[ad_1]

Ethereum is taken into account a benchmark for the market motion after BTC to establish whether or not it’s an excellent time to enter into cryptocurrencies or not. The risky worth motion in ETH charts showcases a fancy street forward within the prospects. Whereas good contacts and the usage of blockchain are on the rise, the outlook and purposes of cryptocurrencies have grow to be clear to customers. The present motion of costs in main hype cash showcases an identical pattern we witnessed in one other set of disrupting expertise in early 2000, the web.

Identical to the dot com bubble, the crypto bubble appears to have burst, which certainly can be a optimistic aspect shifting ahead. The value motion of Ethereum will probably be heading in direction of a optimistic course because the outlook is powerful, however the motion in direction of proof of stake appears to have dulled the consumers’ curiosity as ETH carries the next storage worth in that sense.

The results of this motion would take months to return to gentle, if not years, and we count on an honest consolidation of the costs within the coming months. Market capitalization for ETH holds above 143 billion, however the decline in worth has been greater than 65% on a year-on-year foundation.

Ethereum Worth Evaluation

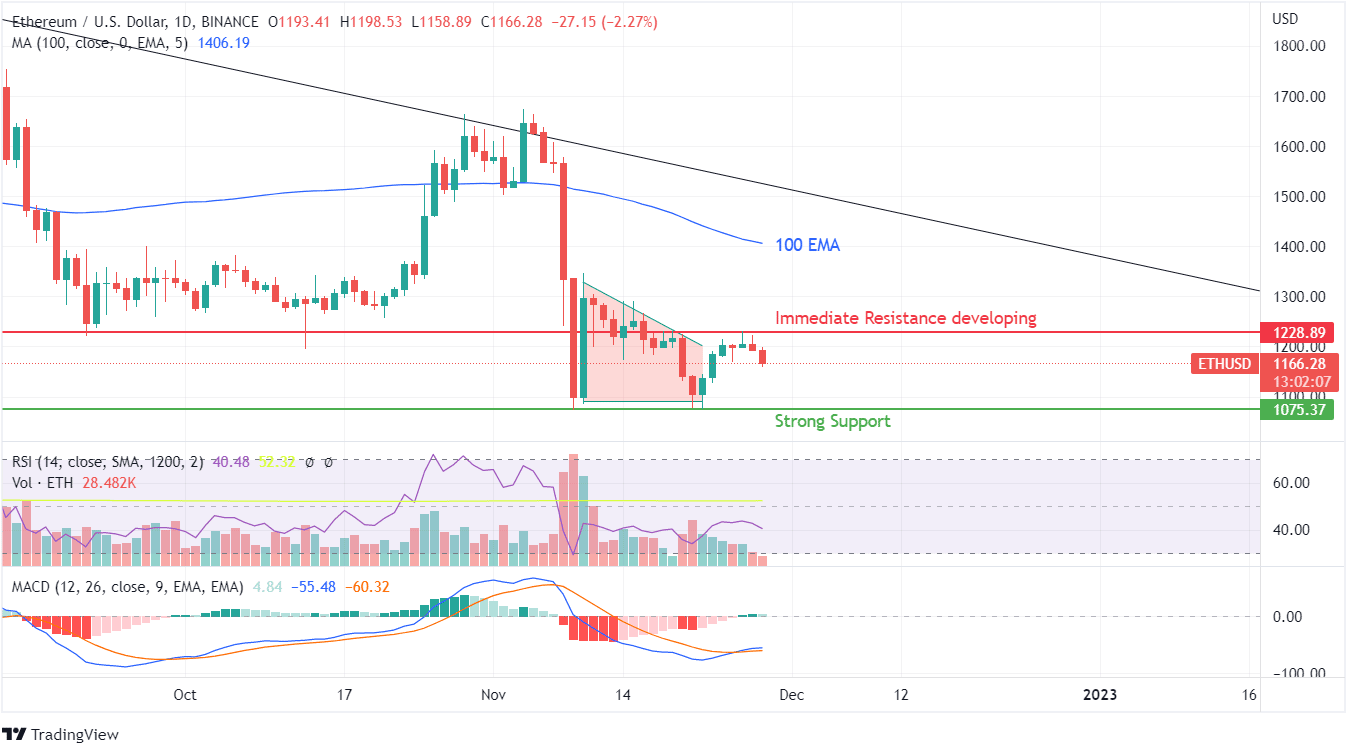

Ethereum token is going through extreme backlash since failing to maintain even the 100 EMA curve in the beginning of November 2022. The general unfavourable sentiment after your complete FTX debacle has left traders in a risky state. The buy-on-dip technique well-known for cryptocurrencies has become promote and exit mode for newcomers.

