[ad_1]

Ethereum and the crypto market have been trending to the upside over the previous week and appear poised to increase the rally. The cryptocurrency underwent a significant improve, dubbed “Shanghai,” which enabled the un-staking of ETH locked on the “Beacon Chain,” the Proof-of-Stake (PoS) blockchain.

In contrast to some expectations, the replace didn’t push Ethereum’s value down. As of this writing, the cryptocurrency recorded an 8-month excessive, climbing north of $2,000 for the primary time in 2023 and probably reaching its subsequent resistance space.

Ethereum Worth Will Run Larger Or Gradual Down? Merchants’ Disbelief May Gas The Rally

Latest knowledge from analysis agency Santiment hints at a possible drop for Ethereum. The cryptocurrency has been on a bull run because the begin of 2023, and now it’s hinting at indicators of a possible drop.

The analysis agency checked out ETH’s 30-day Market Worth To Realized Worth (MVRV) which stands at 9.95% after the replace, as seen within the chart beneath. This indicator enters a hazard zone when it reaches round 15% or above.

In different phrases, Ethereum may nonetheless document some earnings within the quick time period. Regardless of this chance, Santiment warned:

(…) this MVRV being effectively over 0 does point out a better threat of a drop. However it’s not fairly on the stage the place we ought to be extraordinarily involved. On the long-term aspect, the 365-day MVRV is +29%, which is the very best it has been since December 27, 2021. It is a bigger concern, with merchants actually displaying heavy earnings and never plenty of ache that’s usually wanted for costs to rise.

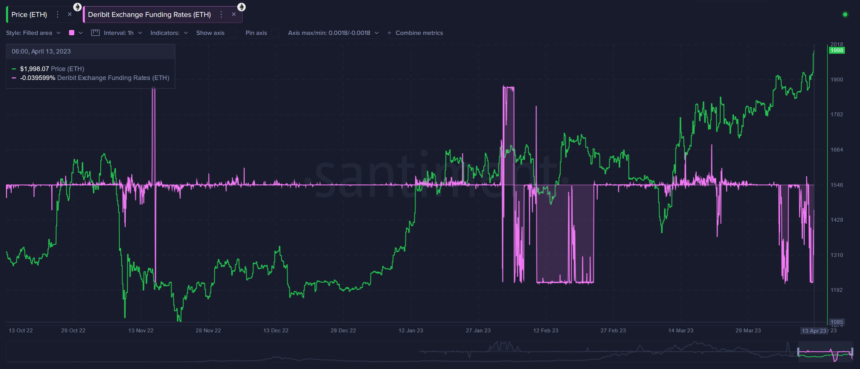

One other constructive signal for ETH within the quick time period is the funding charges within the derivatives sector. Santiment checked out Deribit, a futures and choices buying and selling platform, and found destructive funding charges, which factors to merchants having little confidence within the present rally.

The chart beneath exhibits that ETH’s value correlates negatively with its funding charge. In different phrases, if the funding charge is destructive like now, which means merchants are shorting the crypto, the worth tendencies upwards. The analysis agency famous:

As of now, we are literally seeing fairly a little bit of disbelief. Shorting is kind of prevalent, and this in the end is an efficient signal that there might be extra liquidations so as to add a bit extra rocket gasoline for costs to rise.

ETH’s Worth In The Lengthy Run

NewsBTC has been overlaying the evaluation, speculations, and market expectations round Shanghai. Whereas the occasion technically permits ETH holders to inject liquidity into the market, most of those people are holding the cryptocurrency at a loss.

Thus, ETH holders have little incentive to dump their cash for now. As well as, because the CEO of Ether Capital, Brian Mosoff, informed us in an unique interview, the folks staking Ethereum are usually not speculators however bullish long-term holders.

On the likelihood that Shanghai was going to guide ETH again to assist, Mosoff stated the next, emphasizing its long-term bullish case:

I feel that that is simply noise that may go away, even when there may be some short-term promoting. I feel in a short time the worth would rebound as a result of persons are seeing the chance round a best-in-class sensible contract platform and the flexibility to generate yield. That’s a really robust worth proposition (…).