[ad_1]

On-chain knowledge exhibits the Bitcoin Spent Output Revenue Ratio (SOPR) has plunged not too long ago; right here’s why this can be bullish for the value.

Bitcoin SOPR Noticed A Deep Plunge In Current Days

As an analyst in a CryptoQuant publish identified, many traders have bought at a loss not too long ago. The “SOPR” is an indicator that tells us whether or not traders are presently promoting at a loss or a revenue.

This metric seems on the on-chain historical past of every coin being bought or moved to see the value at which it was beforehand transferred. If this final promoting worth for any coin was lower than the value it’s being bought, then the investor realizes a revenue with the sale. Equally, the coin’s being bought at a loss within the reverse situation.

When the worth of this indicator is larger than 1, it means the variety of earnings being realized is larger than the losses proper now. This implies that the common investor is transferring cash at a revenue.

However, the metric having a worth beneath this threshold implies loss realization is extra dominant out there. Naturally, the SOPR being equal to 1 suggests the holders break even on their promoting.

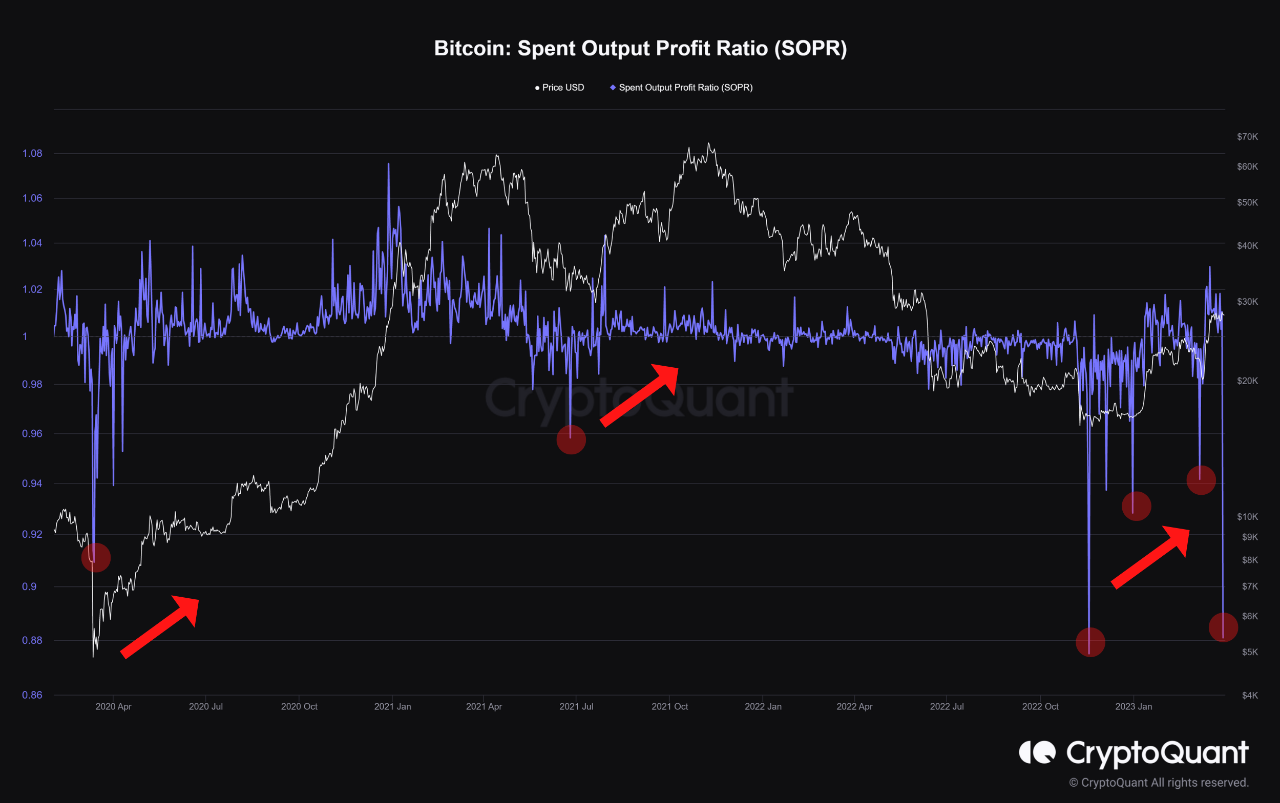

Now, here’s a chart that exhibits the pattern within the Bitcoin SOPR over the previous few years:

The worth of the metric appears to have dipped fairly low not too long ago | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin SOPR has been above 1 for a lot of the 12 months 2023 up to now. Because of this the common investor has been promoting at a revenue throughout this era.

This pattern is sensible, because the asset’s worth has noticed some sturdy bullish momentum in the previous few months. Rallies like these naturally entice traders to reap their good points, therefore why revenue promoting spikes throughout such worth surges.

Nonetheless, the indicator noticed a pointy plunge a few days again, and its worth dipped beneath the 1 stage. This implies that some holders have simply realized numerous losses.

Within the chart, the quant has marked the factors the place comparable downward spikes within the metric have been noticed throughout the previous few years. Curiously, each time the indicator has sharply plummeted, the value has bottomed out and adopted up with an increase.

Such spikes within the Bitcoin SOPR are normally an indication of capitulation from the loss holders. When these traders lastly promote, cash transfer towards holders with stronger convictions, and the promoting strain begins getting exhausted. That is possible why the value bottoms out near such capitulation occasions.

Earlier within the present rally, when BTC had additionally plunged beneath the $20,000 mark, the SOPR noticed such a spike. The most recent stretch within the rally, which has taken the value above $28,000, adopted it.

If this similar sample that has been seen time and time once more repeats for the newest SOPR plunge as effectively, then Bitcoin might really feel a bullish impact from it. Nonetheless, one thing completely different concerning the latest loss promoting is that it has come whereas the value has already been at a comparatively excessive ranges of $28,000.

All of the earlier cases of this pattern got here when the value had been dealing with a bearish wind general. It stays to be seen whether or not this distinction could result in a special final result for the value this time.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,100, up 4% within the final week.

BTC has largely moved sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, CryptoQuant.com