Assessing the inclination of merchants with technical inputs and information, the shopping for sentiment appears to be closely hit by a scarcity of quantity motion. This worth motion signifies a wait-and-watch technique being utilized by traders who should not positive of the crypto motion within the quick time period. The volumes, regardless of being decrease, should not at an all-time low, however truthful shut resemblance through the unfavourable cycle.

MACD delivered a bullish crossover sample, however RSI showcased a dip in shopping for sentiment as a brand new resistance is being developed close to the $1230 vary. The rejection over the last weekend, adopted by a unfavourable motion to the tune of two% right now, showcases a shopping for alternative close to $1100. The outlook for the token appears to be unfavourable as its buying and selling even under the 50 EMA curve. For extra in-depth projections in regards to the Ethereum worth, click on right here.

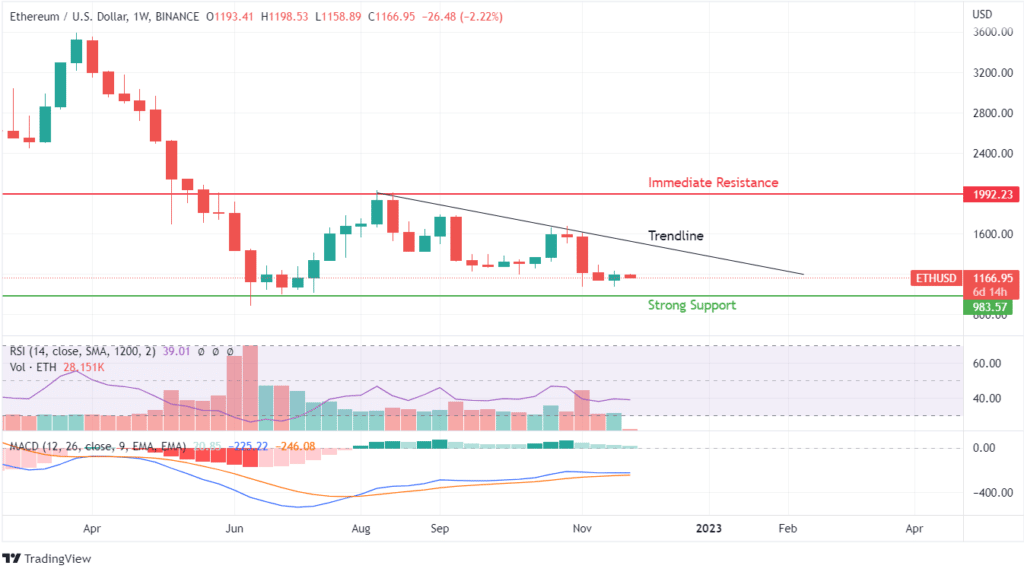

Weekly charts verify the worth pattern evaluation for a long-term affect. The outlook of the token appears to have met its match, with resistance being developed with a declining trendline. The resistance has developed close to the $2000 mark, with assist being accessible at $981.

For the reason that worth of Ethereum appears to be nearer to the assist degree, a breakout is anticipated to finish in a rally in direction of $2000, which might fulfill the expectation and create a rally. Each the technical indicators are fairing in a consolidative stance throughout this part.