[ad_1]

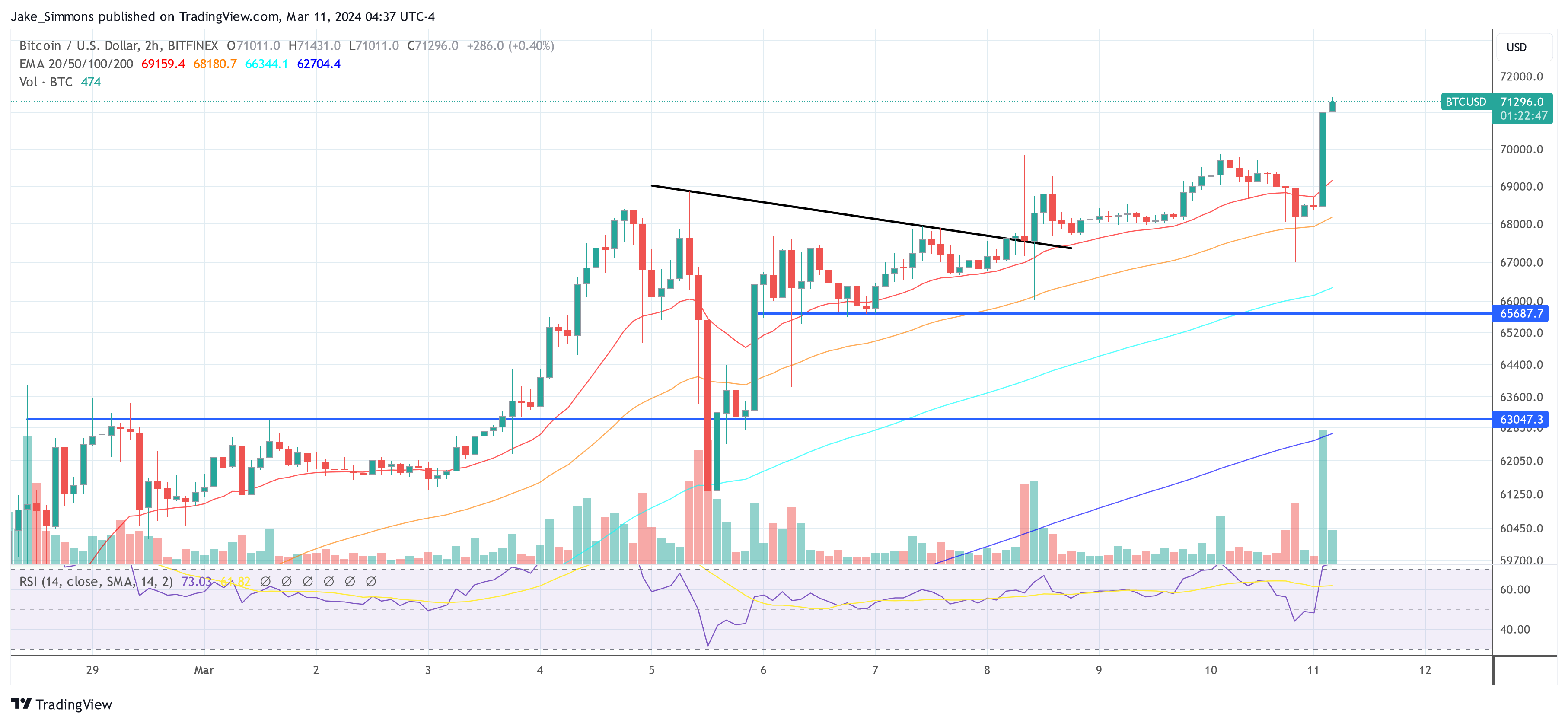

With the beginning of the European buying and selling hour, Bitcoin (BTC) has surged previous the numerous milestone of $71,000, exceeding its earlier all-time excessive set simply final week. This surge may be attributed to a mix of things which have bolstered investor confidence and triggered a wave of shopping for exercise throughout the cryptocurrency market. Right here’s a better examination of the 4 key elements driving this unprecedented rally.

