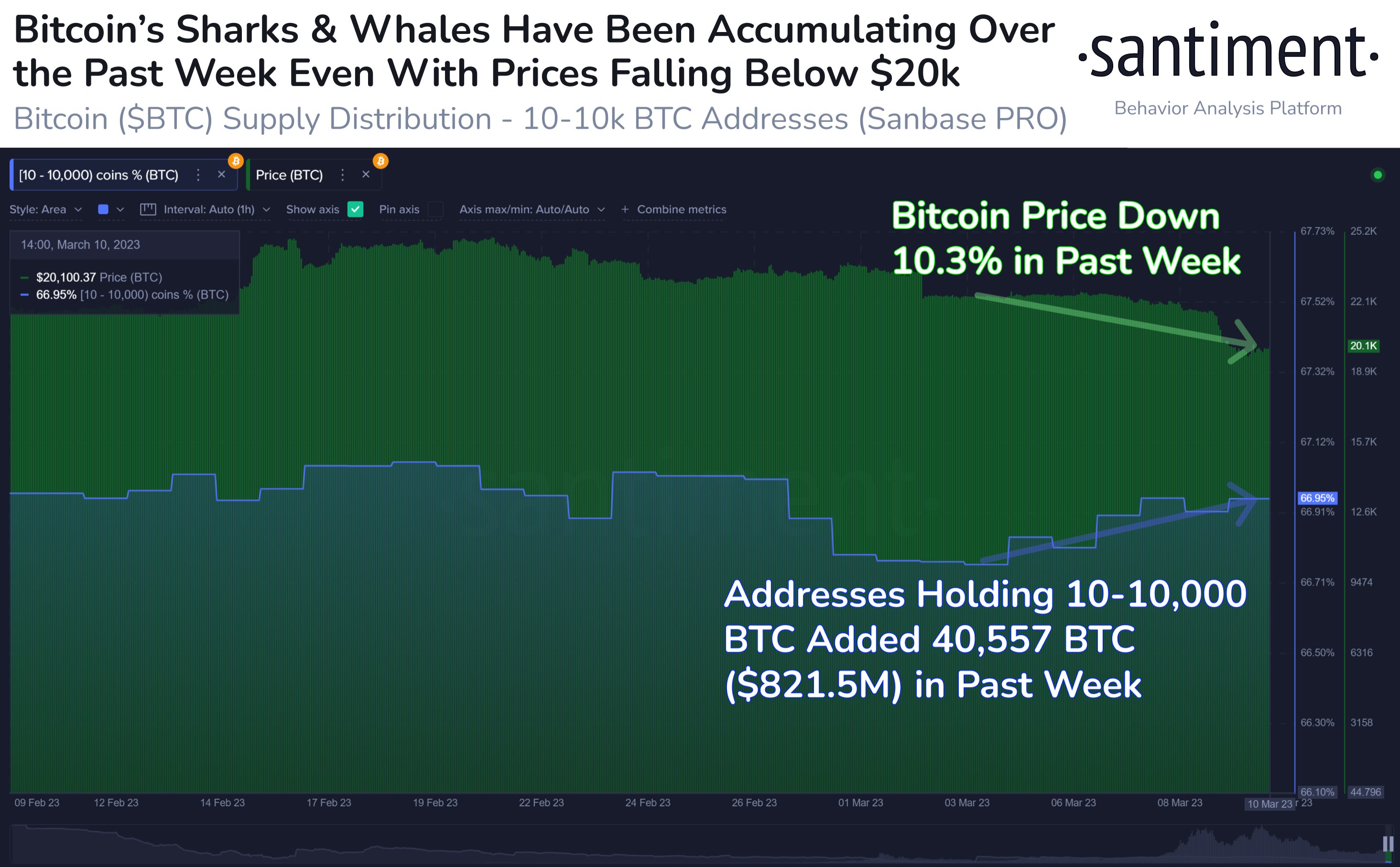

As per knowledge from the on-chain analytics agency Santiment, the sharks and whales weren’t behind the dip within the worth seen earlier. The related indicator right here is the “BTC provide distribution,” which tells us which pockets teams at the moment maintain what share of the full Bitcoin provide.

Wallets are divided into these teams primarily based on the full variety of cash they’re holding proper now. For instance, the 1-10 cash cohort contains all wallets which are carrying a stability between 1 and 10 BTC.

If the Provide Distribution metric is utilized to this particular group, then it will measure the proportion of the BTC provide that wallets satisfying this situation as a complete are holding for the time being.

Now, within the context of the present subject, the vary of curiosity is wallets holding between 10-10,000 BTC. There are three totally different pockets teams falling inside this vary, so here’s a chart that reveals the mixed Provide Distribution knowledge for these teams over the previous month or so:

The worth of the metric appears to have been climbing in latest days | Supply: Santiment on Twitter

This coin vary covers two vital cohorts for Bitcoin: the sharks and whales. Since these holders can have such big pockets quantities (the vary converts to $225,000 on the decrease finish and $225 million on the higher sure), their actions can have noticeable influences available on the market, and due to this cause, their wallets will be those to observe for.

As displayed within the above graph, the Provide Distribution of those sharks and whales has trended up in March, which means that the full share of the BTC provide that’s of their wallets has been rising.

In complete, these buyers have added an extra 40,557 BTC to their holdings throughout this surge. With this newest accumulation, these buyers now personal round 67% of the whole circulating provide.

Apparently, the worth of the cryptocurrency had really been taking place whereas these sharks and whales had been shopping for the coin. Often, throughout worth declines, these humongous buyers shed a few of their holdings because it’s the promoting from these holders themselves that’s usually behind the worth plunge.

Nevertheless, as this hasn’t been the case this time, it will seem that the most recent selloff could not have been pushed by the sharks and whales. The truth that these buyers had been slightly shopping for throughout the worth drawdown would recommend that they nonetheless maintain bullish convictions about Bitcoin and noticed the dip as a worthwhile accumulation alternative.

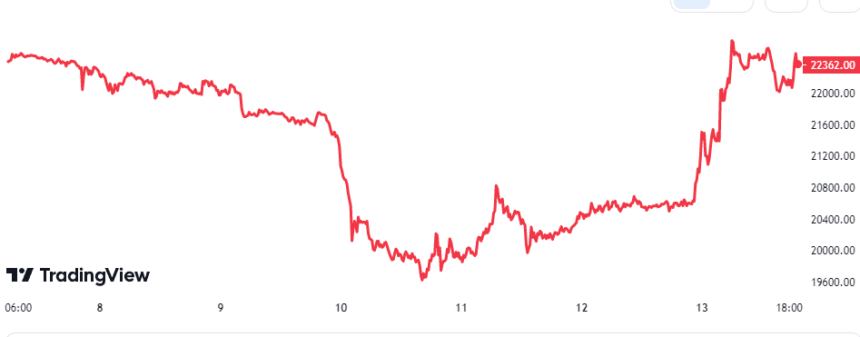

It could additionally appear that the shopping for strain from these whales has ended up having a optimistic impact on the coin, because the asset’s worth has seen some sharp upwards momentum previously day.

BTC Value

On the time of writing, Bitcoin is buying and selling round $22,300, down 1% within the final week.

Appears to be like like the worth of the cryptocurrency has sharply surged previously day | Supply: BTCUSD on TradingView

Featured picture from Sebastian Pena Lambarri on Unsplash.com, charts from TradingView.com, Santiment