#1 London Inventory Change Embraces Bitcoin And Ethereum ETNs

Reported by Bloomberg simply previous to the value surge, the London Inventory Change (LSE) has introduced its plans to simply accept functions for the admission of Bitcoin and Ethereum Change-Traded Notes (ETNs) within the second quarter of the yr.

*LSE TO ACCEPT APPLICATIONS FOR BITCOIN, ETHEREUM ETN ADMISSION: BBG

— Tree Information (@News_Of_Alpha) March 11, 2024

Whereas the precise launch date stays unconfirmed, this transfer signifies a significant step in direction of mainstream monetary markets’ acceptance of cryptocurrencies. The inclusion of crypto ETNs on one of many world’s oldest inventory exchanges underscores the rising institutional curiosity in digital belongings and is anticipated to draw a brand new wave of buyers to the crypto market.

#2 The Impression Of A Brief Squeeze

Predictions of a brief squeeze propelling Bitcoin costs to new heights got here to fruition, as forecasted by conventional finance portfolio supervisor Bitcoin Munger (@bitcoinmunger) on X. “We possible begin the week off with a bang, courtesy of the quick sellers trying to get squeezed at $70k. New highs are incoming,” Munger predicted.

We possible begin the week off with a bang, courtesy of the quick sellers trying to get squeezed at $70k.

New highs are incoming. Tick tock! #bitcoin pic.twitter.com/OFiNmlmc9Y

— Bitcoin Munger (@bitcoinmunger) March 10, 2024

This was evidenced by the liquidation of roughly $23.5 million briefly positions throughout Bitcoin’s ascent to $71,000, as per Coinglass knowledge.

#3 Tether’s Function In Capital Inflow

New cash was getting into the market over the weekend, and final week. Main stablecoin Tether (USDT) was minted, as on-chain evaluation agency Lookonchain reported: “The Tether Treasury minted 2 billion USDT once more [yesterday]! And 5 billion USDT has been minted on Tron and Ethereum in only one week!” reported on-chain evaluation agency Lookonchain.

One notable transaction concerned a whale or establishment receiving 261.6 million USDT from the Tether Treasury and depositing it into the Binance alternate, suggesting substantial preparatory exercise for main buying and selling operations.

After #TetherTreasury minted 2B $USDT, a whale/establishment obtained 261.6M $USDT from #TetherTreasury and deposited it into #Binance.https://t.co/ohBcxqbrzThttps://t.co/Cxs2WfFPCn pic.twitter.com/fvL7Cz5Tvv

— Lookonchain (@lookonchain) March 11, 2024

#4 Surging Demand For Bitcoin ETFs

The passion surrounding Bitcoin Change-Traded Funds (ETFs) in america has been extraordinary. “Bitcoin ETFs have attracted greater than $7.5 billion in internet new belongings since launching within the US on January 11, making a lot of them among the many most profitable ETF launches of all time,” noted Matt Hougan, CIO of Bitwise, in a memo to funding professionals.

Hougan additional detailed, “At Bitwise, we’ve engaged with registered funding advisors (RIAs), household places of work, and enterprise capital funds amongst our present patrons. Wanting ahead, we’re in discussions with main wirehouses, institutional consultants, and huge firms, which characterize trillions of {dollars} in belongings.”

This perception underscores a rising confidence in Bitcoin ETFs as a mainstream funding possibility, with expectations of great capital inflows from these entities beginning within the second quarter of 2024, indicating a bullish outlook for Bitcoin’s future. He acknowledged “Primarily based on present developments, I’d suspect we’ll see our first vital flows from [major wirehouses, institutional consultants, and large corporations] in Q2 2024.”

At press time, BTC traded at $71,296.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site solely at your individual danger.